From Cost Center to ESG Champion: How Strategic Surplus Management is Redefining Pharmaceutical Sustainability

In today’s hyper-aware market, Environmental, Social, and Governance (ESG) performance is no longer a “nice-to-have” for the pharmaceutical industry; it is a critical determinant of long-term value, investor confidence, and brand reputation. As stakeholders from investment firms to patients demand greater transparency and accountability, pharmaceutical companies are under immense pressure to demonstrate tangible progress on their sustainability goals. Yet, a significant and often overlooked area of ESG impact lies hidden in plain sight: the management of surplus materials.

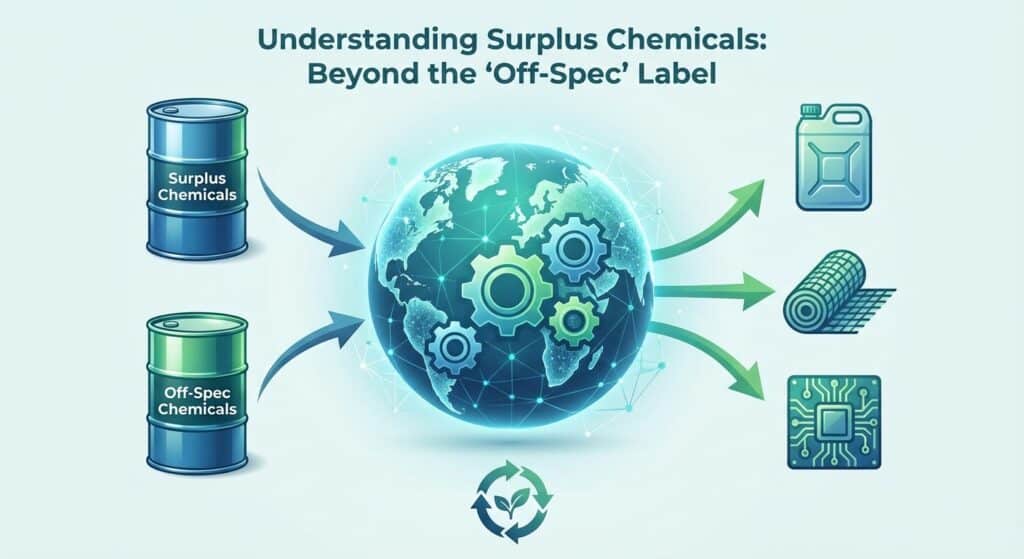

Every year, the pharmaceutical industry generates substantial volumes of surplus, from off-specification batches and unused raw materials to expired or discontinued products. Historically, the default solution has been costly and environmentally damaging destruction. This linear “take-make-dispose” model not only represents a massive financial drain but also creates a significant ESG liability, impacting everything from carbon footprint to resource efficiency.

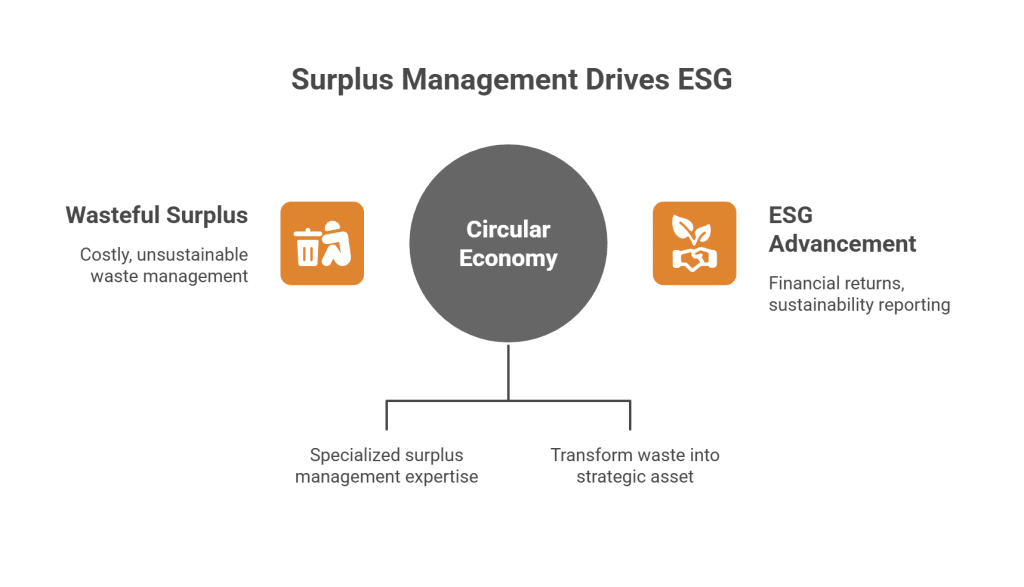

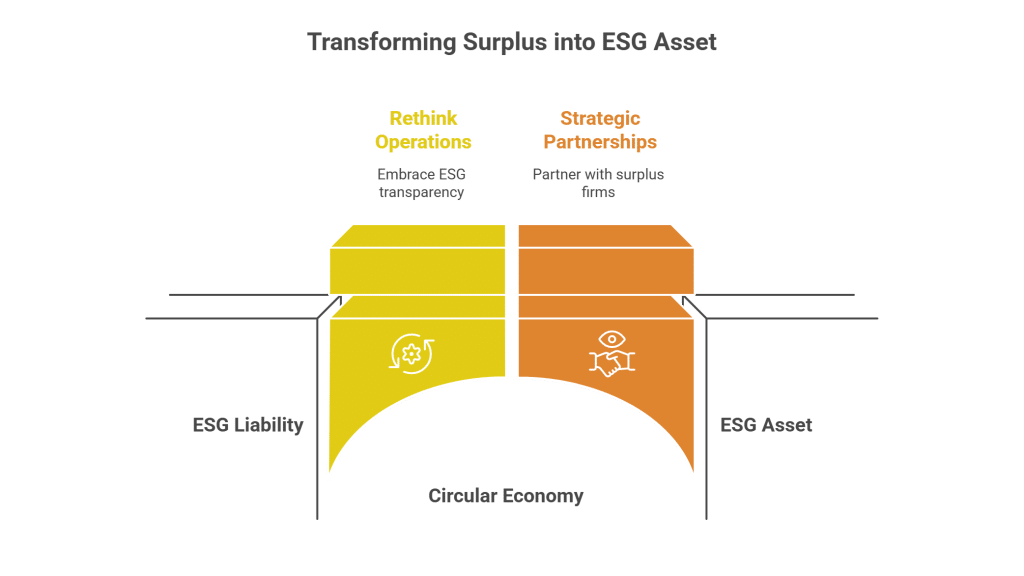

However, a paradigm shift is underway. Forward-thinking pharmaceutical leaders are beginning to recognize that this surplus isn’t just waste to be managed, but a strategic asset waiting to be unlocked. By embracing a circular economy model and partnering with specialized surplus management firms, companies can transform a traditional cost center into a powerful engine for ESG advancement. This article explores the critical link between surplus management and ESG performance, detailing how a strategic approach can generate significant financial returns, enhance sustainability reporting, and build a more resilient and reputable brand.

The Unignorable Rise of ESG in the Pharmaceutical Sector

The days when a pharmaceutical company’s success was measured solely by its drug pipeline and quarterly earnings are over. Today, a new “triple bottom line” of people, planet, and profit has taken center stage, with ESG criteria becoming a primary lens through which investors, regulators, and the public evaluate corporate performance. For the pharmaceutical industry, an industry built on trust and public health, the stakes are particularly high.

Investors are no longer passive observers; they are active participants demanding robust ESG strategies. They recognize that strong ESG performance is a proxy for good management, operational efficiency, and long-term resilience. Companies with high ESG ratings often demonstrate lower risk profiles, better financial performance, and a greater ability to attract and retain top talent. A 2024 report highlighted that 78% of pharmaceutical companies increased their ESG investments, with a staggering $12.4 billion invested in environmental programs across the top 20 firms alone, underscoring the financial commitment to this new paradigm [1].

“ESG initiatives are not only attractive to external stakeholders. These factors and more indicate that ESG is not a passing trend for 2024.” [2]

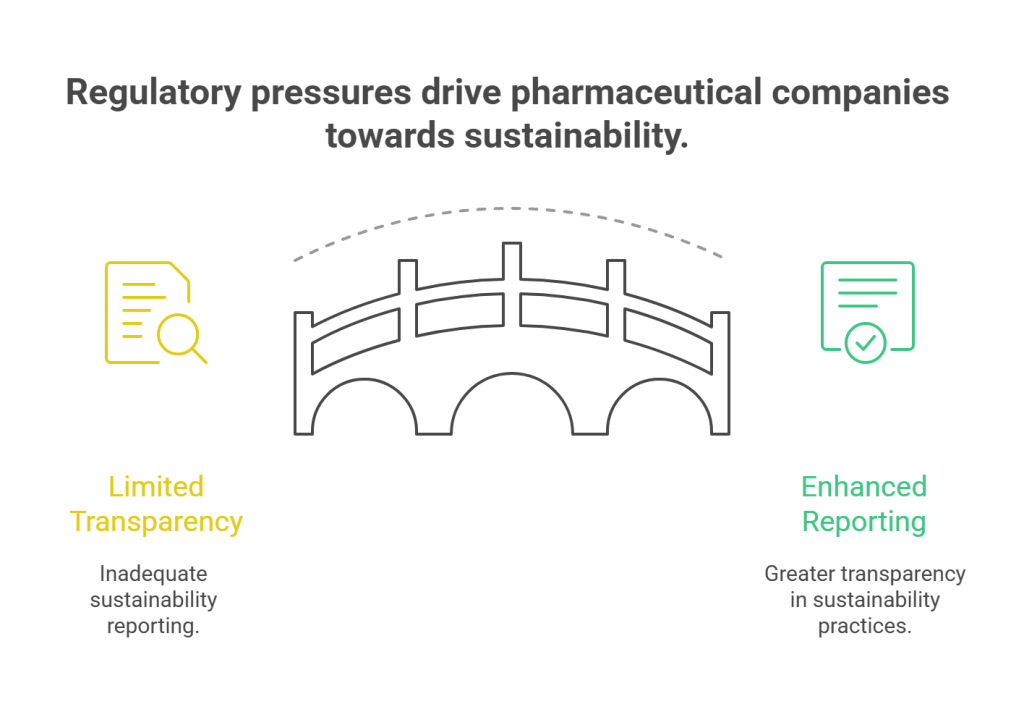

This shift is also being driven by regulatory pressures. Governments and international bodies are implementing stricter environmental regulations and demanding greater transparency in corporate sustainability reporting. The EU’s Corporate Sustainability Reporting Directive (CSRD), for example, requires detailed disclosures on a wide range of sustainability topics, forcing companies to look deeper into their operations and supply chains.

Furthermore, the social component of ESG is gaining significant traction. Patients and healthcare providers are increasingly aware of the ethical and social implications of the pharmaceutical industry. They want to know that the companies they support are committed to ethical practices, from clinical trials to drug pricing and environmental stewardship. This growing consciousness is creating a powerful market force, rewarding companies that demonstrate a genuine commitment to social responsibility.

In this context, every aspect of a pharmaceutical company’s operations is under scrutiny, and waste management has emerged as a critical area of focus. The traditional model of destroying surplus materials is not only financially inefficient but also environmentally and socially irresponsible. It represents a missed opportunity to create value, reduce environmental impact, and demonstrate a tangible commitment to the principles of the circular economy.

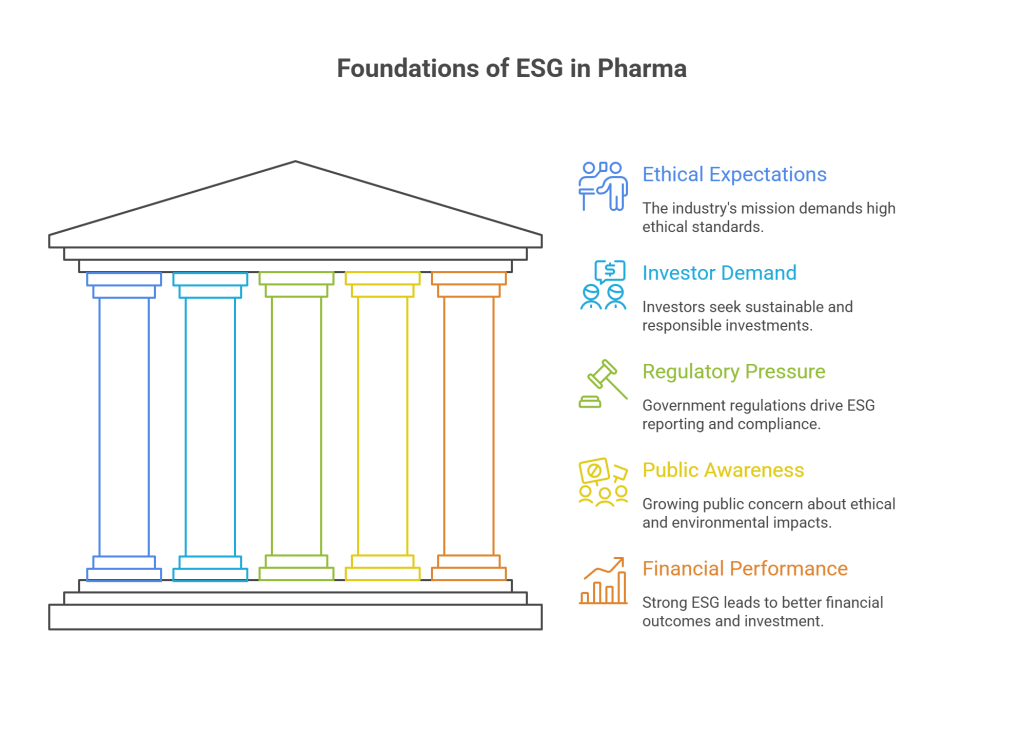

Why is ESG so important for pharmaceutical companies specifically?

The pharmaceutical industry’s core mission is to improve public health. This creates a higher expectation for ethical and sustainable practices. Strong ESG performance builds trust with patients, regulators, and investors, which is essential for long-term success

What are the main drivers of the ESG movement in the pharmaceutical sector?

The main drivers include investor demand for sustainable investments, stricter government regulations on environmental and social reporting, and growing public awareness of the industry’s ethical and environmental impact.

How does ESG performance affect a pharmaceutical company's financial performance?

Strong ESG performance can lead to better financial outcomes by reducing operational risks, improving resource efficiency, attracting and retaining talent, and enhancing brand reputation. It can also provide access to a growing pool of sustainability-focused investment capital.

The Surplus Problem: A Hidden ESG Liability

While many pharmaceutical companies are making strides in areas like renewable energy and ethical sourcing, the management of surplus materials often remains a blind spot in their ESG strategies. This is a significant oversight, as the traditional approach of destroying surplus inventory creates a cascade of negative ESG impacts.

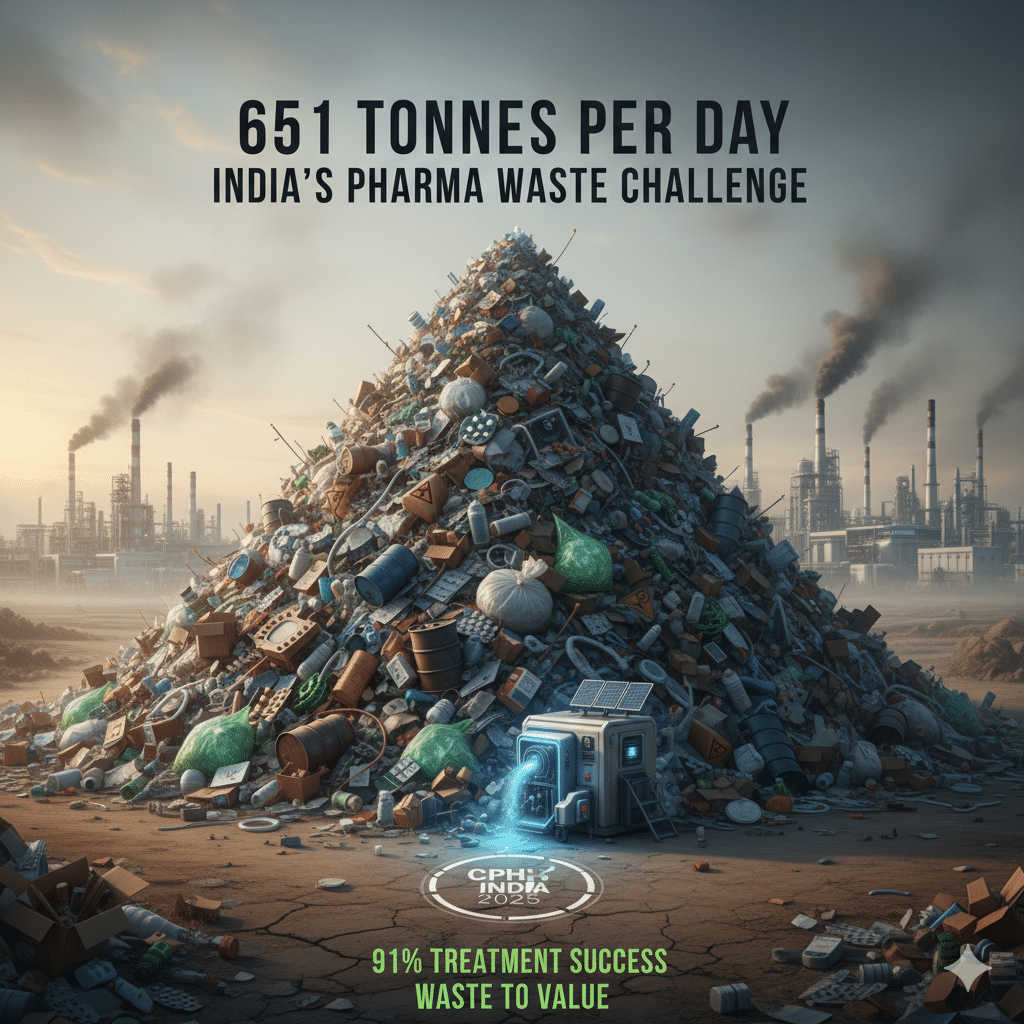

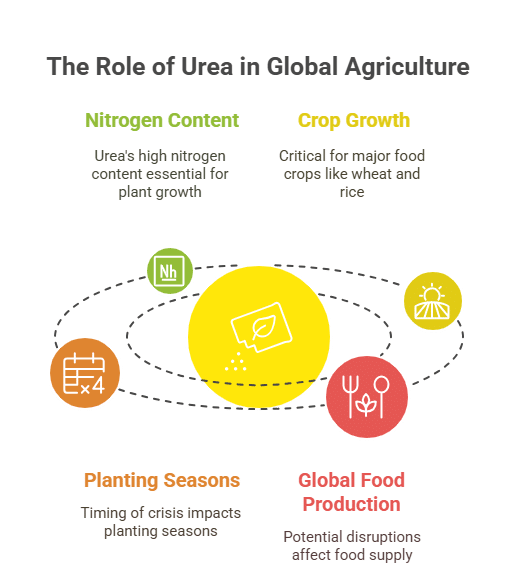

Environmental Impact: The most obvious impact is environmental. The destruction of pharmaceutical materials, often through high-temperature incineration, releases greenhouse gases and other pollutants into the atmosphere. This directly contradicts the industry’s efforts to reduce its carbon footprint. Furthermore, the destruction of usable materials represents a waste of the natural resources and energy that were consumed in their production.

Economic Impact: As detailed in our previous article, the economic costs of waste disposal are substantial. These costs, which can run into the millions of dollars annually for larger companies, represent a direct drain on financial resources that could be better invested in research and development, patient access programs, or other value-creating activities. This inefficient use of capital is a red flag for investors and a clear indicator of operational inefficiency.

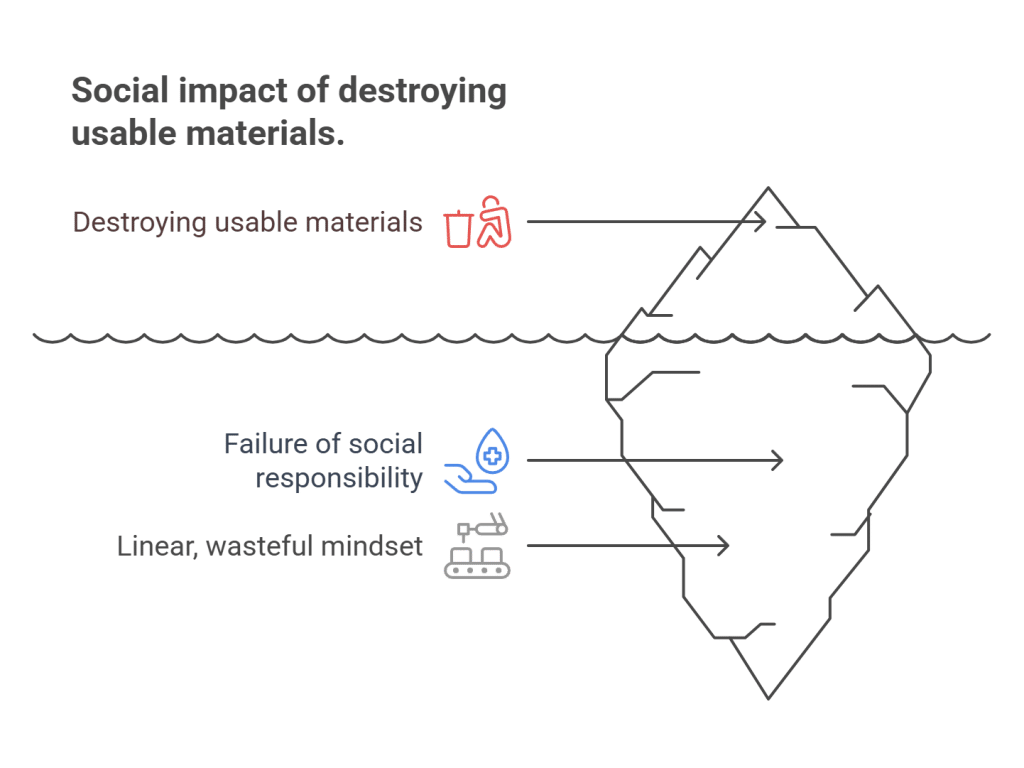

Social Impact: The social impact of destroying usable materials is more subtle but no less significant. In a world where access to essential medicines remains a major challenge, the destruction of perfectly good pharmaceutical products can be seen as a failure of social responsibility. While regulatory and safety considerations are paramount, the inability to find alternative uses for surplus materials reflects a linear, wasteful mindset that is increasingly out of step with societal expectations.

The Reporting Challenge: Connecting Surplus to ESG Metrics

One of the main reasons why surplus management has been overlooked in ESG strategies is the difficulty in quantifying its impact. Traditional waste disposal methods provide little in the way of detailed data that can be used for sustainability reporting. This makes it challenging for companies to demonstrate progress to investors and other stakeholders.

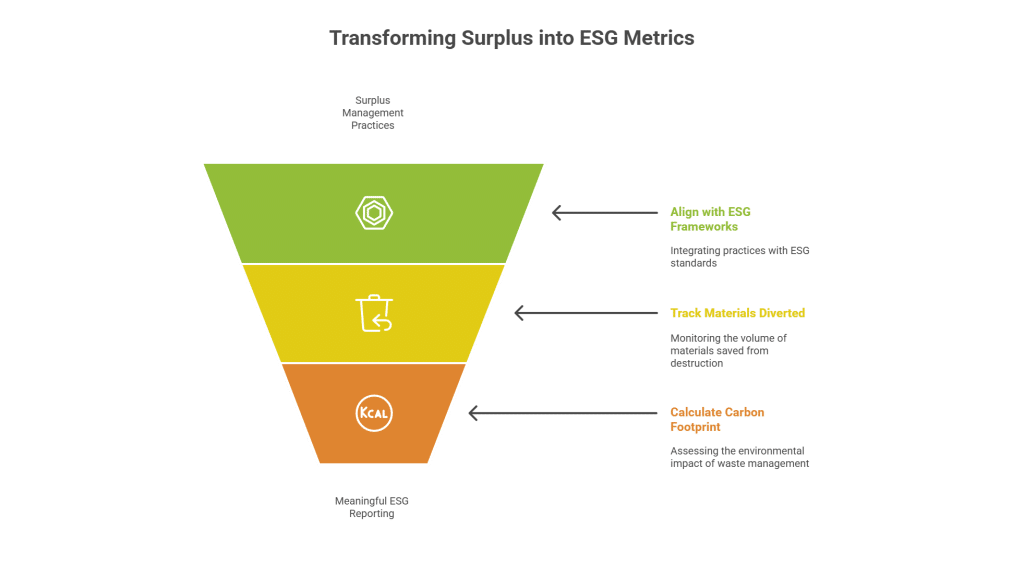

This is where established ESG reporting frameworks like the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB) come into play. These frameworks provide a common language and set of metrics for companies to report on their sustainability performance. As stated by the IFRS Foundation, which now oversees the SASB standards:

"SASB Standards focus on sustainability issues expected to have a material impact on the company’s financial performance, aimed at serving the needs of most investors and other providers of financial capital. GRI Standards focus on the economic, environmental, and social impacts of a company in relation to sustainable development, which is of interest to a broad range of stakeholders, including investors." [3]

By aligning surplus management practices with these frameworks, companies can begin to quantify their impact in a way that is meaningful to investors and other stakeholders. For example, by tracking the volume of materials diverted from destruction, companies can report on key metrics related to waste reduction and resource efficiency. By calculating the carbon footprint of their waste management activities, they can demonstrate progress on their climate goals.

How does surplus management relate to specific ESG reporting frameworks?

Frameworks like GRI and SASB include specific metrics related to waste management, resource efficiency, and circular economy principles. By implementing a strategic surplus management program, companies can collect the data needed to report on these metrics and demonstrate their commitment to sustainability.

What are the key performance indicators (KPIs) for surplus management?

Key KPIs include the volume of materials diverted from destruction, the percentage of surplus materials repurposed or recycled, the cost savings achieved through waste reduction, and the carbon footprint reduction associated with alternative disposal methods.

How can companies start tracking the ESG impact of their surplus management?

The first step is to conduct a comprehensive audit of current waste management practices and costs. This will provide a baseline against which to measure improvement. The next step is to partner with a specialized surplus management firm that can provide detailed data and reporting on the disposition of all materials.

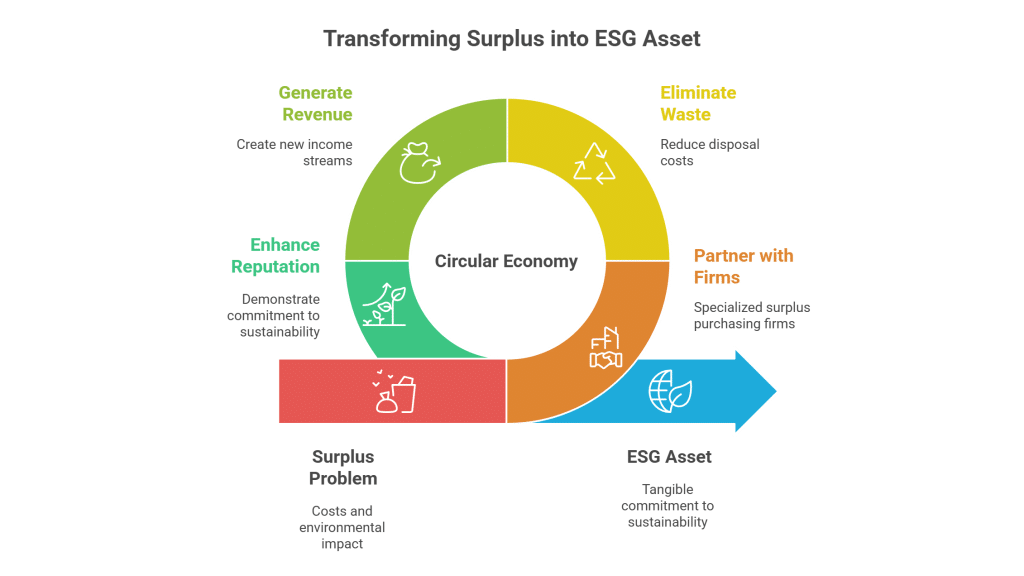

The Circular Solution: Transforming Surplus into an ESG Asset

The good news is that there is a better way. By embracing the principles of the circular economy, pharmaceutical companies can transform their surplus problem into a powerful ESG opportunity. The circular economy is a model of production and consumption that involves sharing, leasing, reusing, repairing, refurbishing, and recycling existing materials and products as long as possible. In this way, the life cycle of products is extended.

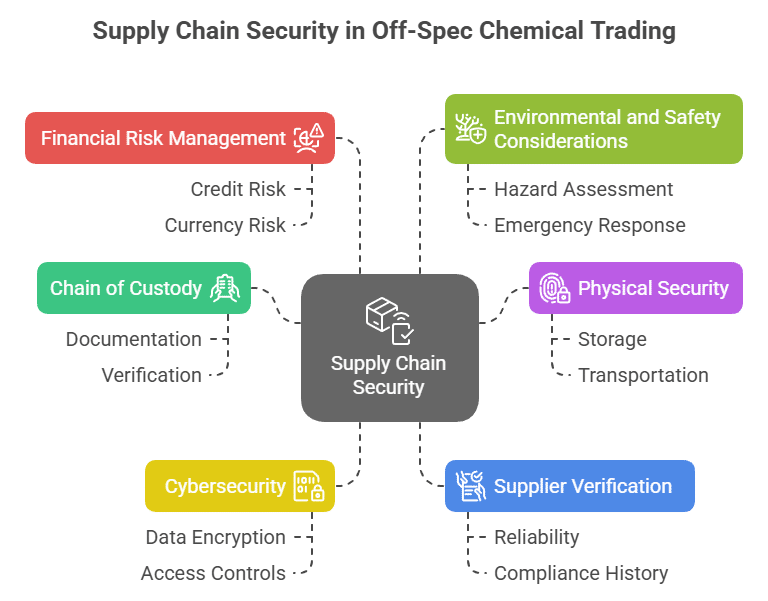

In the context of pharmaceutical surplus, this means moving away from the linear model of destruction and finding alternative uses for materials that are no longer needed for their original purpose. This is where professional surplus purchasing services come in. These specialized firms provide a confidential and brand-protected solution for purchasing surplus materials, ensuring they are kept in circulation rather than being destroyed.

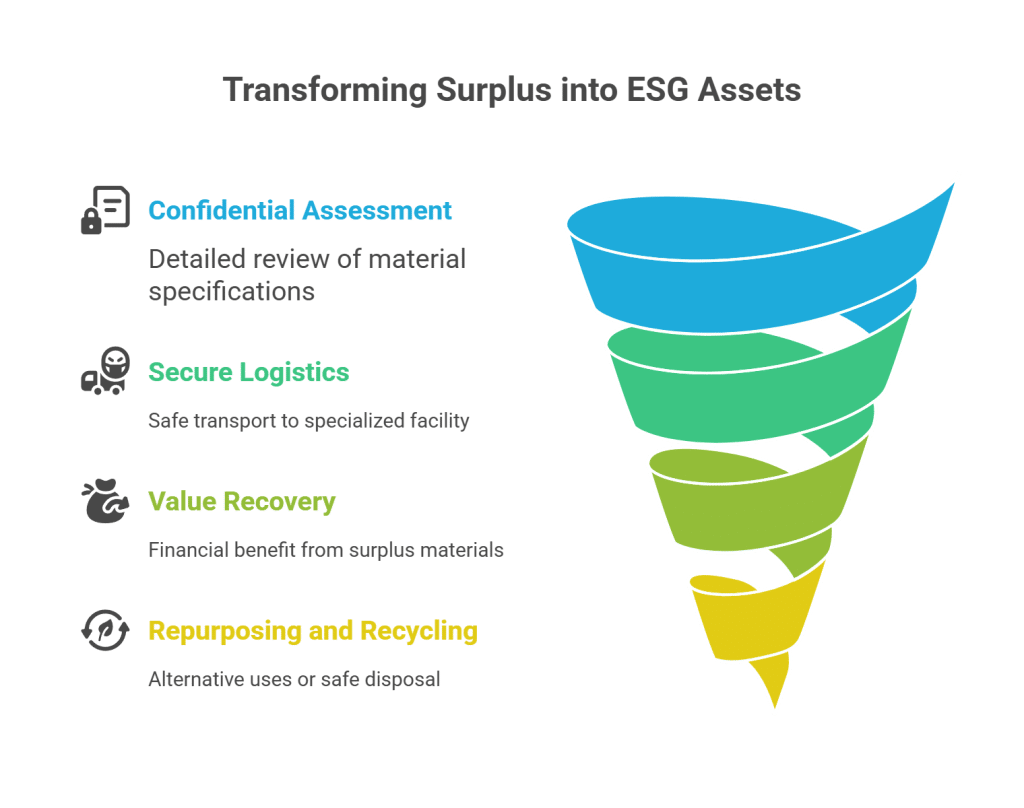

How It Works: A Confidential and Compliant Process

The process is designed to address the unique needs of the pharmaceutical industry, with a strong emphasis on confidentiality, brand protection, and regulatory compliance.

- Confidential Assessment: The process begins with a confidential assessment of the surplus materials. This includes a detailed review of the material specifications, quantities, and remaining shelf life.

- Secure Logistics: Once a purchase agreement is in place, the materials are securely transported to a specialized facility. All packaging materials bearing company logos are destroyed to ensure complete brand protection.

- Value Recovery: Instead of paying for destruction, the company receives payment for its surplus materials. This represents a direct financial benefit and a significant improvement over the total loss associated with traditional disposal methods.

- Repurposing and Recycling: The materials are then evaluated for alternative uses. This may include repurposing them for non-pharmaceutical applications, recycling them into new materials, or, in some cases, safely disposing of them in an environmentally responsible manner.

The ESG Benefits of a Circular Approach

The ESG benefits of this circular approach are significant and far-reaching:

- Environmental: By diverting materials from destruction, companies can significantly reduce their carbon footprint and conserve natural resources. This provides a tangible and measurable contribution to their environmental goals.

- Economic: The economic benefits are twofold. First, companies eliminate the direct costs of waste disposal. Second, they generate revenue from the sale of their surplus materials. This transforms a traditional cost center into a value-generating activity.

- Social: By participating in the circular economy, companies demonstrate a commitment to responsible resource management and social responsibility. This can enhance their brand reputation and build trust with stakeholders.

Is the circular economy a viable model for the highly regulated pharmaceutical industry?

Yes. While regulatory compliance is paramount, there are many opportunities to apply circular economy principles to pharmaceutical surplus. This includes repurposing materials for non-pharmaceutical applications, recycling packaging materials, and finding alternative uses for off-specification batches.

How can companies ensure brand protection when selling their surplus materials?

The key is to partner with a reputable surplus purchasing firm that has robust confidentiality and brand protection protocols in place. This includes secure destruction of all branded packaging and a clear chain of custody for all materials.

What is the first step to implementing a circular surplus management program?

The first step is to conduct a thorough assessment of your current surplus streams and waste management practices. This will help you identify the biggest opportunities for improvement and build a business case for a circular approach.

Conclusion: The Future of Pharmaceutical Sustainability

The pharmaceutical industry is at a crossroads. The growing demand for ESG transparency and accountability is forcing companies to rethink every aspect of their operations, and surplus management has emerged as a critical area of opportunity. The traditional model of destroying surplus materials is no longer tenable, either financially or environmentally. It represents a significant ESG liability and a missed opportunity to create value.

By embracing the principles of the circular economy and partnering with specialized surplus purchasing firms, pharmaceutical companies can transform their surplus problem into a powerful ESG asset. This strategic approach not only eliminates the costs and environmental impact of waste disposal but also generates new revenue streams, enhances brand reputation, and demonstrates a tangible commitment to sustainability.

The journey to a more sustainable future begins with a single step. By rethinking surplus management, pharmaceutical companies can take a significant leap forward on their ESG journey, creating value for their shareholders, their stakeholders, and the planet. The time to act is now.

References

[1] Laboratorios Rubio. (2024). ESG Innovation in Pharmaceutical Industry. Retrieved from https://www.laboratoriosrubio.com/en/esg-pharma/

[2] Vynamic. (2024). 2024 Health Industry Outlook. Retrieved from https://adv.vynamic.com/hubfs/Inizio%20Advisory/Vynamic/2024%20Health%20Industry%20Outlook.pdf

[3] IFRS Foundation. (n.d.). SASB Standards and other ESG frameworks. Retrieved from https://sasb.ifrs.org/about/sasb-and-other-esg-frameworks/