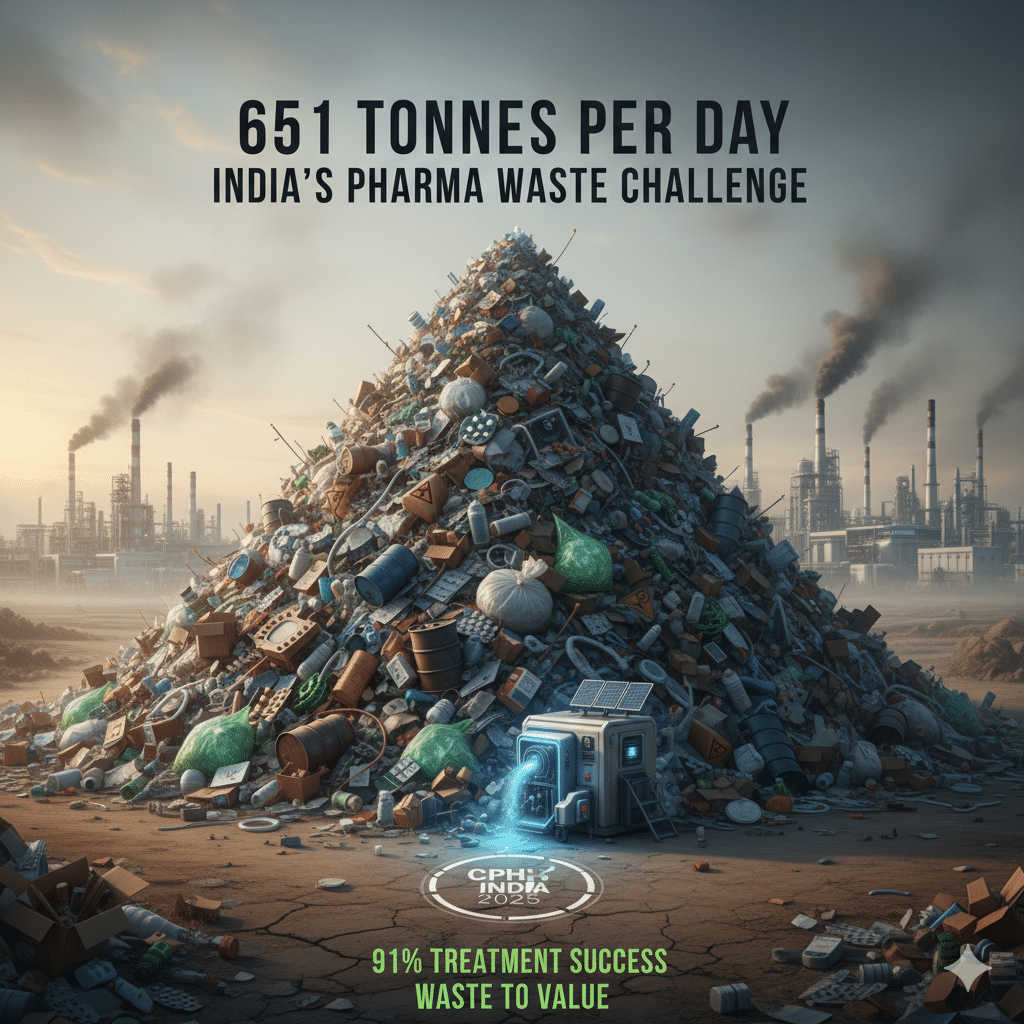

From Waste to Wealth: Navigating India’s Pharmaceutical Surplus Challenge

India’s pharmaceutical sector, the “pharmacy of the world,” is facing a critical challenge: a staggering 651 tonnes of biomedical waste generated daily. This article explores the unique complexities of India’s pharmaceutical surplus problem, from the stringent “red category” regulations to the hidden operational costs. Discover how leading companies are turning this challenge into a multi-billion dollar opportunity by embracing circular economy principles, transforming compliance costs into revenue streams, and securing a competitive edge in the global market.

Introduction: The Double-Edged Sword of India’s Pharma Success

India’s pharmaceutical industry is a global powerhouse. Valued at over $50 billion and ranked as the world’s third-largest by production volume, it supplies nearly 10% of the world’s pharmaceutical output to over 200 countries [2]. This incredible scale has rightfully earned it the title of the “pharmacy of the world.” However, this success comes with a significant and often overlooked consequence: a monumental waste management challenge.

Every single day, the Indian pharmaceutical sector generates a staggering 651 tonnes of non-COVID biomedical waste. At the height of the pandemic, this figure, combined with COVID-related waste, soared to over 1,600 tonnes per day [1]. These are not just abstract numbers; they represent a complex and hazardous stream of expired medicines, off-spec active pharmaceutical ingredients (APIs), volatile solvents, and cytotoxic drugs that pose a significant threat to the environment and public health if not managed correctly.

While the industry has achieved a commendable 91% treatment rate for this waste, the sheer volume and complexity of the problem present a unique set of challenges that are distinct from those faced by pharmaceutical companies in Western markets. The scale of manufacturing, the diversity of waste streams, and a rapidly evolving regulatory landscape create a perfect storm of operational, financial, and environmental pressures.

This article dives into the specific challenges and opportunities of pharmaceutical surplus management in India. We will explore the intricate regulatory framework, the hidden costs of traditional waste disposal, and the innovative circular economy solutions that are emerging to transform this challenge into a strategic advantage.

For the companies that get this right, the prize is not just compliance, but a significant competitive edge in the global market.

The primary differences are scale and complexity. India’s massive production volume creates a far larger waste stream. Furthermore, the waste itself is more diverse, including not just finished products but also raw materials, chemical intermediates, and hazardous solvents, which require more sophisticated management and disposal protocols.

Several factors are converging: stricter enforcement by India’s Central Pollution Control Board (CPCB), increasing pressure from global buyers for sustainable and transparent supply chains, and a growing internal recognition that traditional waste management is a significant and unnecessary cost center.

No. While large manufacturers are a major source of surplus, the principles and solutions discussed are relevant for any company in the pharmaceutical supply chain, including R&D labs, contract manufacturing organizations (CMOs), and logistics providers that handle and store pharmaceutical materials.

The Indian Regulatory Maze: Navigating the CPCB Framework

The regulatory environment for pharmaceutical waste in India is one of the most stringent in the world. The Central Pollution Control Board (CPCB) has classified pharmaceutical manufacturing as a “red category” activity, the highest risk classification, due to the hazardous nature of the waste it produces [3]. This designation places a heavy burden of responsibility on manufacturers to ensure that every gram of waste is handled, tracked, and disposed of in compliance with a complex set of rules.

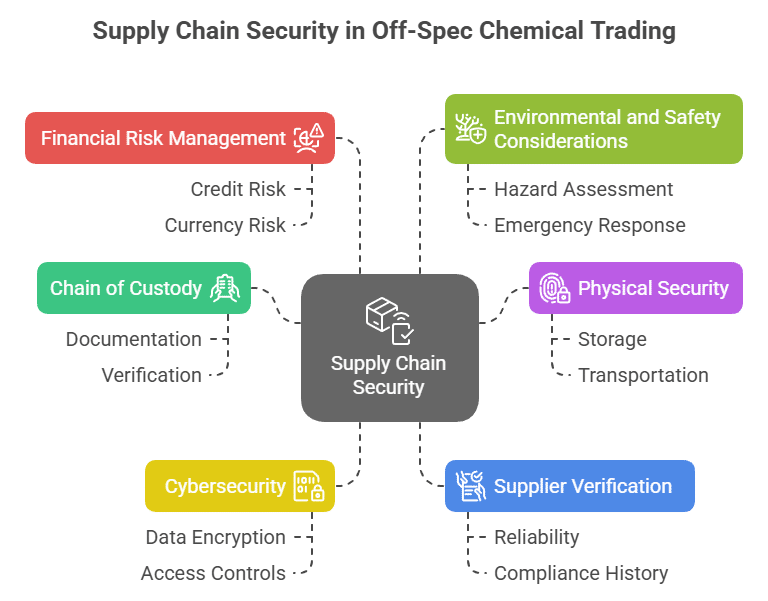

The cornerstone of this framework is the Hazardous and Other Wastes (Management and Transboundary Movement) Rules, 2016. These rules establish a “cradle-to-grave” manifest system, a rigorous chain of custody that tracks hazardous waste from the point of generation to its final, authorized disposal facility. This system is designed to prevent illegal dumping and ensure full accountability.

According to a CPCB draft guideline, “Expired or Discarded Medicines shall be treated and disposed of in accordance with Schedule I, and in compliance with the standards provided in Schedule-II of the Bio-medical Waste Management Rules, 2016.” [4]

This means companies cannot simply discard surplus materials. They must follow a prescribed process that includes proper segregation, labeling, storage, and transportation. CPCB audits are thorough and unforgiving. Inspectors physically verify records, review manifests, and inspect storage areas. They are empowered to take laboratory samples of effluent or sludge to detect any signs of illegal dumping. Companies found in violation face severe penalties, including legal action under the Environment Protection Act, 1986.

One of the most significant operational challenges is the strict time limit on waste storage. Companies are generally prohibited from storing hazardous waste on-site for more than 90-180 days without specific authorization [1]. For an industry that often deals with long lead times and fluctuating production schedules, this creates immense pressure to find efficient and compliant disposal solutions quickly.

However, the regulatory framework, while challenging, also provides the foundation for a more sustainable solution. The very existence of a robust tracking and compliance system creates the transparency and accountability needed for a legitimate circular economy to thrive. The data generated by the manifest system can be leveraged to identify patterns, quantify waste streams, and build a business case for investment in waste-to-value technologies.

The “red category” is the highest risk classification assigned by the CPCB to industries that have the potential to cause significant environmental pollution. It triggers the most stringent monitoring, reporting, and compliance requirements.

Violations can result in significant fines, suspension of operations, and even criminal prosecution of company executives under the Environment Protection Act, 1986. The reputational damage can be equally severe, impacting relationships with global buyers and investors.

It is a documentation system that tracks hazardous waste from its creation (cradle) to its final disposal (grave). Every entity that handles the waste (generator, transporter, treatment facility) must sign off on a manifest, creating an unbroken chain of custody that ensures the waste is not illegally dumped or mishandled.

Beyond Compliance: The Hidden Costs and Strategic Opportunities

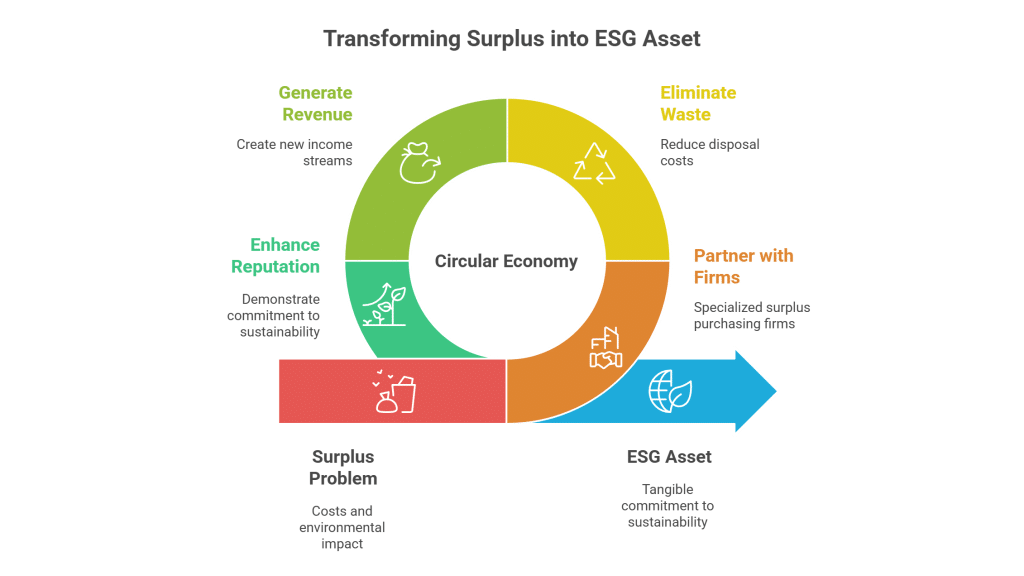

For decades, most Indian pharmaceutical companies have viewed waste management through the narrow lens of compliance. The primary goal has been to avoid penalties, not to create value. This mindset has led to a focus on disposal, a linear process that treats surplus materials as a liability to be destroyed, often at a significant cost.

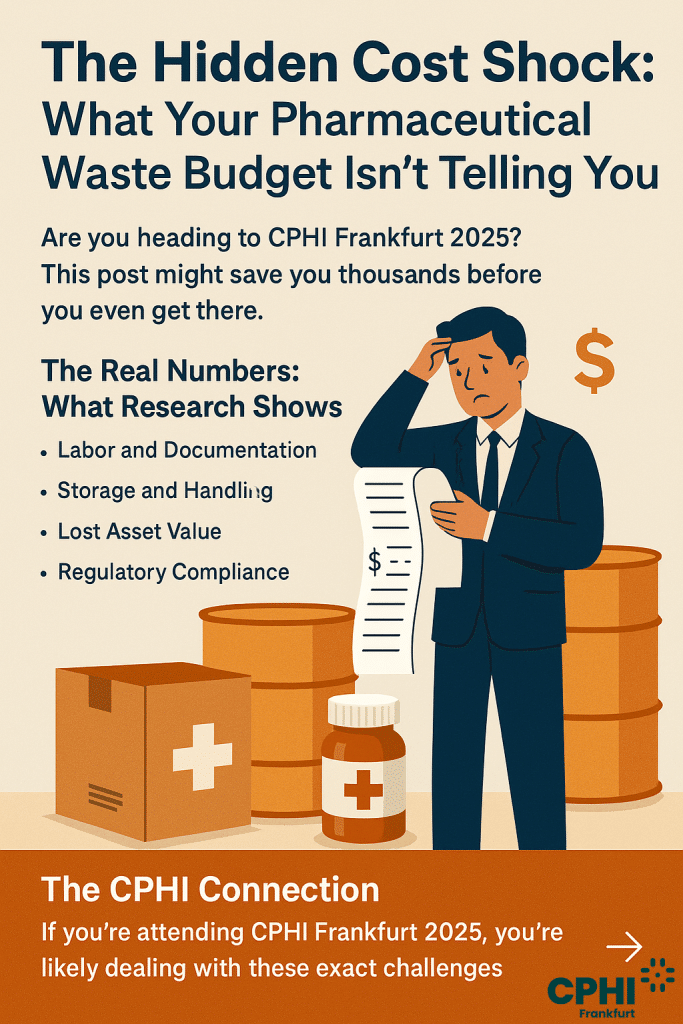

This traditional approach, however, ignores a vast landscape of hidden costs and missed opportunities. The direct cost of incineration or landfilling is just the tip of the iceberg. The true cost of surplus includes:

- Warehousing and Storage: Valuable warehouse space is occupied by materials that will never be used, incurring costs for rent, climate control, and security.

- Labor and Administration: Employees spend time managing, tracking, and documenting materials that are destined for destruction.

- Lost Value of Materials: The intrinsic value of the raw materials, which could be recovered and resold, is completely lost.

- Risk and Insurance: Storing large quantities of hazardous materials increases insurance premiums and the risk of accidents or spills.

When these hidden costs are factored in, the financial case for a more strategic approach becomes undeniable. The 91% treatment rate for biomedical waste in India is a testament to the country’s operational capability [1]. The infrastructure for safe handling and disposal exists. The missing piece is a strategic shift from a linear “take-make-dispose” model to a circular “recover-repurpose-revalue” model.

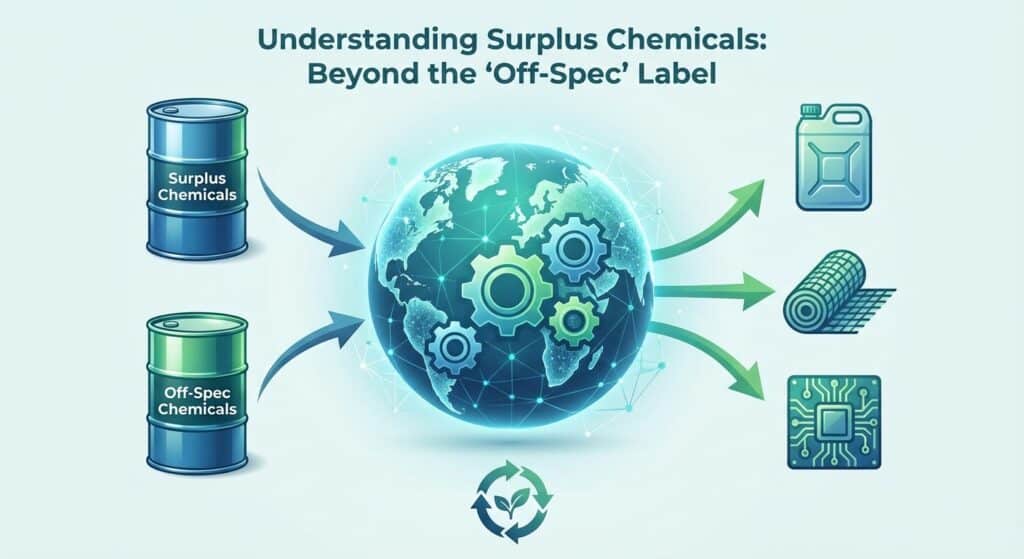

This is where the concept of a circular economy comes into play. Instead of destroying surplus materials, a circular approach seeks to keep them in circulation for as long as possible, extracting the maximum value from them before they are finally disposed of. This can take many forms:

- Re-selling: Off-spec or unused materials that are still within their shelf life can be sold to other industries that have less stringent quality requirements.

- Repurposing: Chemical intermediates can be reprocessed and used in the synthesis of different products.

- Solvent Recovery: Used solvents can be purified and reused in the manufacturing process, reducing the need to purchase new solvents.

Embracing a circular economy model transforms surplus management from a cost center into a potential revenue stream. It aligns with the growing global demand for sustainability and provides a powerful story to tell investors, regulators, and customers. As one industry report notes, “Circular economy in Indian industries is fast becoming a practical solution—cutting costs, reducing waste, and opening up new revenue streams.” [5]

For Indian pharmaceutical companies, the opportunity is clear. By shifting their mindset from compliance to value creation, they can unlock significant financial benefits, enhance their ESG credentials, and build a more resilient and sustainable business model.

The circular economy is an economic model that aims to eliminate waste and the continual use of resources. It is a departure from the traditional linear model of “take, make, dispose.” In a circular system, resources are kept in use for as long as possible, the maximum value is extracted from them whilst in use, and then materials are recovered and regenerated at the end of each service life.

Absolutely, provided it is done through a reputable and compliant partner. A professional surplus management company will ensure that materials are only sold to legitimate buyers in non-competing industries, with full brand protection and confidentiality. The process is fully documented to maintain the chain of custody and comply with all regulatory requirements.

The first step is to conduct a thorough audit of all waste streams to identify and quantify surplus materials. The next step is to partner with a specialist surplus management company that has the expertise to assess the value of these materials and find suitable buyers. This allows the company to focus on its core business while still benefiting from the financial and environmental advantages of a circular approach.

Sources:

[1] Pharma Industrial India – “India’s USD 50 Billion Pharma Sector Faces a Growing Waste Challenge” (August 2025) https://www.pharmaindustrial-india.com/articles-interviews-online-watch/-usd-50-billion-india-pharma-sector-faces-a-growing-waste-challenge

[2] Press Information Bureau, Government of India – “India’s pharmaceutical market for FY 2023-24 is valued at USD 50 billion” (December 2024) https://www.pib.gov.in/PressReleaseIframePage.aspx?PRID=2085345

[3] Changing Markets Foundation – “Impacts of Pharmaceutical Pollution on Environment and Human Health in India” https://changingmarkets.org/wp-content/uploads/2023/10/2016-04_pharma-pollution-in-India_small_web_spread.pdf

[4] Central Pollution Control Board (CPCB) – “Draft Guidelines for the Pharmaceutical Industry in India” https://cpcb.nic.in/openpdffile.php?id=TmV3c0ZpbGVzLzExMV8xNzM3MDA1ODU1X21lZGlhcGhvdG8xMjUwMy5wZGY=

[5] HECS – “Circular Economy in Indian Industries – Waste to Wealth” (July 2025) https://hecs.in/circular-economy-in-indian-industries