The Patent Expiry Gold Rush: How Pharma Companies Are Turning Shelved IP into Strategic Assets

Introduction: The $400 Billion Paradox

The pharmaceutical industry is standing on the edge of a precipice. Between 2025 and 2030, a wave of patent expirations is set to wipe out an estimated $200 to $400 billion in annual revenue for blockbuster drugs [1]. This “patent cliff” is a well-known threat, a source of anxiety for executives and investors alike. But what if this narrative is incomplete? What if this cliff is actually a goldmine in disguise?

For every blockbuster drug that reaches the market, hundreds of promising compounds are shelved. They may have failed to meet primary endpoints, been deemed commercially unviable, or simply been out-prioritized. These discontinued projects represent billions of dollars in R&D investment, written off as losses and left to gather dust in company archives. But as the patents on these “failed” compounds expire, a new and exciting opportunity is emerging: The Patent Expiry Gold Rush.

Forward-thinking companies are beginning to realize that their archives are not graveyards of failed projects, but treasure troves of untapped potential. They are systematically reviewing their discontinued portfolios, not as a clean-up exercise, but as a strategic asset management initiative. They are discovering that a compound that failed as an Alzheimer’s drug might be a breakthrough in oncology, or that an off-spec API can be a valuable research tool for academic institutions.

This article explores this paradigm shift- from viewing discontinued projects as sunk costs to seeing them as strategic assets. We will delve into the mechanics of the patent expiry gold rush, the strategies companies are using to unlock value, and the massive financial and strategic benefits of this new approach. The companies that master this will not only survive the patent cliff- they will thrive in the new landscape of pharmaceutical innovation.

Chapter 1: The Hidden Value in the R&D Graveyard

The scale of the opportunity is staggering. A typical large pharmaceutical company may have 150-300 discontinued compounds in its portfolio [2]. Historically, these have been viewed as a liability- materials to be stored, managed, and eventually destroyed. But this perspective ignores the immense value locked within these assets.

The Dual Value Proposition: IP and Materials

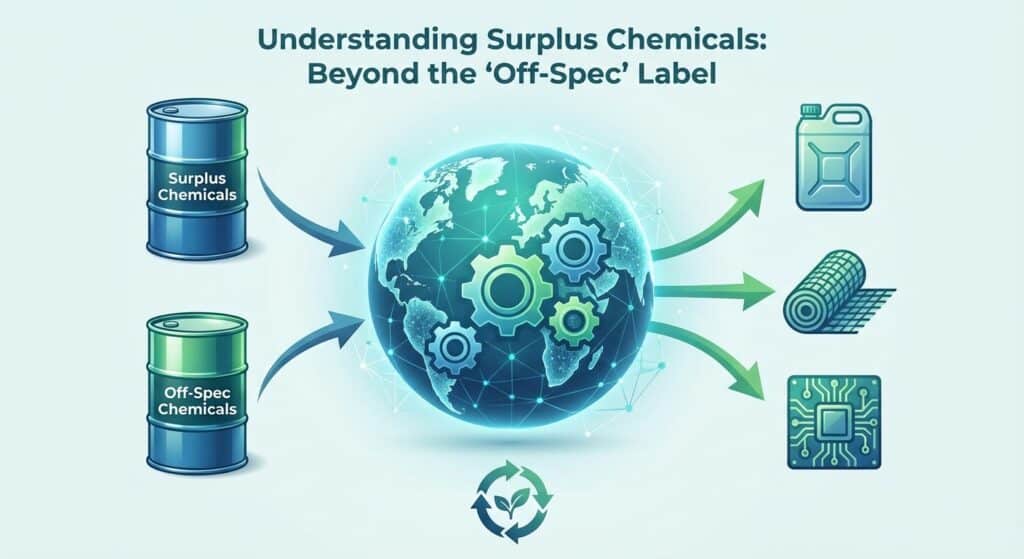

The value of a discontinued project can be broken down into two main components:

- Intellectual Property (IP): The research data, clinical trial results, and formulation know-how associated with the compound. Even if the original patent has expired, the associated data package can be incredibly valuable to other companies exploring similar therapeutic areas.

- Physical Materials: The actual APIs, intermediates, and reagents from the discontinued project. These materials, often of high purity and quality, can be repurposed for a variety of applications.

A 2013 study in the California Management Review highlighted the potential of out-licensing abandoned compounds, noting that “pharmaceutical companies are sitting on a treasure trove of abandoned drug candidates that could be developed by others” [3]. The study found that while companies were hesitant to license out compounds for fear of competition, the benefits of creating new revenue streams and partnerships often outweighed the risks.

Case Study: The Accidental Breakthrough

A well-known (though often anonymized) story in the industry involves a major pharmaceutical company that shelved a promising cardiovascular drug due to side effects. Years later, a small biotech company licensed the compound for a fraction of its original development cost. They repurposed it for a rare autoimmune disease, where the side effect profile was manageable. The drug is now a blockbuster in its own right, generating hundreds of millions in annual revenue. The original company, which had written off the project as a $100M+ loss, now receives a steady stream of royalties.

This is not an isolated incident. The secondary market for pharmaceutical compounds is growing at an estimated 25% annually, driven by the increasing cost of new drug discovery and the pressure to fill pipelines.

FAQ – Chapter 1

The primary driver is the massive wave of patent expirations facing the pharmaceutical industry, which is forcing companies to find new sources of revenue. This, combined with the high cost of new drug discovery, is making the repurposing of existing assets a more attractive and economically viable strategy

IP value refers to the data and knowledge associated with the compound (e.g., clinical trial data, formulation), which can be licensed to other companies. Material value refers to the physical chemical compounds themselves, which can be sold for alternative uses in research, non-pharma industries, or even for different therapeutic applications.

The main concerns were fear of creating a future competitor, the perceived complexity of the out-licensing process, and a cultural mindset that viewed discontinued projects as “failures” to be buried rather than assets to be monetized.

Chapter 2: Strategies for Unlocking Hidden Value

Recognizing the opportunity is the first step. The next is implementing a systematic process for unlocking it. This requires a new function within the organization, one that sits at the intersection of R&D, IP management, business development, and supply chain. We call this the Strategic Asset Recovery Team.

The Discontinuation Audit: A 4-Point Checklist

The core of this process is the “discontinuation audit”- a systematic review of all shelved projects. The audit should evaluate each compound against four key criteria:

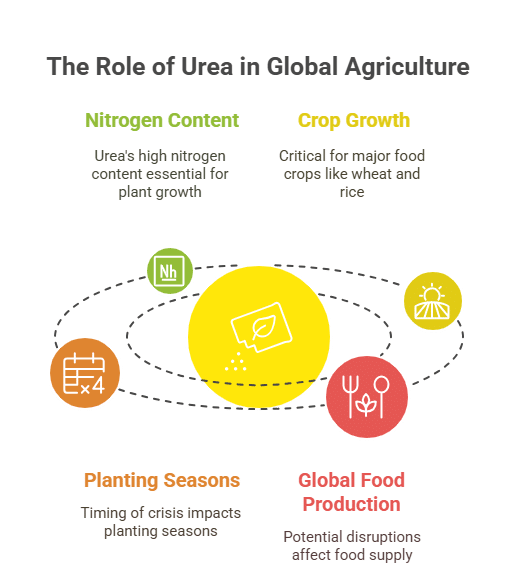

- Alternative Therapeutic Potential: Could this compound be effective for other diseases? This requires a review of the mechanism of action, side effect profile, and current unmet medical needs.

- Research Tool Potential: Could this compound be a valuable tool for academic or commercial researchers? High-purity, well-characterized compounds are always in demand.

- Cross-Industry Licensing Opportunities: Could this compound have applications outside of pharmaceuticals? For example, in agriculture, cosmetics, or specialty chemicals.

- Material Recovery Value: What is the market value of the physical materials? This requires an assessment of the quantity, purity, and stability of the surplus inventory.

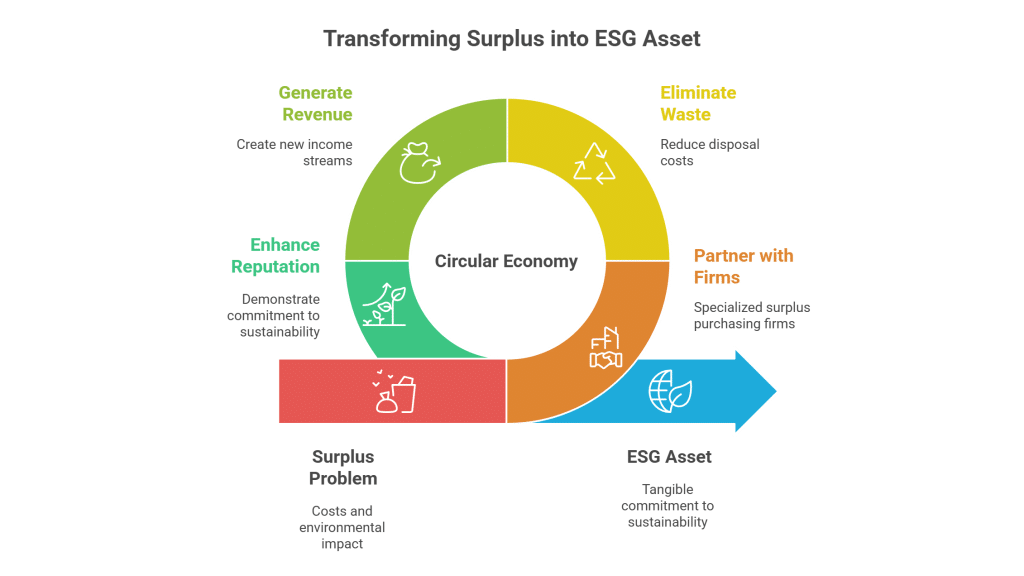

From “Write-Off” to “Activate”: A New Mindset

This process represents a fundamental shift from a “write-off and forget” mindset to an “archive and activate” strategy. Instead of seeing discontinued projects as a one-time loss, companies are beginning to see them as a long-term asset class with multiple potential pathways to value creation.

As noted by EY, navigating the “loss of exclusivity (LOE)” requires a proactive and strategic approach. While their focus is on managing the decline of existing blockbusters, the same principles apply to monetizing the “long tail” of a company’s IP portfolio [4].

The Role of Specialized Partners

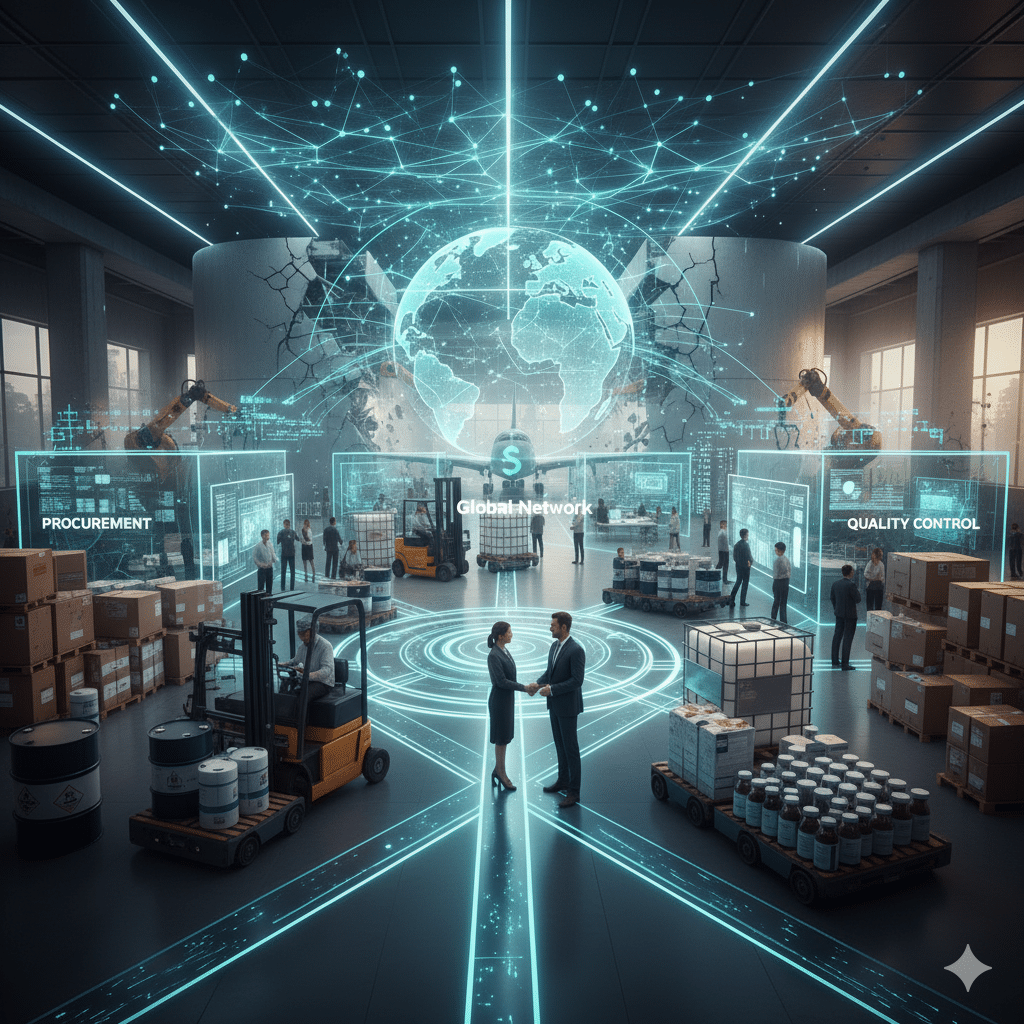

Most pharmaceutical companies are not equipped to handle this process internally. They are experts in drug discovery and manufacturing, not in the secondary markets for chemical compounds or the intricacies of cross-industry licensing. This is where specialized partners like Surplus International come in.

These partners provide the expertise and network to:

- Assess the value of discontinued portfolios

- Identify potential buyers and licensing partners

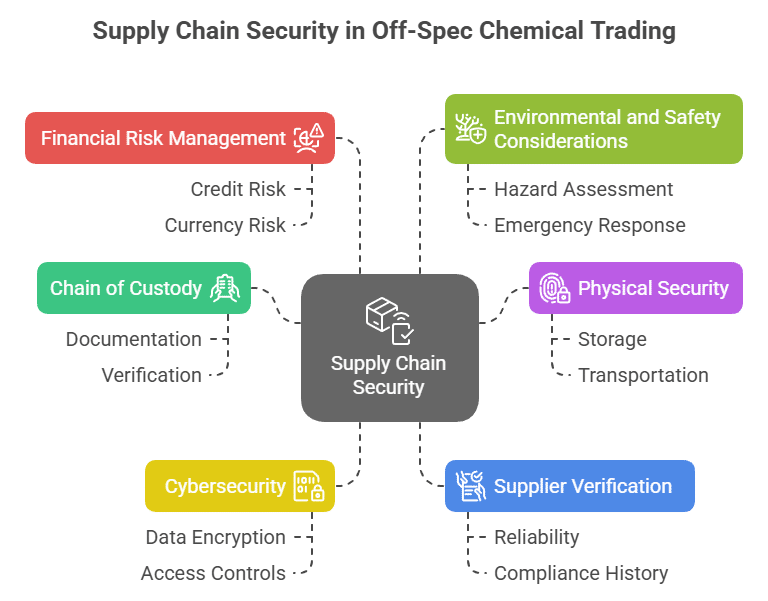

- Navigate the complex regulatory and logistical challenges

- Ensure complete confidentiality and brand protection

By working with a specialized partner, pharmaceutical companies can unlock the value of their shelved assets without diverting resources from their core mission of developing new medicines.

The team should be cross-functional, including representatives from R&D (who understand the science), IP/Legal (who understand the patent landscape), Business Development (who can identify commercial opportunities), and Supply Chain/Finance (who can quantify the material value and financial impact).

It should be an ongoing process. A full portfolio review should be conducted annually, with quarterly updates to assess new additions to the discontinued list. The key is to treat it as an active asset management process, not a one-time clean-up.

The biggest challenges are typically cultural and organizational. Overcoming the “not invented here” syndrome, breaking down silos between departments, and shifting the mindset from “failure” to “opportunity” are often more difficult than the technical aspects of the process.

Conclusion: The Future is in Your Archives

The pharmaceutical patent cliff is not just a threat; it is a catalyst for transformation. It is forcing the industry to look for value in unexpected places, and the most unexpected place of all is its own archives. The Patent Expiry Gold Rush is more than just a trend; it is a fundamental re-imagining of the pharmaceutical value chain.

The companies that embrace this shift will not only create new revenue streams and enhance their bottom line; they will also foster a culture of innovation, resourcefulness, and strategic agility. They will turn their R&D “graveyards” into innovation incubators, funding their next breakthroughs with the successes of the past.

As the industry gathers at CPHI India 2025, the conversation will be about the future. But the most strategic conversations will also be about the past- and how to unlock the immense value that lies dormant in discontinued projects and shelved IP. The future of your company may not just be in your pipeline; it may be in your filing cabinets.

References

[1] Drug Patent Watch. (2025, November 9). The End of Exclusivity: Navigating the Drug Patent Cliff for Financial Success. https://www.drugpatentwatch.com/blog/the-impact-of-drug-patent-expiration-financial-implications-lifecycle-strategies-and-market-transformations/

[2] Pharmaceutical Technology. (2025, July 4). Big pharma braces for revenue headwinds as patent expiries loom. https://www.pharmaceutical-technology.com/news/big-pharma-braces-for-revenue-headwinds-as-patent-expiries-loom/

[3] Chesbrough, H. W. (2013). Recovering abandoned compounds through expanded external IP licensing. California Management Review, 55(4), 83-101. https://journals.sagepub.com/doi/abs/10.1525/cmr.2013.55.4.83

[4] EY. (n.d.). Navigating pharma loss of exclusivity. https://www.ey.com/en_us/insights/life-sciences/navigating-pharma-loss-of-exclusivity

[5] Fierce Pharma. (2025, March 17). The top 10 drugs losing US exclusivity in 2025. https://www.fiercepharma.com/special-reports/top-10-drugs-losing-us-exclusivity-2025

Ready to Unlock the Gold in Your Archives?

Is your company sitting on a hidden goldmine of discontinued projects and surplus materials? It’s time to find out.

At Surplus International, we specialize in helping pharmaceutical companies navigate the Patent Expiry Gold Rush. Our team of experts can help you:

- Audit your discontinued project portfolio for hidden value

- Assess the market value of your surplus IP and materials

- Connect you with a global network of buyers and licensing partners

- Manage the entire process with complete confidentiality and compliance

Don’t Let Your Past Successes Go to Waste

Your “failures” could be your next big success story. Let us help you unlock it.

Contact us today for a confidential consultation and a complimentary portfolio assessment.

📧 Email: info@surplus-inter.com

🌐 Website: www.surplus-inter.com/

📞 Schedule a Call: Book a free strategy session with our IP recovery specialists

CPHI India 2025: Meet us at the event to discuss how we can turn your archives into assets. Limited meeting slots available.

The gold rush is on. Don’t get left behind.