Transatlantic Tightrope: Chemical Trade in an Era of Regulatory Flux and Economic Headwinds

The global chemical industry is at a pivotal juncture, navigating a complex interplay of shifting trade policies, stringent new regulations, and persistent economic headwinds. For international chemical traders, particularly those operating in the critical Europe-US corridor, the landscape is evolving at an unprecedented pace. The past month alone has brought a series of developments that will have far-reaching implications for supply chains, market access, and competitive positioning. This article provides a comprehensive analysis of these recent trends, offering insights and practical recommendations for industry leaders to navigate this dynamic environment successfully. We will delve into the nuances of the new US-EU trade framework, the challenges confronting the European chemical sector, the evolving regulatory landscape, and the transformative potential of technology and automation. By understanding these interconnected forces, chemical trading companies can not only mitigate risks but also identify and seize emerging opportunities for growth and innovation.

A New Chapter in US-EU Trade: The August 2025 Framework

A landmark development in transatlantic trade relations emerged on August 21, 2025, with the announcement of a new US-EU framework agreement on reciprocal, fair, and balanced trade [2]. This agreement, a culmination of intensive negotiations, signals a significant shift in trade policy and holds profound implications for the chemical industry. A key provision of this framework is the differential tariff treatment for various chemical products, creating both opportunities and challenges for traders on both sides of the Atlantic.

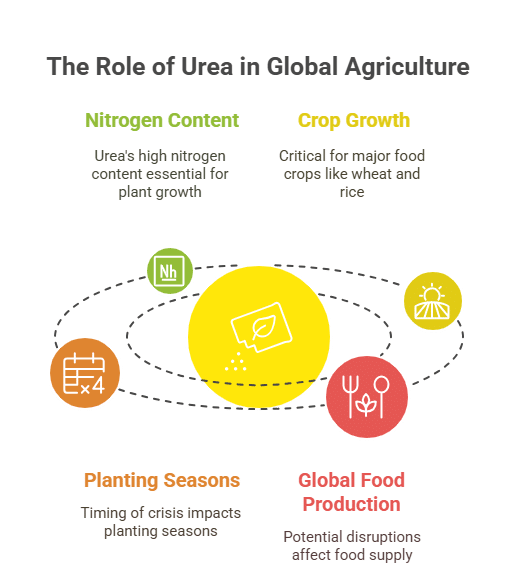

For European chemical exporters, the most significant boon comes from the special treatment of chemical precursors. Under the new agreement, the United States has committed to applying only its Most Favored Nation (MFN) tariff rates to these products, which average a mere 2.7% [3]. This is a substantial reduction from the 15% tariff that will be applied to many other EU industrial goods. This preferential treatment for chemical precursors, which are the fundamental building blocks for a vast array of downstream products, is a strategic move that will enhance the competitiveness of European specialty chemical manufacturers in the US market. It will also streamline supply chains for industries that rely on these precursors, such as pharmaceuticals, plastics, and advanced materials.

Furthermore, the EU has committed to eliminating all tariffs on US industrial goods, a move that will save importers an estimated €5 billion [3]. This creates a more level playing field for US chemical producers and opens up new avenues for market expansion in Europe. The agreement also caps US tariffs at 15% on EU pharmaceuticals and their chemical ingredients, providing a degree of certainty and stability for this critical sector. The timeline for implementation is also noteworthy, with the benefits for chemical precursors taking effect from September 1, 2025, allowing for immediate adjustments in trade flows and pricing strategies.

However, the agreement is not without its complexities. The 15% tariff on many other EU industrial goods, while a reduction from previous threats of higher tariffs, still represents a significant cost for many exporters. The agreement also leaves room for further negotiations on other sectors and products, indicating that the trade landscape will continue to evolve. For chemical traders, this new framework necessitates a granular understanding of product classifications and tariff schedules to optimize their sourcing and pricing strategies. It also underscores the importance of staying abreast of ongoing negotiations and potential future adjustments to the trade agreement.

The European Chemical Industry: A Sector Under Pressure

While the new trade framework offers a glimmer of hope, the European chemical industry is currently grappling with a multitude of challenges that are putting immense pressure on profitability and growth. The sector, which accounts for 12.6% of global chemical sales, has seen its share of the global market decline by nearly 4% over the past decade [1]. The recent confluence of high energy costs, slowing demand, and intense international competition has created a perfect storm for European producers.

The German chemical sector, the powerhouse of the European industry, is currently operating at its lowest capacity in over three decades [1]. Production volumes across Europe are expected to fall by 2% in 2025, with industrial sales declining by 1%. The financial impact is stark, with third-quarter earnings for European chemical companies projected to fall by 5%, following a staggering 22% drop in the second quarter [1].

Several factors are contributing to this downturn. The 2022 energy crisis, triggered by the war in Ukraine, has left a lasting legacy of high gas and power prices, eroding the competitiveness of European producers. The indirect effects of US tariffs on key customer industries, such as automotive and machinery, have also had a significant impact. As a Reuters article from September 3, 2025, notes, “Europe’s chemical producers are facing fresh turmoil as U.S. import tariffs disrupt global trade, prompting customers to delay orders and hitting demand in a sector struggling to recover from the region’s 2022 energy crisis” [1].

This challenging environment is forcing major players to make tough decisions. BASF, the world’s largest chemical company, has lowered its full-year outlook, citing a dramatic drop in customer order lead times from months to weeks [1]. Akzo Nobel and Wacker Chemie have also cut their profit forecasts, pointing to market uncertainties and unfavorable currency exchange rates. In a move that underscores the severity of the situation, ExxonMobil is reportedly considering an exit from its European chemical plants [1]. For international chemical traders, this period of turmoil in the European chemical industry requires careful risk management and a proactive approach to sourcing and supply chain diversification.

Navigating the Shifting Sands of Regulation

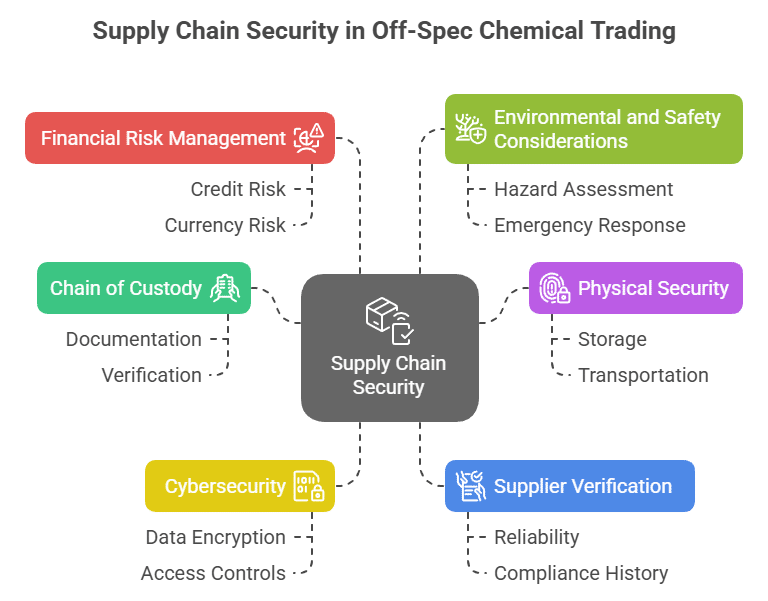

The regulatory landscape for the chemical industry is in a constant state of flux, with new rules and updates to existing legislation being introduced at a rapid pace. For international chemical traders, staying abreast of these changes is not just a matter of compliance but a critical component of risk management and strategic planning. Recent developments in Europe and the US, particularly concerning REACH, TSCA, and PFAS, are set to have a significant impact on the industry.

In Europe, the European Chemicals Agency (ECHA) published an updated proposal to restrict per- and polyfluoroalkyl substances (PFAS) on August 20, 2025 [4]. This proposal, which is part of the EU’s broader strategy to phase out these “forever chemicals,” will have far-reaching implications for a wide range of industries. The proposed restrictions will likely lead to increased compliance costs, supply chain disruptions, and a growing demand for safer alternatives. Additionally, on September 1, 2025, a new EU regulation (2025/1731) came into force, adding 16 new carcinogenic, mutagenic, or reprotoxic (CMR) substances to Annex XVII of the REACH regulation. This means that these substances are now subject to new restrictions on their manufacture, use, and placing on the market.

Across the Atlantic, the US Environmental Protection Agency (EPA) is also actively updating its chemical regulations. On July 21, 2025, the EPA added 18 new chemicals to its Safer Chemical Ingredients List, a move that encourages the use of safer alternatives in a variety of products. The EPA also released the latest update to the Toxic Substances Control Act (TSCA) Inventory on August 14, 2025, providing a comprehensive list of all existing chemicals in US commerce. However, the implementation of some regulations has been delayed. For example, the EPA has postponed the new requirements for trichloroethylene (TCE) until November 17, 2025, providing a temporary reprieve for industries that use this solvent.

For chemical traders, this evolving regulatory landscape presents both challenges and opportunities. The increasing complexity of regulations necessitates a robust compliance infrastructure and a deep understanding of the specific requirements in each market. However, it also creates opportunities for companies that can provide their customers with regulatory expertise and a reliable supply of compliant products. By proactively engaging with these regulatory changes, chemical traders can position themselves as trusted partners and gain a competitive edge in the market.

The Transformative Power of Technology and Automation

Amidst the challenges of trade tensions and regulatory pressures, the chemical industry is also on the cusp of a technological revolution. The integration of artificial intelligence (AI), automation, and digital technologies is set to transform every aspect of the chemical value chain, from research and development to logistics and supply chain management. For international chemical traders, embracing these innovations is no longer a choice but a necessity for survival and growth.

The numbers speak for themselves. The global market for AI in the chemical industry is projected to reach an astounding $28 billion by 2034, growing at a compound annual growth rate (CAGR) of 32.05%. The chemical logistics market is also on a steep growth trajectory, expected to reach $324 billion by 2030 [5]. This growth is being driven by the increasing adoption of digital technologies that enhance efficiency, safety, and visibility across the supply chain.

One of the most significant areas of transformation is in warehouse and inventory management. The implementation of fully automated warehouses, such as the 4,500-pallet system developed by Linde MH for the chemical company Fosfa in the Czech Republic, is a prime example of the efficiency gains that can be achieved through automation. These systems, which leverage advanced robotics and warehouse management systems (WMS), can operate 24/7 with minimal human intervention, reducing labor costs, minimizing errors, and improving safety. Real-time analytics and AI-powered inventory management systems are also becoming increasingly sophisticated, enabling companies to optimize their stock levels, predict demand with greater accuracy, and prevent stockouts.

In the realm of logistics, digital platforms are revolutionizing the way chemicals are transported and tracked. These platforms provide real-time visibility into the location and condition of shipments, enabling companies to monitor their supply chains more effectively and respond quickly to any disruptions. The upcoming implementation of the IATA 67th edition of the Dangerous Goods Regulations, effective January 1, 2026, will further accelerate the adoption of digital solutions for managing the transportation of hazardous materials.

For chemical traders, the message is clear: the future is digital. By investing in AI, automation, and other advanced technologies, companies can not only streamline their operations and reduce costs but also enhance their value proposition to customers. In an increasingly complex and competitive market, technology will be a key differentiator for those who can harness its transformative power.

Conclusion: Thriving in an Age of Disruption

The international chemical trade is at a crossroads, shaped by a confluence of powerful forces. The new US-EU trade framework presents a significant opportunity for savvy traders to optimize their sourcing and pricing strategies, particularly in the realm of chemical precursors. However, this opportunity is set against a backdrop of significant challenges, including a struggling European chemical industry, an increasingly complex regulatory landscape, and the ever-present threat of global economic headwinds. In this dynamic environment, the chemical traders who will thrive are those who can embrace agility, innovation, and a forward-thinking approach.

To navigate this transatlantic tightrope successfully, chemical trading companies must prioritize several key areas. First, they must develop a deep and nuanced understanding of the evolving trade and regulatory landscape, enabling them to anticipate changes and adapt their strategies accordingly. Second, they must embrace the transformative power of technology, investing in AI, automation, and digital platforms to enhance efficiency, reduce costs, and improve supply chain visibility. Third, they must prioritize risk management, developing resilient and diversified sourcing strategies to mitigate the impact of market volatility and supply chain disruptions. Finally, they must cultivate strong relationships with their customers, providing them with not just products but also expertise, reliability, and a commitment to navigating the complexities of the global chemical market together.

By focusing on these key areas, chemical traders can not only weather the current storm but also position themselves for long-term success. The future of the chemical industry will be defined by those who can turn disruption into opportunity, and for those who are prepared, the rewards will be substantial.

[1] Trump’s tariffs threaten to choke European chemicals recovery – Reuters. (2025, September 3). Retrieved from https://www.reuters.com/business/autos-transportation/trumps-tariffs-threaten-choke-european-chemicals-recovery-2025-09-03/

[2] Joint Statement on a United States-European Union framework on an agreement on reciprocal, fair and balanced trade – European Commission. (2025, August 21). Retrieved from https://policy.trade.ec.europa.eu/news/joint-statement-united-states-european-union-framework-agreement-reciprocal-fair-and-balanced-trade-2025-08-21_en

[3] US to impose lower tariff on EU imports of chemical precursors – ICIS. (2025, August 21). Retrieved from https://www.icis.com/explore/resources/news/2025/08/21/11130839/us-to-impose-lower-tariff-on-eu-imports-of-chemical-precursors

[4] ECHA publishes updated PFAS restriction proposal – ECHA. (2025, August 20). Retrieved from https://echa.europa.eu/-/echa-publishes-updated-pfas-restriction-proposal

[5] Chemical Logistics Market to Reach USD 324 Billion by 2030 – GlobeNewswire. (2025, August 21). Retrieved from https://www.globenewswire.com/news-release/2025/08/21/3136882/0/en/Chemical-Logistics-Market-to-Reach-USD-324-Billion-by-2030-Key-Growth-Trends-and-Technology-Innovations.html