Complete Guide to Off-Spec Chemical Trading: Regulations, Opportunities, and Best Practices

This comprehensive guide explores the specialized world of off-spec chemical trading, a significant secondary market within the global chemical industry. It delves into the nuances of materials that don’t meet original manufacturing specifications but still hold substantial commercial value. The guide covers crucial aspects such as regulatory compliance, quality assessment, market opportunities, and best practices, offering essential knowledge for manufacturers, buyers, and intermediaries navigating this complex yet rewarding sector.

Table of Contents

Introduction to Off-Spec Chemical Trading

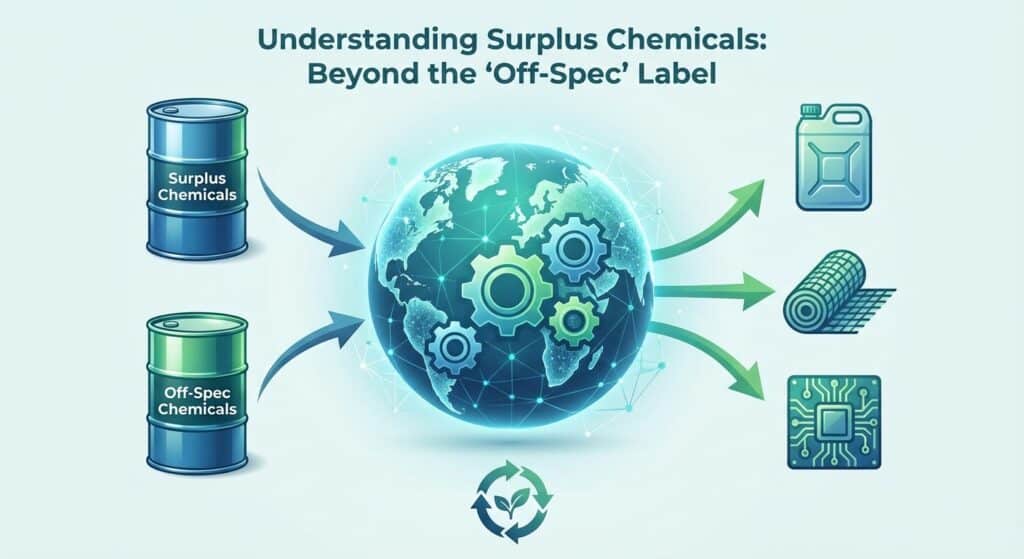

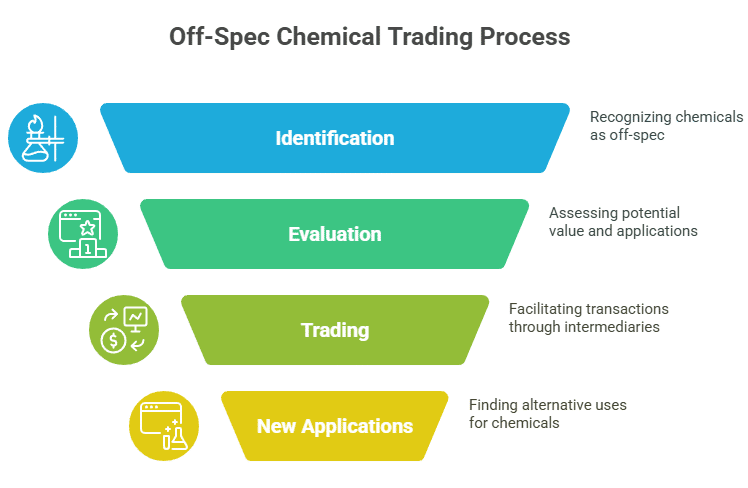

The global chemical industry generates billions of dollars worth of off-specification chemicals annually, creating a substantial secondary market that offers significant opportunities for both manufacturers and buyers. Off-specification chemical trading represents a specialized sector within the broader chemical industry, where materials that fail to meet original manufacturing specifications find new applications and markets through expert intermediaries and trading platforms.

Off-specification chemicals, commonly referred to as “off-spec” materials, are chemical products that do not conform to the exact specifications originally intended during manufacturing but retain substantial commercial value for alternative applications. These materials emerge from various sources including production overruns, specification changes, quality control variations, and inventory management decisions by chemical manufacturers worldwide.

The off-spec chemical trading market has evolved into a sophisticated ecosystem that requires deep understanding of regulatory frameworks, quality assessment protocols, and international trade requirements. Unlike standard chemical trading, off-spec transactions demand specialized expertise in areas such as hazardous waste classification, regulatory compliance across multiple jurisdictions, and risk assessment for alternative applications.

According to the U.S. Environmental Protection Agency, the distinction between off-specification commercial chemical products and hazardous waste is critical for legal compliance and market participation [1]. The EPA’s guidance on “Solvents in the Workplace – How to Determine if They Are Hazardous Waste” specifically addresses off-specification commercial chemical products and their regulatory status under the Resource Conservation and Recovery Act (RCRA) [1].

This comprehensive guide examines every aspect of off-spec chemical trading, from regulatory compliance and documentation requirements to market opportunities and risk management strategies. Whether you are a chemical manufacturer seeking to monetize surplus inventory, a buyer looking for cost-effective chemical solutions, or an intermediary facilitating these transactions, this guide provides the essential knowledge needed to navigate this complex but rewarding market successfully.

The importance of proper regulatory compliance cannot be overstated in off-spec chemical trading. The Toxic Substances Control Act (TSCA) in the United States and the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) regulation in the European Union establish comprehensive frameworks that govern chemical trading activities [2][3]. Understanding these regulations and their implications for off-spec materials is fundamental to successful and legal trading operations.

Understanding Off-Specification Chemicals

Definition and Classification

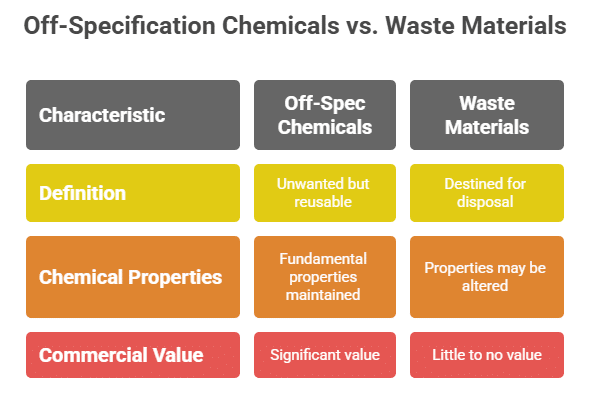

Off-specification chemicals represent a diverse category of materials that, while not meeting their original manufacturing specifications, retain significant commercial value for alternative applications. The Environmental Protection Agency defines off-specification commercial chemical products as materials that “can no longer be used” for their intended purpose but are “unwanted and/or unused and destined for disposal” unless they find alternative markets [1].

The classification of off-spec chemicals requires careful consideration of multiple factors including chemical composition, purity levels, contamination types, and potential applications. Unlike waste materials, off-spec chemicals maintain their fundamental chemical properties and can often be utilized in applications where the original specification requirements are less stringent or where the specific deviation from specification is acceptable or even beneficial.

Chemical manufacturers typically generate off-spec materials through several pathways. Production variations during manufacturing can result in products that fall outside specified parameters for concentration, purity, color, or physical properties. Equipment changeovers between different product runs may produce transition materials that contain mixtures of different chemicals. Quality control processes may identify batches that fail to meet customer specifications but remain suitable for other applications.

Storage and handling considerations also contribute to off-spec generation. Materials that approach or exceed shelf-life limits may be classified as off-spec even when their chemical properties remain largely unchanged. Environmental factors such as temperature fluctuations, moisture exposure, or container degradation can affect product specifications while leaving the core chemical composition intact.

Types and Categories

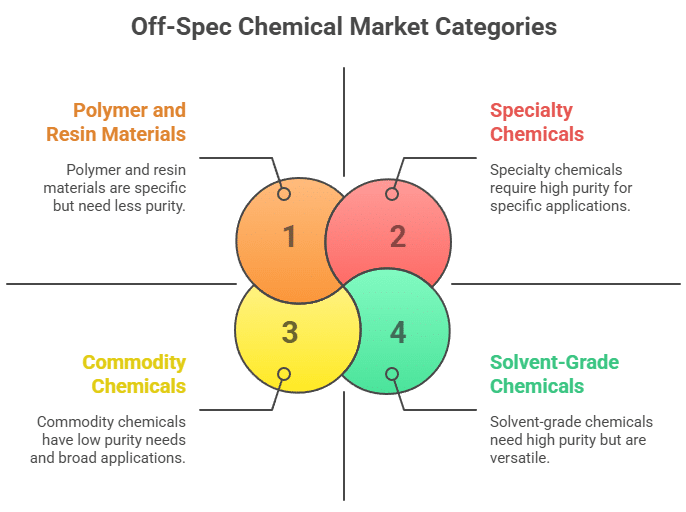

The off-spec chemical market encompasses numerous categories of materials, each with distinct characteristics and potential applications. Solvent-grade chemicals represent one of the largest segments, where materials originally intended for high-purity applications can find use in cleaning, extraction, or industrial processes with less stringent purity requirements.

Polymer and resin materials frequently enter the off-spec market when molecular weight distributions, viscosity measurements, or additive concentrations fall outside original specifications. These materials often retain excellent performance characteristics for applications such as adhesives, coatings, or molding compounds where the specific deviation may be inconsequential or even advantageous.

Specialty chemicals including catalysts, surfactants, and performance additives may become off-spec due to concentration variations, impurity levels, or physical property changes. Despite these deviations, many specialty off-spec chemicals maintain their fundamental functionality and can provide cost-effective solutions for applications where premium-grade materials are not essential.

Commodity chemicals such as acids, bases, and salts represent another significant category where off-spec materials can offer substantial value. Industrial processes often have tolerance ranges that accommodate off-spec materials, particularly in applications such as water treatment, metal processing, or chemical synthesis where exact specifications may be less critical.

Quality Assessment and Characterization

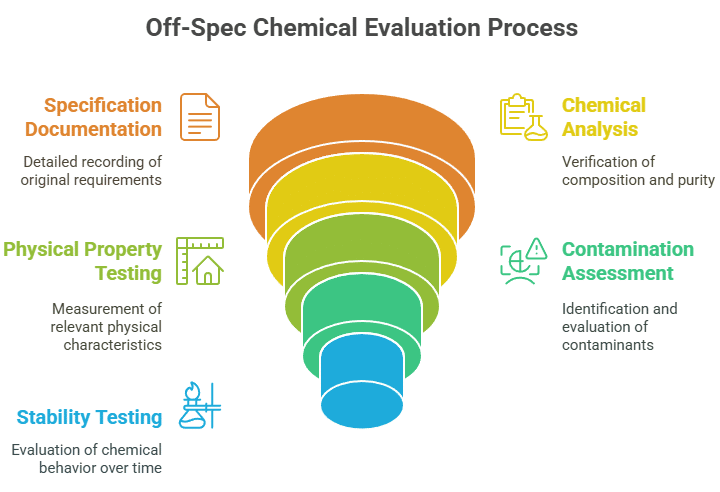

Proper characterization of off-spec chemicals requires comprehensive analytical testing to determine their suitability for alternative applications. This process begins with detailed documentation of the original specification requirements and identification of specific parameters that caused the material to be classified as off-spec.

Chemical analysis typically includes composition verification through techniques such as gas chromatography, liquid chromatography, or spectroscopic methods. Purity assessments identify both the concentration of the primary component and the nature and levels of impurities present. Physical property testing may include measurements of density, viscosity, melting point, boiling point, and other characteristics relevant to potential applications.

Contamination assessment represents a critical aspect of off-spec chemical evaluation. Understanding the source, nature, and concentration of contaminants helps determine whether materials can be used directly, require treatment or purification, or are suitable only for specific applications where the contaminants are acceptable or removable.

Stability testing evaluates how off-spec chemicals behave over time under various storage and handling conditions. This information is essential for determining shelf life, storage requirements, and potential degradation pathways that could affect performance or safety in alternative applications.

The documentation of analytical results must be comprehensive and traceable to support regulatory compliance and customer confidence. Certificate of Analysis (COA) documents for off-spec chemicals should clearly identify deviations from original specifications while providing complete characterization data to enable informed decision-making by potential users.

Regulatory Framework and Compliance

United States Regulatory Environment

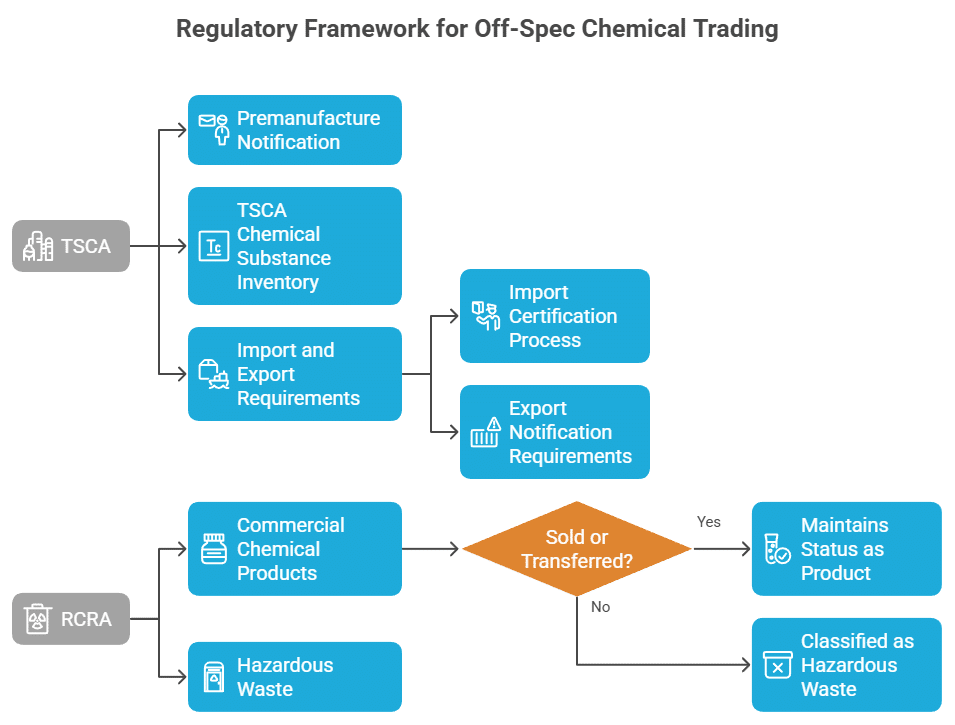

The regulatory landscape for off-spec chemical trading in the United States is primarily governed by the Toxic Substances Control Act (TSCA), administered by the Environmental Protection Agency. TSCA establishes comprehensive requirements for the manufacture, import, export, and distribution of chemical substances, with specific provisions that directly impact off-spec chemical trading activities [2].

Under TSCA Section 5, any person planning to manufacture a new chemical substance for commercial purposes must provide EPA with a Premanufacture Notification (PMN) [2]. This requirement extends to off-spec chemicals when they are used in applications that constitute new uses under TSCA definitions. The EPA’s TSCA Chemical Substance Inventory serves as the definitive list of chemicals that can be manufactured or imported for commercial purposes without additional notification requirements [2].

Import and export requirements under TSCA Section 6 contain special provisions for certain chemicals including polychlorinated biphenyls (PCBs), mercury, asbestos, and lead [2]. These requirements apply regardless of whether the chemicals meet original specifications, making compliance essential for off-spec materials containing these substances.

The TSCA import certification process requires importers to certify that chemical substances comply with TSCA requirements or are not subject to TSCA [2]. The U.S. Customs and Border Protection published regulations in 2016 establishing electronic filing options for TSCA import certification statements through the Automated Commercial Environment (ACE) system [2]. This electronic filing capability, effective March 21, 2017, streamlines the import process for off-spec chemicals while maintaining regulatory oversight.

TSCA Section 12(b) establishes export notification requirements for certain chemicals, requiring exporters to notify EPA of their intent to export specific substances [2]. These notifications must be submitted according to detailed timing requirements and must include specific information about the chemicals being exported, regardless of their specification status.

The Resource Conservation and Recovery Act (RCRA) provides another critical regulatory framework affecting off-spec chemical trading. RCRA regulations distinguish between commercial chemical products and hazardous waste, a distinction that is fundamental to legal off-spec trading [1]. The EPA’s guidance document “Solvents in the Workplace – How to Determine if They Are Hazardous Waste” specifically addresses off-specification commercial chemical products and provides detailed criteria for determining when such materials are considered waste versus products [1].

Under RCRA Section 261.33, commercial chemical products, including off-specification species, container residues, and spill residues, may be classified as hazardous waste when discarded [1]. However, when off-spec chemicals are sold or transferred for use in legitimate applications, they typically maintain their status as commercial chemical products rather than waste, provided they meet specific regulatory criteria.

European Union REACH Regulation

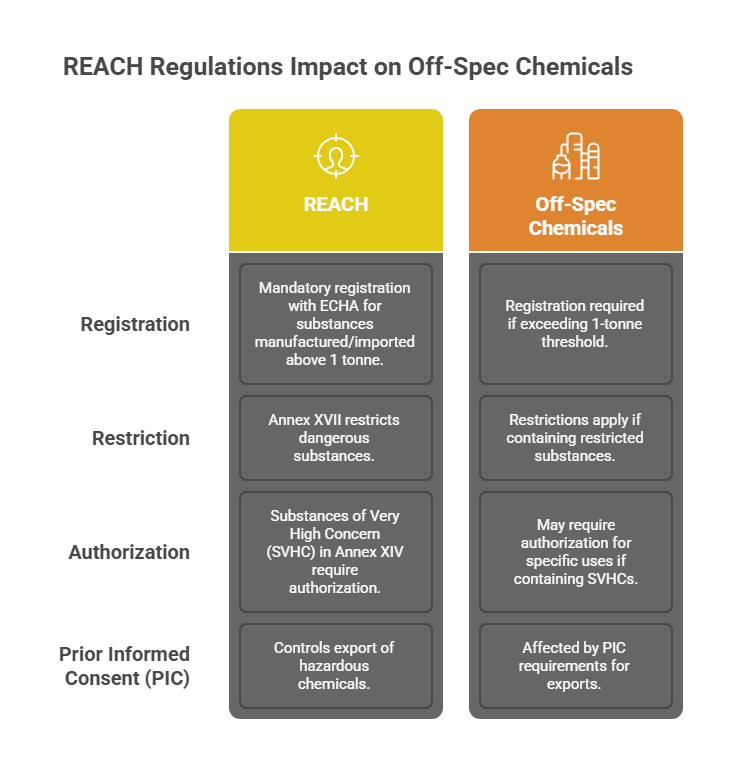

The Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) regulation establishes the European Union’s comprehensive framework for chemical safety and trading [3]. REACH applies to all chemical substances manufactured or imported into the EU in quantities of one tonne or more per year, regardless of whether they meet original specifications.

Under REACH, manufacturers and importers must register chemical substances with the European Chemicals Agency (ECHA) and provide detailed safety information [3]. This registration requirement applies to off-spec chemicals when they are manufactured or imported in quantities exceeding the one-tonne threshold. The registration dossier must include comprehensive data on chemical properties, uses, exposure scenarios, and risk management measures.

The REACH regulation’s Annex XVII contains restrictions on the manufacture, placing on the market, and use of certain dangerous substances [3]. As of June 2025, the ECHA database contains 77 unique substances or entries subject to restrictions under REACH [3]. These restrictions apply to off-spec chemicals containing restricted substances, potentially limiting their trading opportunities or requiring specific risk management measures.

REACH authorization requirements under Title VII apply to substances of very high concern (SVHC) listed in Annex XIV [3]. Off-spec chemicals containing SVHC substances may require authorization for specific uses, adding complexity to trading arrangements and requiring detailed application processes with ECHA.

The Prior Informed Consent (PIC) Regulation works in conjunction with REACH to control the export of hazardous chemicals from the EU [3]. Recent updates to PIC requirements, effective March 1, 2025, added 40 additional hazardous chemicals to the notification requirements for EU exporters [3]. These requirements affect off-spec chemical exports and require careful compliance planning.

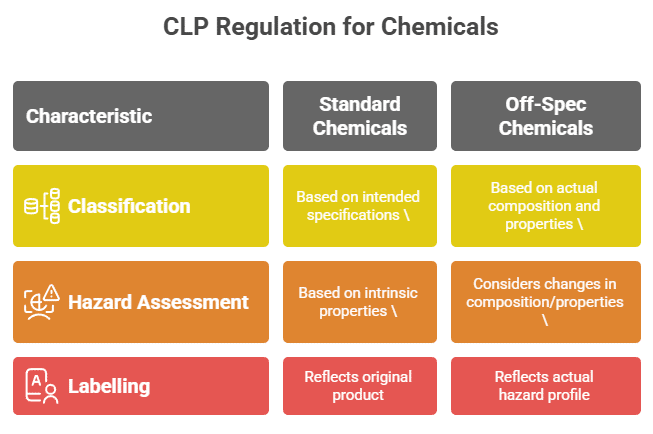

Classification, Labelling and Packaging (CLP) Regulation

The CLP Regulation implements the United Nations Globally Harmonized System (GHS) for classification and labelling of chemicals in the European Union [3]. Off-spec chemicals must be classified and labelled according to CLP requirements based on their actual chemical composition and properties, not their original intended specifications.

Classification under CLP requires assessment of physical, health, and environmental hazards based on the chemical’s intrinsic properties [3]. For off-spec chemicals, this assessment must consider any changes in composition or properties that may affect hazard classification. Impurities or contaminants present in off-spec materials may alter the overall hazard profile and require updated classification.

Labelling requirements under CLP mandate specific hazard pictograms, signal words, hazard statements, and precautionary statements based on the chemical’s classification [3]. Off-spec chemicals must display accurate labelling that reflects their actual hazard profile, which may differ from the original product labelling if composition or properties have changed.

International Trade Considerations

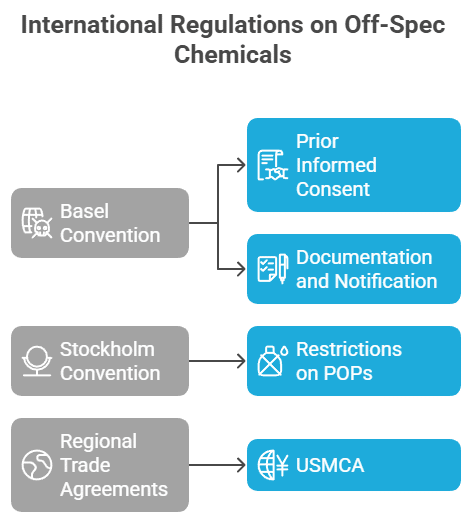

The Basel Convention on the Control of Transboundary Movements of Hazardous Wastes and Their Disposal affects international trading of off-spec chemicals when they are classified as waste [4]. The convention requires prior informed consent procedures for transboundary movements of hazardous waste and establishes specific documentation and notification requirements.

The Stockholm Convention on Persistent Organic Pollutants restricts or eliminates the production and use of specific chemicals [4]. Off-spec chemicals containing persistent organic pollutants (POPs) are subject to these international restrictions, which may limit trading opportunities or require specific management approaches.

Regional trade agreements and bilateral arrangements may establish additional requirements or exemptions for chemical trading. The United States-Mexico-Canada Agreement (USMCA), for example, includes specific provisions for chemical trade that may affect off-spec chemical transactions between these countries.

Compliance Strategies and Best Practices

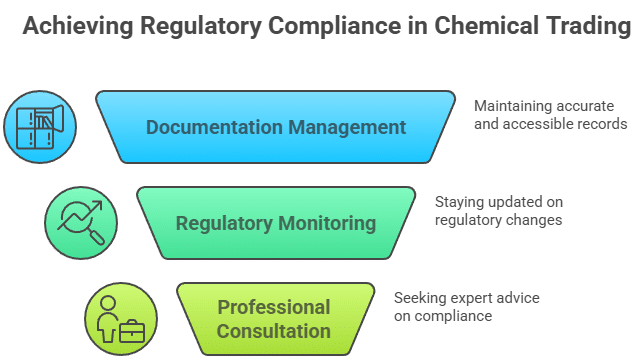

Successful regulatory compliance in off-spec chemical trading requires comprehensive understanding of applicable regulations across all relevant jurisdictions. This understanding must encompass not only the primary chemical trading regulations but also environmental, transportation, and occupational safety requirements that may apply.

Documentation management represents a critical compliance element. Proper records must be maintained for all regulatory notifications, registrations, certifications, and authorizations. These records must be readily accessible for regulatory inspections and must demonstrate ongoing compliance with all applicable requirements.

Regular regulatory monitoring ensures awareness of changing requirements and new restrictions that may affect off-spec chemical trading. Regulatory agencies frequently update guidance documents, issue new restrictions, and modify existing requirements. Staying current with these changes is essential for maintaining compliance and avoiding violations.

Professional consultation with regulatory experts, legal counsel, and industry associations provides valuable support for complex compliance issues. The specialized nature of off-spec chemical trading often requires expert interpretation of regulatory requirements and their application to specific trading scenarios.

The Role of Chemical Intermediaries

Definition and Function of Chemical Intermediaries

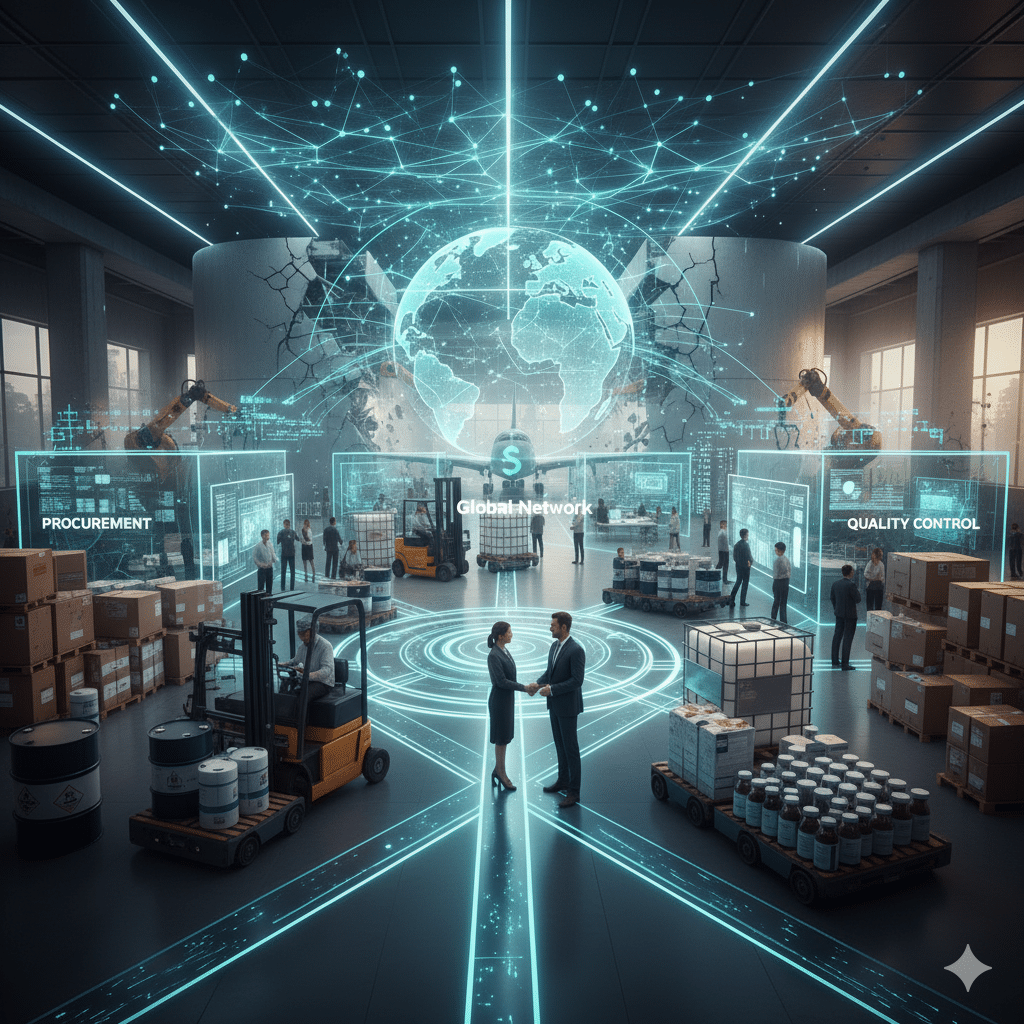

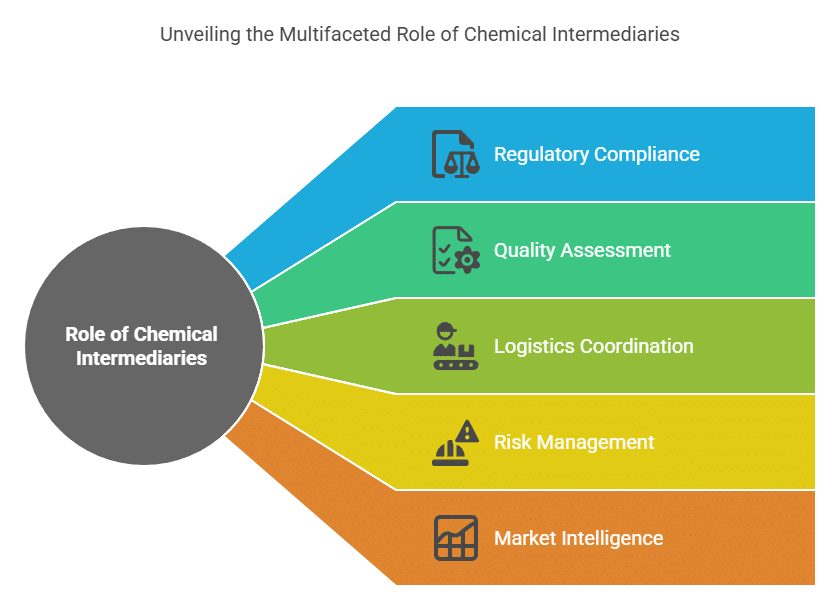

Chemical intermediaries serve as specialized facilitators in the off-spec chemical trading market, bridging the gap between manufacturers with surplus materials and buyers seeking cost-effective chemical solutions. The Drug Enforcement Administration defines intermediaries in chemical trading as entities that function as brokers or facilitators, distinct from end customers in the supply chain [5].

The role of chemical intermediaries extends far beyond simple brokerage services. These specialized companies provide comprehensive expertise in regulatory compliance, quality assessment, logistics coordination, and risk management. Their deep understanding of both supply and demand dynamics enables efficient matching of off-spec materials with appropriate applications and end users.

Chemical intermediaries typically maintain extensive networks of both suppliers and customers across multiple industries and geographic regions. This network effect creates significant value by enabling rapid identification of suitable markets for specific off-spec materials while providing buyers with access to diverse supply sources that would be difficult to develop independently.

The expertise provided by chemical intermediaries is particularly valuable in the off-spec market due to the specialized knowledge required for proper evaluation, handling, and application of materials that deviate from original specifications. This expertise encompasses technical assessment capabilities, regulatory compliance knowledge, and market intelligence that enables optimal value realization for all parties involved.

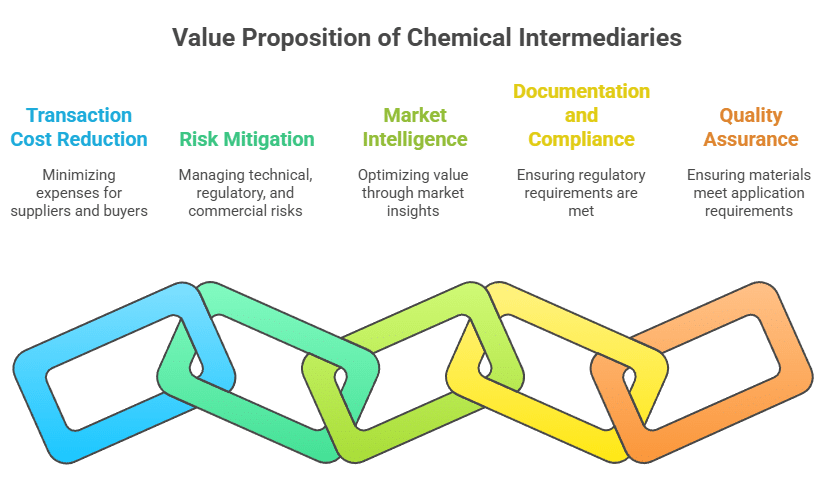

Value Proposition and Services

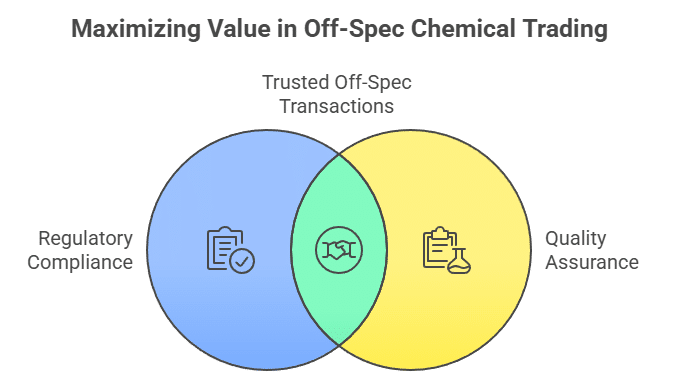

The primary value proposition of chemical intermediaries lies in their ability to reduce transaction costs, minimize risks, and optimize outcomes for both suppliers and buyers of off-spec chemicals. For manufacturers, intermediaries provide immediate liquidity for surplus materials while eliminating the need to develop specialized expertise in off-spec marketing and sales.

Risk mitigation represents a fundamental service provided by chemical intermediaries. The off-spec chemical market involves numerous technical, regulatory, and commercial risks that can be effectively managed through specialized expertise and experience. Intermediaries assume responsibility for proper characterization, regulatory compliance, and quality assurance, reducing exposure for both suppliers and buyers.

Market intelligence and pricing expertise enable intermediaries to optimize value realization for off-spec materials. Their understanding of market dynamics, alternative applications, and pricing trends allows for strategic timing of transactions and identification of premium applications where off-spec materials may command higher prices than commodity markets.

Documentation and compliance services provided by intermediaries ensure that all regulatory requirements are met throughout the trading process. This includes preparation of certificates of analysis, safety data sheets, regulatory notifications, and import/export documentation. The complexity of these requirements makes professional management essential for successful transactions.

Quality assurance and technical support services help ensure that off-spec materials meet the requirements of their intended applications. Intermediaries often provide additional testing, blending, or treatment services to optimize material properties for specific end uses. This technical capability adds significant value by expanding the range of suitable applications for off-spec materials.

Regulatory Compliance and Expertise

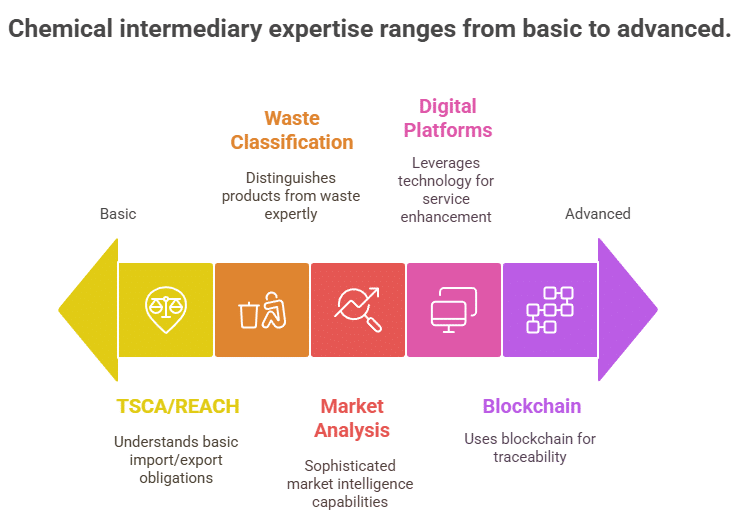

Chemical intermediaries must maintain comprehensive expertise in the complex regulatory frameworks governing chemical trading across multiple jurisdictions. This expertise is essential for ensuring compliance with TSCA requirements in the United States, REACH regulations in the European Union, and other applicable regulations in target markets.

Under TSCA, intermediaries involved in chemical trading must understand their obligations regarding import certification, export notification, and new use notifications [2]. The complexity of these requirements, particularly for off-spec materials that may have novel applications, requires specialized regulatory expertise that most manufacturers and end users lack.

REACH compliance for intermediaries involves understanding registration requirements, restriction provisions, and authorization obligations [3]. When intermediaries import off-spec chemicals into the European Union, they may assume registration obligations and must ensure that all safety requirements are met. This responsibility requires detailed knowledge of REACH procedures and ongoing monitoring of regulatory updates.

The distinction between chemical products and waste under various regulatory frameworks represents a critical area of expertise for intermediaries. Improper classification can result in significant legal and financial consequences, making expert evaluation essential for every transaction. The EPA’s guidance on this distinction provides detailed criteria that must be carefully applied to each specific situation [1].

International trade regulations add another layer of complexity that intermediaries must navigate. This includes customs classification, duty optimization, transportation regulations, and bilateral trade agreement provisions. Professional management of these requirements can significantly impact transaction economics and feasibility.

Market Intelligence and Network Effects

Chemical intermediaries develop and maintain sophisticated market intelligence capabilities that provide significant advantages in identifying opportunities and optimizing transactions. This intelligence encompasses supply availability, demand patterns, pricing trends, and regulatory developments across multiple markets and applications.

The network effects created by intermediaries generate substantial value for all market participants. Large intermediaries maintain relationships with hundreds or thousands of suppliers and customers, creating liquidity and efficiency that would be impossible for individual companies to achieve independently. These networks enable rapid response to market opportunities and efficient allocation of materials to their highest-value applications.

Geographic reach and local expertise enable intermediaries to access global markets while managing regional regulatory and commercial requirements. This capability is particularly valuable for off-spec chemicals, where local regulations and market conditions can significantly impact feasibility and value realization.

Industry specialization allows some intermediaries to develop deep expertise in specific chemical categories or applications. This specialization enables more effective evaluation of off-spec materials and identification of optimal applications where specification deviations may be acceptable or even beneficial.

Technology and Digital Platforms

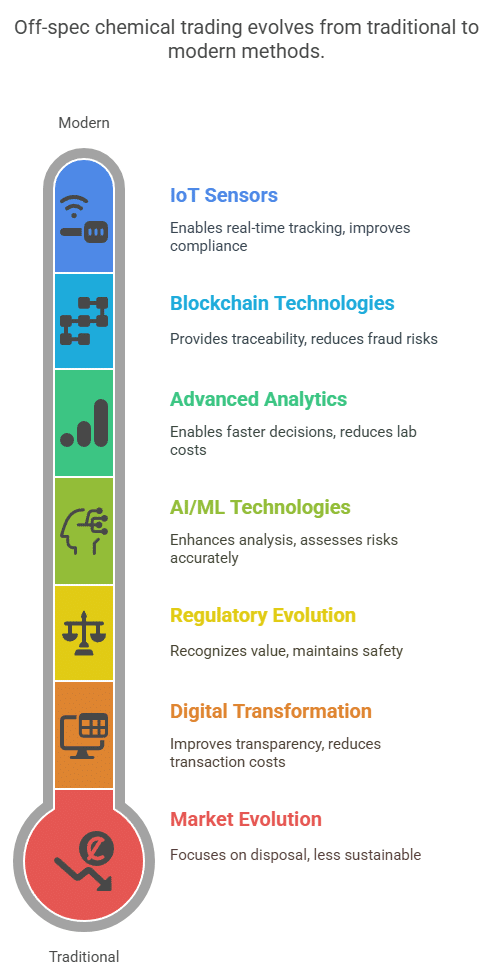

Modern chemical intermediaries increasingly leverage technology platforms to enhance their service capabilities and market reach. Digital platforms enable efficient matching of supply and demand while providing transparency and documentation throughout the trading process.

Online marketplaces and trading platforms allow intermediaries to reach broader audiences while reducing transaction costs. These platforms often include sophisticated search and filtering capabilities that enable rapid identification of suitable materials or applications based on specific technical requirements.

Data analytics and artificial intelligence capabilities enable intermediaries to optimize pricing, predict market trends, and identify emerging opportunities. These technologies can process vast amounts of market data to identify patterns and opportunities that would be difficult to detect through traditional methods.

Blockchain and distributed ledger technologies are beginning to find applications in chemical trading, particularly for documentation and traceability requirements. These technologies can provide immutable records of transactions, testing results, and regulatory compliance activities, enhancing trust and reducing administrative burdens.

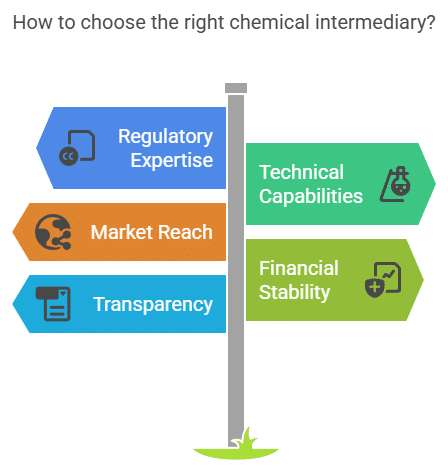

Selection Criteria for Chemical Intermediaries

Choosing the right chemical intermediary is critical for successful off-spec chemical trading. Key selection criteria include regulatory expertise, technical capabilities, market reach, financial stability, and track record of successful transactions.

Regulatory expertise should encompass all relevant jurisdictions and regulations applicable to the specific chemicals and markets involved. This expertise should be demonstrated through professional certifications, regulatory submissions, and successful compliance history.

Technical capabilities must match the complexity and requirements of the specific off-spec materials involved. This includes analytical testing capabilities, quality assurance procedures, and technical support services that ensure materials meet application requirements.

Market reach and network effects determine the intermediary’s ability to identify optimal applications and achieve competitive pricing. Established relationships with qualified buyers and suppliers provide significant advantages in transaction execution and value optimization.

Financial stability and insurance coverage provide protection against various risks inherent in chemical trading. Adequate financial resources ensure that intermediaries can fulfill their obligations and provide appropriate risk management for all parties involved.

Transparency and communication practices affect the overall trading experience and relationship quality. Professional intermediaries provide regular updates, detailed documentation, and responsive communication throughout the transaction process.

Market Opportunities and Benefits

Market Size and Growth Potential

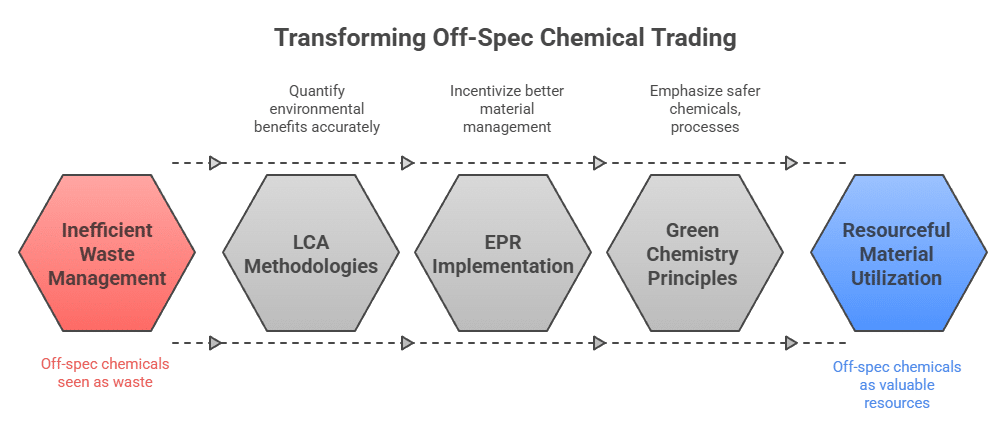

The global off-spec chemical trading market represents a substantial and growing segment of the broader chemical industry, with annual transaction values estimated in the billions of dollars worldwide. This market has experienced consistent growth driven by increasing environmental awareness, cost optimization pressures, and improved regulatory frameworks that facilitate legitimate trading of off-spec materials.

Market growth is supported by several fundamental trends in the chemical industry. Manufacturing efficiency improvements have reduced the generation of off-spec materials, but the absolute volume remains substantial due to overall industry growth. Simultaneously, increasing sophistication in application development has expanded the range of uses for off-spec materials, creating new market opportunities.

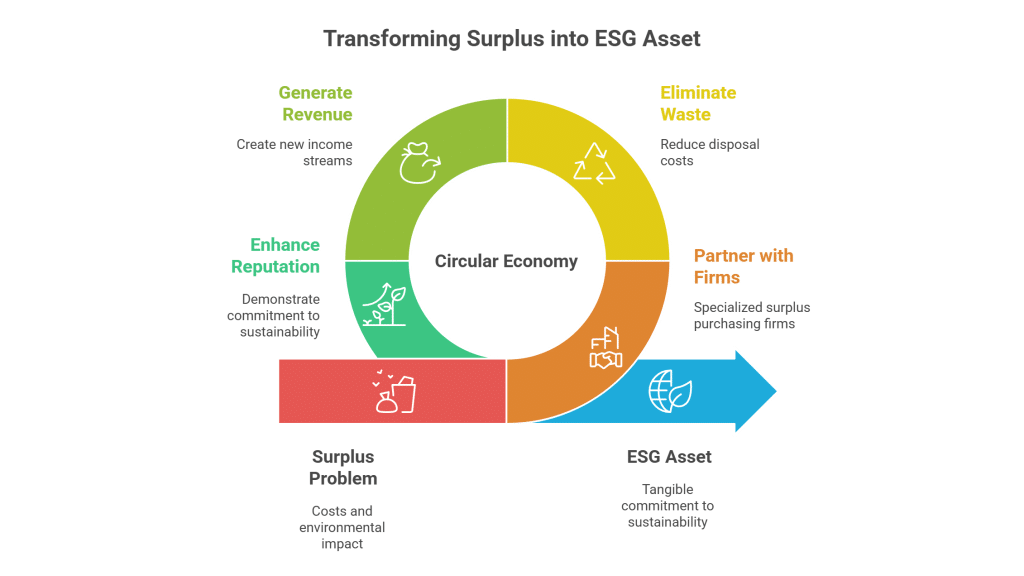

The circular economy movement has provided additional impetus for off-spec chemical trading by emphasizing resource efficiency and waste minimization. Companies increasingly view off-spec materials as valuable resources rather than waste products, driving demand for professional trading services that can optimize value realization while ensuring regulatory compliance.

Regional market dynamics vary significantly based on local regulations, industrial development, and environmental policies. Developed markets typically offer higher prices but require more stringent compliance with regulatory requirements. Emerging markets may provide volume opportunities but require careful evaluation of regulatory frameworks and commercial practices.

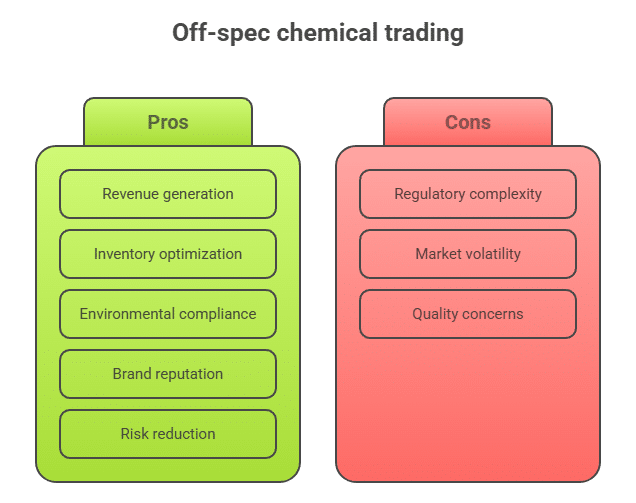

Benefits for Chemical Manufacturers

Chemical manufacturers realize multiple benefits from professional off-spec chemical trading beyond simple waste disposal cost avoidance. Revenue generation from materials that would otherwise require costly disposal can significantly impact profitability, particularly for high-volume manufacturing operations.

Inventory optimization represents another significant benefit, as manufacturers can convert slow-moving or obsolete inventory into cash flow while freeing up valuable storage space for active products. This optimization is particularly valuable for specialty chemical manufacturers with limited storage capacity and diverse product portfolios.

Environmental compliance benefits include reduced waste generation reporting requirements and lower environmental liability exposure. When off-spec materials are sold for legitimate use rather than disposed of as waste, manufacturers can often reduce their regulatory reporting burdens and associated compliance costs.

Brand reputation enhancement occurs when manufacturers demonstrate commitment to sustainability and resource efficiency through responsible off-spec material management. This commitment can support corporate sustainability goals and provide competitive advantages in environmentally conscious markets.

Risk reduction benefits include elimination of long-term storage liabilities and reduced exposure to changing waste disposal regulations. Professional trading arrangements transfer these risks to specialized intermediaries with appropriate expertise and insurance coverage.

Opportunities for Chemical Buyers

Chemical buyers can realize substantial cost savings through strategic use of off-spec materials in appropriate applications. These savings typically range from 20% to 60% compared to prime-grade materials, depending on the specific deviation from specification and market conditions.

Supply chain diversification benefits include reduced dependence on single suppliers and improved resilience against supply disruptions. Off-spec materials can provide alternative supply sources that enhance overall supply security while reducing procurement costs.

Innovation opportunities arise when off-spec materials enable development of new applications or processes that would not be economically viable with prime-grade materials. The lower cost of off-spec materials can justify experimentation and development activities that support innovation and competitive advantage.

Quality advantages may occur in specific applications where the deviation from original specification actually improves performance. For example, off-spec solvents with slightly higher water content may perform better in certain cleaning applications, while off-spec polymers with modified molecular weight distributions may offer improved processing characteristics.

Sustainability benefits include reduced environmental impact through resource conservation and waste minimization. Companies using off-spec materials can often claim environmental benefits that support corporate sustainability reporting and stakeholder engagement activities.

Industry-Specific Applications

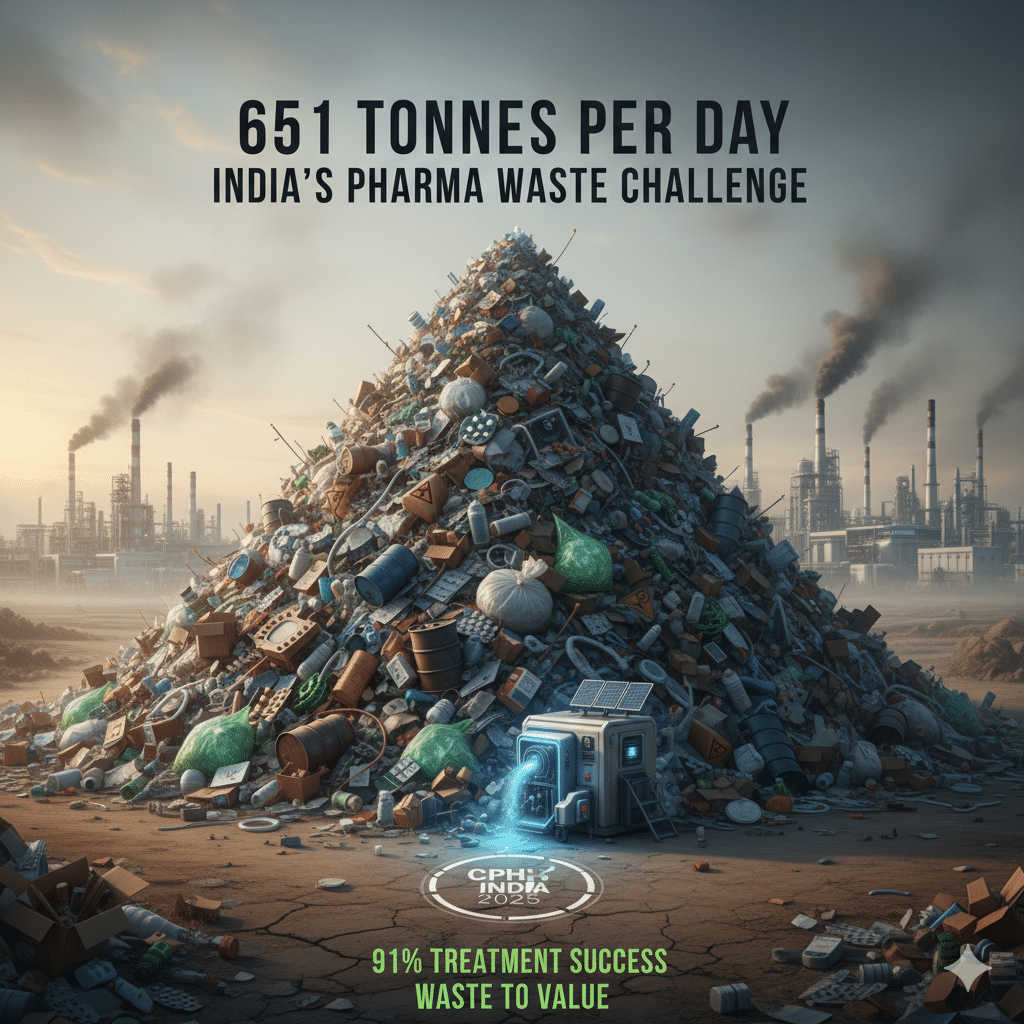

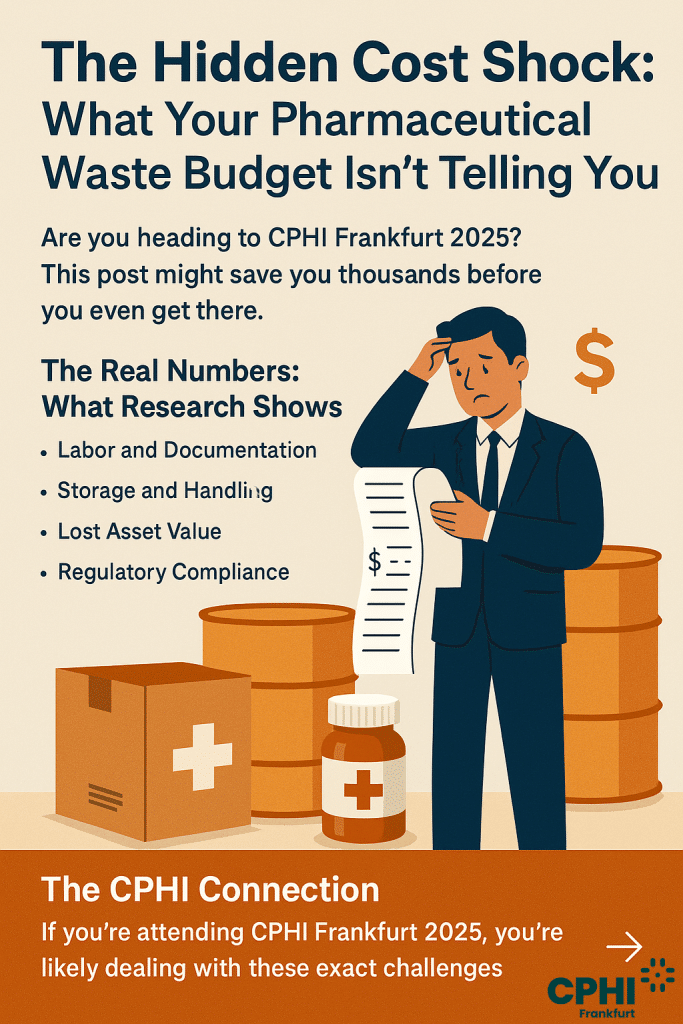

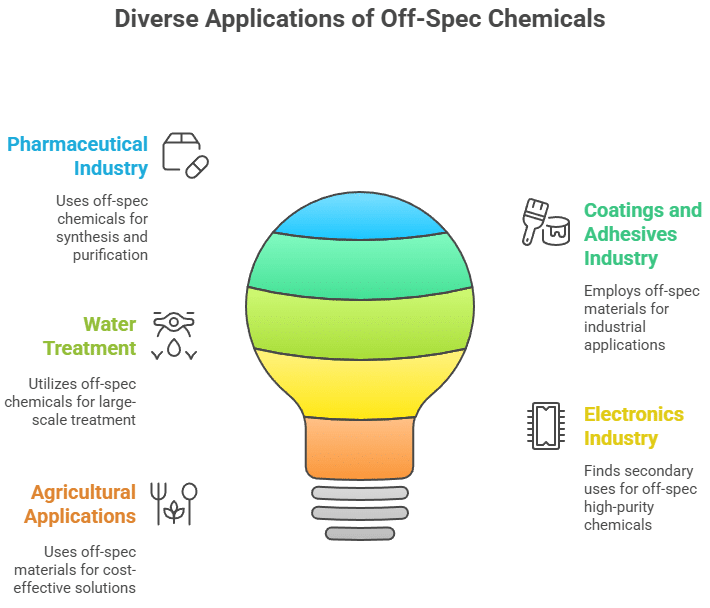

The pharmaceutical industry represents a significant market for off-spec chemicals, particularly for materials used in synthesis, purification, and formulation processes. Off-spec solvents, reagents, and intermediates can often be used in non-critical applications where exact specifications are less important than cost optimization.

The coatings and adhesives industry frequently utilizes off-spec polymers, resins, and solvents where performance requirements may be less stringent than in original applications. Color variations, viscosity differences, or molecular weight distributions that make materials unsuitable for premium applications may be perfectly acceptable for industrial coatings or construction adhesives.

Water treatment applications provide substantial opportunities for off-spec chemicals, particularly acids, bases, and specialty treatment chemicals. The large volumes required for water treatment and the tolerance for specification variations make this an attractive market for many off-spec materials.

The electronics industry uses significant quantities of high-purity chemicals for manufacturing processes. Off-spec materials from these applications may find secondary uses in less critical cleaning, etching, or processing applications where ultra-high purity is not required.

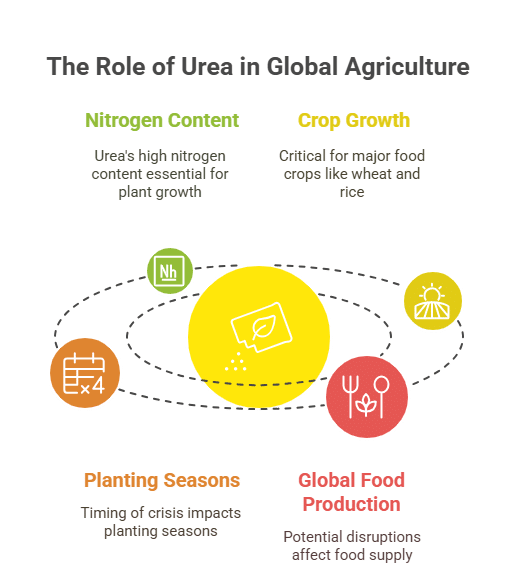

Agricultural applications include fertilizers, pesticide formulations, and soil treatment chemicals where off-spec materials may provide cost-effective alternatives to prime-grade products. The seasonal nature of agricultural demand can create opportunities for strategic inventory management using off-spec materials.

Geographic Market Dynamics

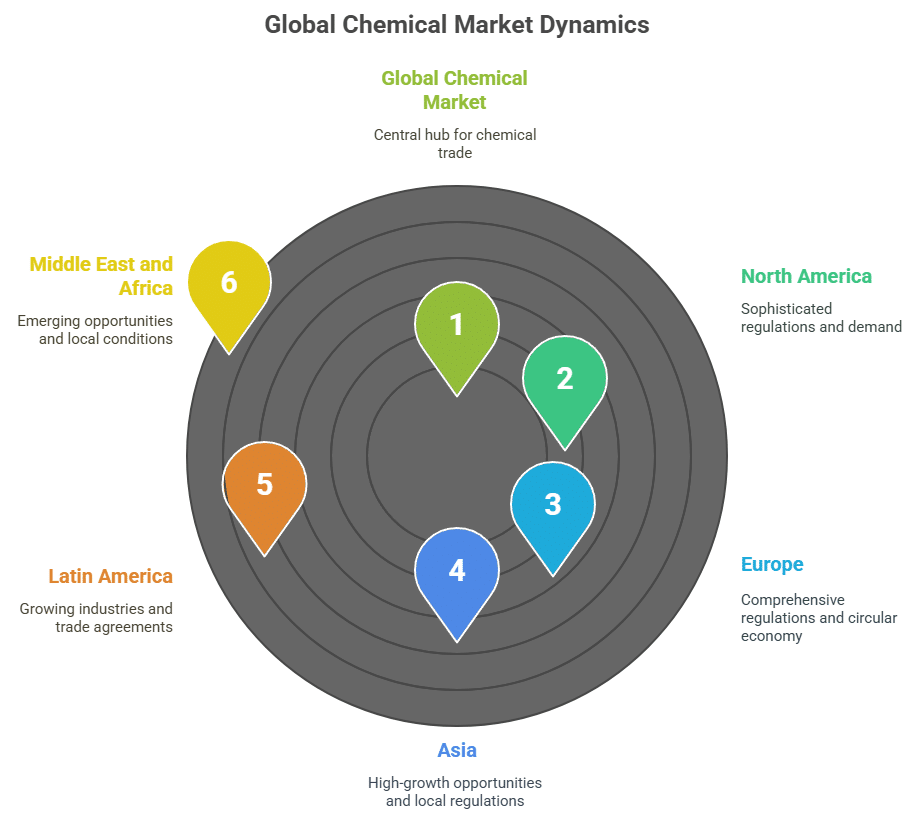

North American markets are characterized by sophisticated regulatory frameworks, established trading networks, and strong demand for cost-effective chemical solutions. The TSCA regulatory environment provides clear guidelines for legitimate trading while ensuring environmental protection and safety.

European markets operate under the comprehensive REACH regulatory framework, which provides transparency and safety assurance but requires detailed compliance documentation. The European emphasis on circular economy principles creates strong policy support for legitimate off-spec chemical trading.

Asian markets, particularly China and India, represent high-growth opportunities driven by rapid industrialization and increasing environmental awareness. However, these markets require careful evaluation of local regulations, quality standards, and commercial practices to ensure successful transactions.

Latin American markets offer opportunities for both supply and demand, with growing chemical industries and increasing sophistication in regulatory frameworks. Regional trade agreements may provide advantages for off-spec chemical trading within Latin America.

Middle Eastern and African markets present emerging opportunities as industrial development accelerates and regulatory frameworks mature. These markets may offer attractive pricing for off-spec materials while requiring careful evaluation of local conditions and requirements.

Economic Impact and Value Creation

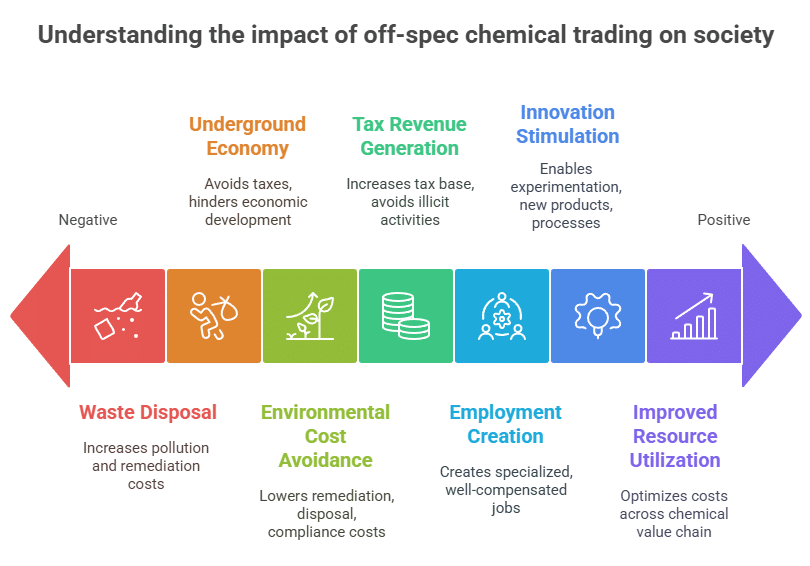

The off-spec chemical trading market creates substantial economic value through improved resource utilization and cost optimization across the chemical value chain. This value creation benefits manufacturers through revenue generation, buyers through cost savings, and society through reduced environmental impact.

Employment creation occurs throughout the off-spec trading ecosystem, including specialized intermediaries, testing laboratories, logistics providers, and regulatory consultants. These jobs often require specialized skills and provide above-average compensation, contributing to economic development.

Innovation stimulation results from the availability of cost-effective off-spec materials that enable experimentation and development activities. This innovation can lead to new products, processes, and applications that create additional economic value and competitive advantages.

Tax revenue generation occurs through legitimate business transactions that are properly documented and reported. Professional off-spec trading contributes to tax bases while avoiding the underground economy activities that can occur with improper waste disposal.

Environmental cost avoidance includes reduced waste disposal costs, lower environmental remediation expenses, and decreased regulatory compliance burdens. These cost savings benefit both individual companies and society as a whole through reduced environmental impact and improved resource efficiency.

Future Growth Drivers

Regulatory evolution toward more sophisticated frameworks that better distinguish between waste and products will continue to support market growth. Improved regulatory clarity reduces transaction costs and risks while encouraging legitimate trading activities.

Technology advancement in areas such as chemical analysis, quality assessment, and supply chain management will enhance market efficiency and expand trading opportunities. Digital platforms and data analytics will improve matching of supply and demand while reducing transaction costs.

Sustainability pressures from stakeholders, regulators, and customers will continue to drive demand for resource-efficient solutions including off-spec chemical trading. Corporate sustainability commitments and environmental reporting requirements will support market growth.

Globalization of chemical markets will create additional opportunities for cross-border trading of off-spec materials. Improved international regulatory coordination and trade facilitation will reduce barriers to global off-spec chemical trading.

Economic pressures for cost optimization will maintain strong demand for off-spec materials across all industries. Competitive pressures and margin optimization requirements will continue to drive interest in cost-effective chemical solutions.

Documentation and Quality Control

Essential Documentation Requirements

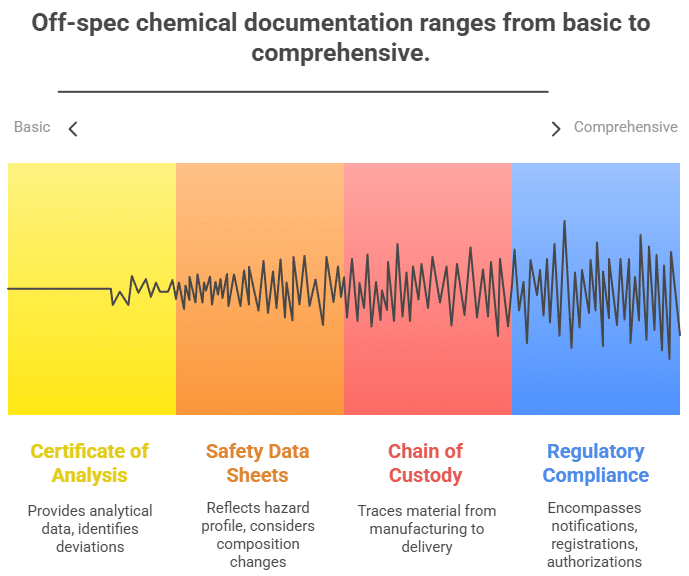

Comprehensive documentation represents the foundation of successful off-spec chemical trading, providing the transparency and traceability required for regulatory compliance, quality assurance, and commercial confidence. The documentation requirements for off-spec chemicals often exceed those for prime-grade materials due to the need to clearly communicate deviations from original specifications and demonstrate suitability for alternative applications.

The Certificate of Analysis (COA) serves as the primary technical document for off-spec chemicals, providing detailed analytical data that characterizes the material’s composition and properties. Unlike standard COAs, off-spec chemical certificates must clearly identify specific deviations from original specifications while providing comprehensive data to support alternative applications. This documentation must include test methods, detection limits, and uncertainty measurements to enable proper evaluation by potential users.

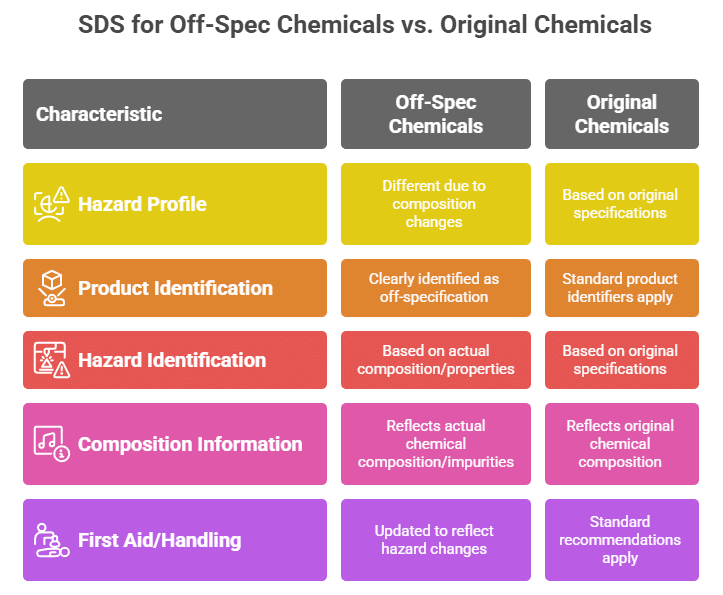

Safety Data Sheets (SDS) for off-spec chemicals require careful preparation to accurately reflect the actual hazard profile of the material as it exists, not as originally specified. The SDS must consider any changes in composition, concentration, or impurity levels that may affect hazard classification under the Globally Harmonized System (GHS). Section 3 of the SDS, which covers composition and ingredient information, must accurately reflect the actual chemical composition including any impurities or contaminants present in the off-spec material.

Chain of custody documentation provides critical traceability from the original manufacturing process through any intermediate handling, storage, or treatment steps to final delivery. This documentation must include detailed records of all parties involved in handling the material, storage conditions, transportation methods, and any processing or treatment activities that may have affected the material’s properties.

Regulatory compliance documentation encompasses all notifications, registrations, certifications, and authorizations required under applicable regulations. For TSCA compliance in the United States, this may include import certification statements, export notifications, or new use notifications depending on the specific circumstances [2]. For REACH compliance in the European Union, documentation may include registration dossiers, safety data sheets, and exposure scenarios [3].

Quality Control Protocols

Quality control for off-spec chemicals requires sophisticated protocols that go beyond standard chemical testing to address the specific challenges associated with materials that deviate from original specifications. These protocols must provide confidence in material characterization while identifying any safety or performance risks associated with the specification deviations.

Analytical testing protocols for off-spec chemicals typically include comprehensive composition analysis using multiple analytical techniques to provide complete characterization. Gas chromatography-mass spectrometry (GC-MS) and liquid chromatography-mass spectrometry (LC-MS) provide detailed identification and quantification of organic components and impurities. Inductively coupled plasma (ICP) spectroscopy enables detection and quantification of metallic impurities that may affect performance or safety.

Physical property testing encompasses measurements of density, viscosity, melting point, boiling point, flash point, and other characteristics relevant to handling, storage, and application requirements. These measurements must be compared to both original specifications and requirements for intended alternative applications to ensure suitability and safety.

Stability testing evaluates how off-spec chemicals behave under various storage and handling conditions over extended periods. This testing is particularly important for materials that may have been stored for extended periods or exposed to conditions that could affect stability. Accelerated aging studies can provide insights into long-term stability and shelf life under normal storage conditions.

Contamination assessment protocols identify and quantify any foreign materials that may be present in off-spec chemicals. This assessment must consider both chemical contaminants that may affect performance and physical contaminants that could impact processing or application. Specialized techniques such as particle size analysis, microscopy, and spectroscopic methods may be required for comprehensive contamination assessment.

Microbiological testing may be required for certain off-spec chemicals, particularly those intended for applications where microbial contamination could pose health or performance risks. Standard microbiological testing protocols must be adapted to account for the specific chemical environment and potential antimicrobial properties of the material being tested.

Certificate of Analysis Preparation

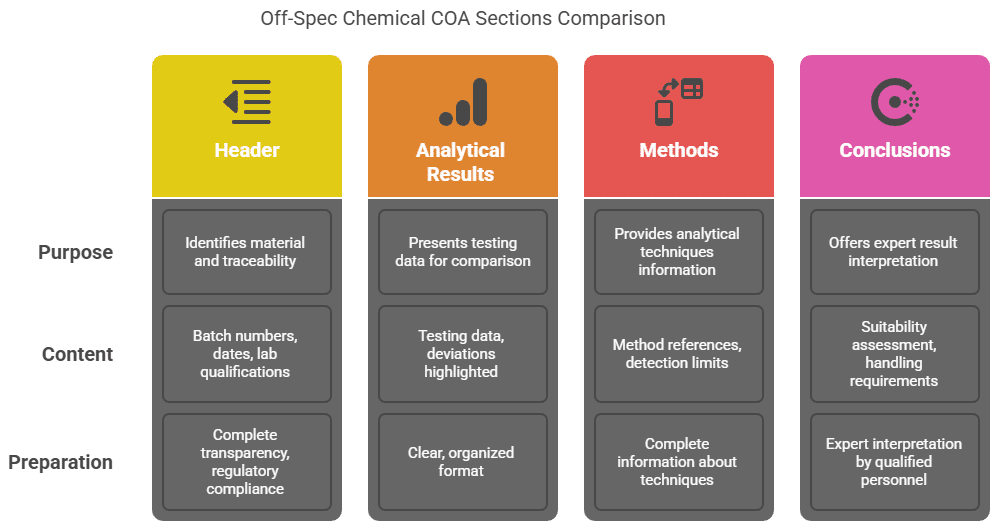

The preparation of certificates of analysis for off-spec chemicals requires specialized expertise to ensure that all relevant information is accurately communicated while maintaining compliance with regulatory and commercial requirements. The COA must provide complete transparency about the material’s properties while clearly identifying any deviations from original specifications.

The header section of an off-spec chemical COA must clearly identify the material as off-specification and provide complete traceability information including original manufacturing batch numbers, dates of manufacture and testing, and any intermediate processing or handling activities. This section must also include clear identification of the testing laboratory and certification of its qualifications and accreditations.

The analytical results section must present all testing data in a clear and organized format that enables easy comparison with both original specifications and requirements for intended applications. Results that deviate from original specifications must be clearly highlighted, and the significance of these deviations must be explained in terms of potential impact on performance or safety.

The methods section must provide complete information about analytical techniques used, including method references, detection limits, and measurement uncertainties. This information enables users to evaluate the reliability and appropriateness of the analytical data for their specific applications and requirements.

The conclusions section should provide expert interpretation of the analytical results, including assessment of suitability for specific applications and identification of any limitations or special handling requirements. This section must be prepared by qualified technical personnel with appropriate expertise in both analytical chemistry and the specific chemical applications involved.

Safety Data Sheet Considerations

Safety Data Sheets for off-spec chemicals present unique challenges because the hazard profile may differ from that of the original specification material due to changes in composition, concentration, or impurity levels. The SDS must accurately reflect the actual hazard characteristics of the off-spec material to ensure proper handling, storage, and use.

Section 1 of the SDS must clearly identify the material as off-specification and provide appropriate product identifiers that distinguish it from the original specification material. The emergency contact information must be current and appropriate for the actual supplier or intermediary handling the off-spec material.

Section 2 covering hazard identification must be based on the actual composition and properties of the off-spec material, not the original specification. This may require reclassification under GHS criteria if impurities or concentration changes affect the overall hazard profile. Any changes in classification must be clearly documented and justified based on analytical data.

Section 3 addressing composition and ingredient information must accurately reflect the actual chemical composition including all significant impurities or contaminants. This section must provide sufficient detail to enable proper hazard assessment and risk management by users while protecting any legitimate confidential business information.

Sections 4 through 8 covering first aid, firefighting, accidental release, and handling and storage must be updated to reflect any changes in hazard characteristics or recommended procedures based on the actual properties of the off-spec material. Standard recommendations may not be appropriate if the material’s properties differ significantly from original specifications.

Regulatory Notification and Reporting

Regulatory notification and reporting requirements for off-spec chemicals vary significantly depending on the specific regulations applicable in each jurisdiction and the nature of the trading activities involved. Proper compliance requires careful evaluation of all applicable requirements and timely submission of required notifications and reports.

TSCA notification requirements in the United States may include import certification for imported off-spec chemicals, export notification for exported materials, and new use notification if the off-spec material is used in applications that constitute new uses under TSCA definitions [2]. The timing and content requirements for these notifications are specific and must be carefully followed to ensure compliance.

REACH notification requirements in the European Union may include registration updates if the off-spec material represents a change in composition or use pattern that affects the original registration [3]. Downstream user obligations may also apply if the off-spec material is used in ways that differ from the exposure scenarios provided in the original registration.

Waste notification requirements must be carefully evaluated to ensure that off-spec chemicals are properly classified as products rather than waste. Improper classification can result in significant regulatory violations and associated penalties. The EPA’s guidance on distinguishing between commercial chemical products and hazardous waste provides detailed criteria that must be applied to each specific situation [1].

Transportation regulations require proper classification, packaging, labeling, and documentation for shipment of off-spec chemicals. The hazard classification for transportation purposes must be based on the actual properties of the off-spec material and may differ from the original specification material if composition or properties have changed.

Quality Assurance Systems

Comprehensive quality assurance systems for off-spec chemical trading must address the unique challenges associated with materials that deviate from original specifications while ensuring consistent quality and regulatory compliance. These systems must integrate technical, regulatory, and commercial considerations to provide confidence for all parties involved in trading transactions.

Document control systems must ensure that all documentation accurately reflects the current status and properties of off-spec materials throughout the trading process. Version control procedures must track any changes or updates to analytical data, safety information, or regulatory status that may affect the material’s suitability for specific applications.

Traceability systems must provide complete records of all handling, storage, and processing activities from original manufacture through final delivery to end users. These systems must be capable of rapid retrieval of information in response to regulatory inquiries, customer questions, or quality issues that may arise.

Supplier qualification procedures must evaluate the capabilities and reliability of all parties involved in the off-spec chemical supply chain. This includes original manufacturers, intermediate handlers, testing laboratories, and logistics providers. Qualification criteria must address technical capabilities, regulatory compliance history, and quality system effectiveness.

Corrective action procedures must address any quality issues, regulatory non-compliance, or customer complaints that may arise during off-spec chemical trading activities. These procedures must include root cause analysis, immediate corrective actions, and preventive measures to avoid recurrence of similar issues.

Continuous improvement processes must regularly evaluate and enhance quality assurance systems based on experience, regulatory changes, and evolving best practices. Regular management reviews must assess system effectiveness and identify opportunities for improvement in quality, efficiency, and compliance performance.

International Trade Considerations

Customs Classification and Harmonized System Codes

International trade in off-spec chemicals requires proper classification under the Harmonized Commodity Description and Coding System (HS), which serves as the foundation for customs procedures, duty assessment, and trade statistics worldwide. The classification of off-spec chemicals can be complex because their properties may differ from those of the original specification material, potentially affecting their appropriate HS code assignment.

The World Customs Organization (WCO) maintains the international HS nomenclature, which is implemented by individual countries with varying degrees of detail and interpretation. For off-spec chemicals, classification must be based on the actual composition and intended use of the material rather than its original specification. This requirement may result in different HS codes for off-spec materials compared to their prime-grade counterparts.

Chemical classification under the HS system follows a hierarchical structure that considers chemical composition, degree of processing, and intended use. Off-spec chemicals may fall into different categories depending on their specific deviations from original specifications. For example, off-spec solvents with higher water content may be classified differently from anhydrous solvents, potentially affecting duty rates and regulatory requirements.

The General Rules for the Interpretation of the HS provide guidance for classification decisions, but their application to off-spec chemicals often requires expert analysis and may benefit from advance rulings from customs authorities. These rulings provide certainty for classification decisions and can prevent delays and disputes during importation.

Country-specific variations in HS implementation can create additional complexity for international off-spec chemical trading. The United States uses the Harmonized Tariff Schedule (HTS), while the European Union implements the Combined Nomenclature (CN), each with specific provisions that may affect off-spec chemical classification and treatment.

Import and Export Procedures

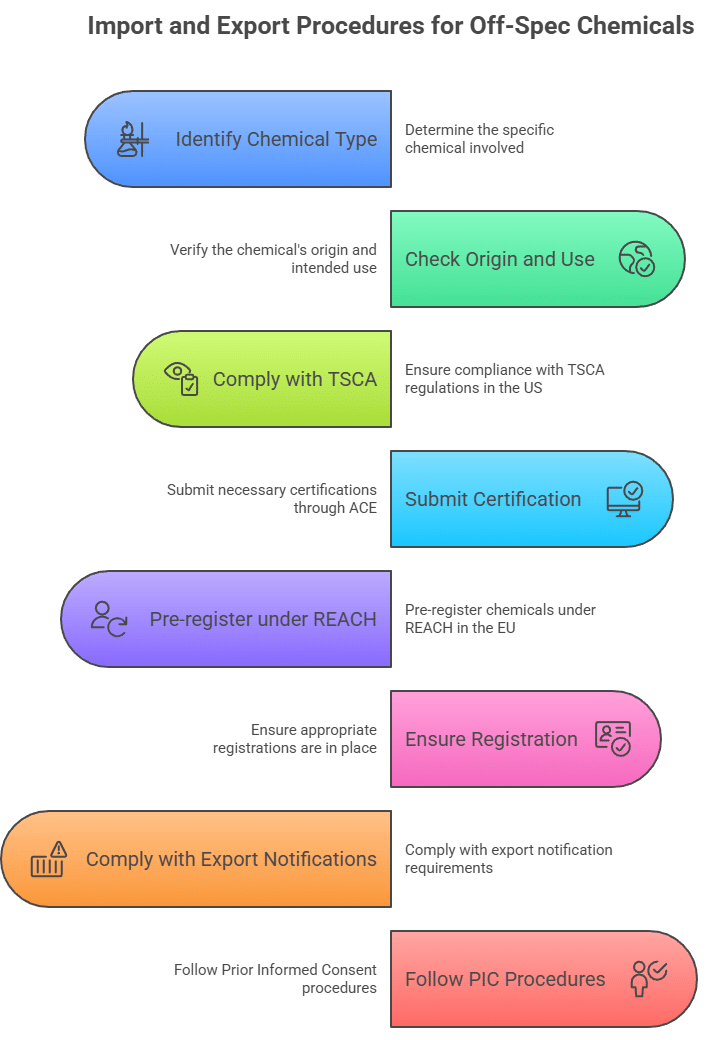

Import procedures for off-spec chemicals must address both standard customs requirements and specialized regulations applicable to chemical substances. The complexity of these procedures varies significantly depending on the specific chemicals involved, their country of origin, and their intended use in the destination country.

TSCA import certification requirements in the United States apply to all chemical imports, including off-spec materials [2]. Importers must certify that imported chemicals either comply with TSCA requirements or are not subject to TSCA. This certification must be submitted electronically through the Automated Commercial Environment (ACE) system and must accurately reflect the regulatory status of the specific off-spec material being imported.

Pre-registration of chemicals under REACH may be required for off-spec chemical imports into the European Union, depending on the tonnage and registration status of the specific substances involved [3]. Importers must ensure that appropriate registrations are in place or that valid exemptions apply before importing off-spec chemicals into EU markets.

Export procedures must comply with notification requirements under various international agreements and domestic regulations. TSCA Section 12(b) requires export notification to EPA for certain chemicals exported from the United States [2]. The timing and content of these notifications are specific and must be carefully managed to ensure compliance.

The Prior Informed Consent (PIC) procedure under the Rotterdam Convention requires notification and consent procedures for exports of certain hazardous chemicals [3]. Recent updates to PIC requirements have expanded the list of chemicals subject to these procedures, affecting off-spec chemical exports from the European Union and other participating countries.

Duty Optimization and Trade Preferences

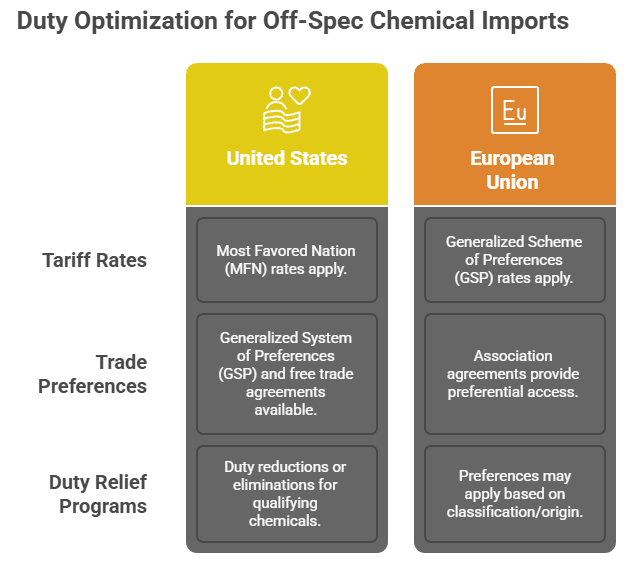

Duty optimization for off-spec chemical imports requires careful analysis of applicable tariff rates, trade preferences, and duty relief programs that may be available. The classification of off-spec chemicals can significantly impact duty rates, making proper classification essential for cost optimization.

Most Favored Nation (MFN) tariff rates apply to imports from WTO member countries unless more favorable rates are available under preferential trade agreements. The United States maintains preferential trade programs including the Generalized System of Preferences (GSP) and various free trade agreements that may provide duty reductions or eliminations for qualifying off-spec chemicals.

The European Union’s Generalized Scheme of Preferences (GSP) and various association agreements provide preferential access for imports from developing countries and specific partner countries. These preferences may apply to off-spec chemicals depending on their classification and country of origin.

Rules of origin requirements determine eligibility for preferential tariff treatment under various trade agreements. For off-spec chemicals, origin determination must consider the location where the material acquired its off-spec characteristics, which may differ from the location of original manufacture.

Duty drawback programs in various countries allow for refund of duties paid on imported materials that are subsequently exported or used in exported products. These programs may provide opportunities for duty optimization in off-spec chemical trading operations that involve re-export or incorporation into exported products.

Transportation and Logistics

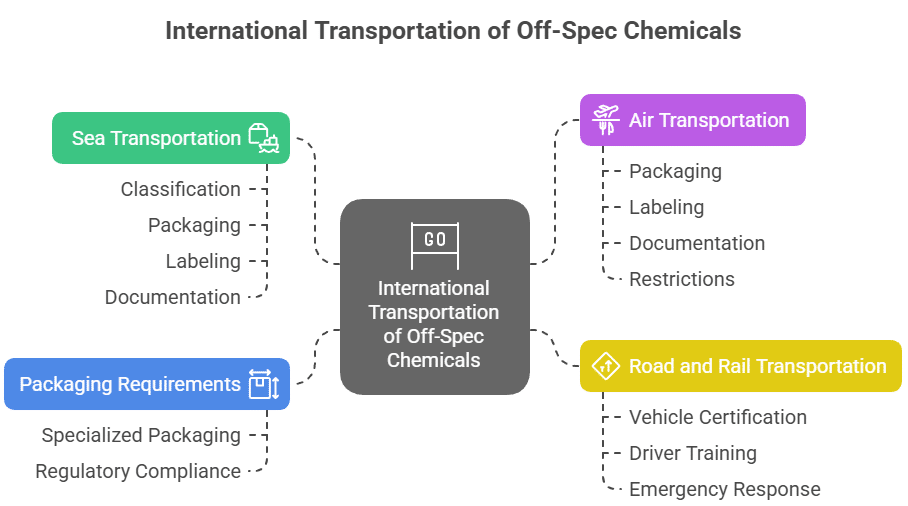

International transportation of off-spec chemicals must comply with comprehensive regulations governing the movement of hazardous materials by air, sea, and land. These regulations are based on international standards but are implemented with variations by individual countries and transportation modes.

The International Maritime Dangerous Goods (IMDG) Code governs sea transportation of hazardous chemicals and requires proper classification, packaging, labeling, and documentation based on the actual properties of the off-spec material. Classification for transportation purposes may differ from customs classification and must be based on hazard assessment rather than commercial considerations.

The International Air Transport Association (IATA) Dangerous Goods Regulations govern air transportation of hazardous chemicals and impose strict requirements for packaging, labeling, and documentation. Many off-spec chemicals may be subject to additional restrictions or prohibitions for air transport depending on their specific hazard characteristics.

Road and rail transportation regulations vary by country but generally follow international standards such as the European Agreement concerning the International Carriage of Dangerous Goods by Road (ADR) and similar agreements. These regulations require proper vehicle certification, driver training, and emergency response procedures for hazardous chemical transportation.

Packaging requirements for international transportation must meet both transportation regulations and customs requirements. Off-spec chemicals may require specialized packaging to address their specific properties and ensure safe transportation while meeting regulatory requirements in all transit and destination countries.

Documentation and Compliance

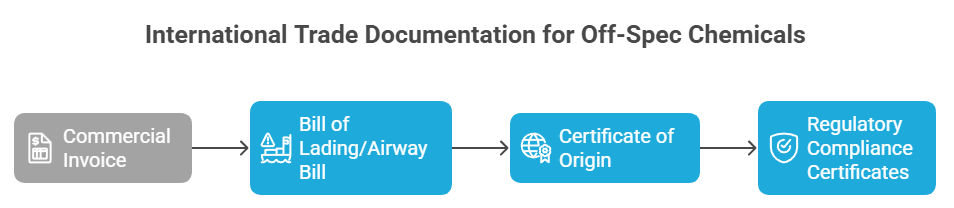

International trade documentation for off-spec chemicals must address both commercial and regulatory requirements while providing complete transparency about the material’s properties and regulatory status. This documentation serves multiple purposes including customs clearance, regulatory compliance, and commercial transaction support.

Commercial invoices for off-spec chemicals must accurately describe the materials being traded while providing sufficient detail for customs classification and valuation. The description must clearly identify the materials as off-specification and provide appropriate technical details to support proper classification and handling.

Bills of lading or airway bills must accurately reflect the hazard classification and special handling requirements for off-spec chemicals. These documents serve as contracts of carriage and must provide complete information to ensure safe and compliant transportation.

Certificates of origin may be required to support preferential tariff treatment under various trade agreements. These certificates must accurately reflect the country where the off-spec characteristics were acquired, which may require careful analysis of the material’s history and processing.

Regulatory compliance certificates must demonstrate compliance with all applicable regulations in both export and import countries. This may include TSCA compliance certificates, REACH compliance documentation, and various health and safety certifications depending on the specific requirements of each jurisdiction.

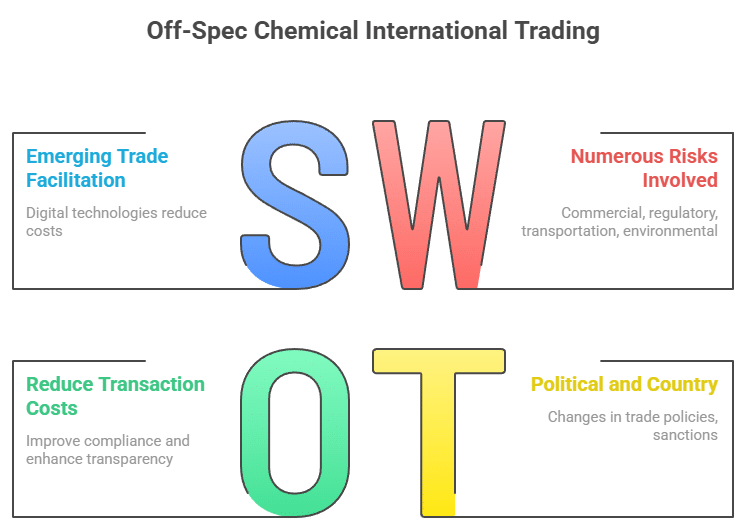

Risk Management and Insurance

International trading of off-spec chemicals involves numerous risks that must be properly identified, assessed, and managed through appropriate risk management strategies and insurance coverage. These risks encompass commercial, regulatory, transportation, and environmental considerations that can significantly impact transaction success.

Commercial risks include currency fluctuation, credit risk, and market volatility that can affect transaction profitability and feasibility. Off-spec chemical trading may involve longer transaction cycles and greater price volatility than standard chemical trading, requiring specialized risk management approaches.

Regulatory risks include changes in regulations, classification disputes, and compliance failures that can result in delays, additional costs, or transaction cancellation. The specialized nature of off-spec chemical regulations makes these risks particularly significant and requires expert management.

Transportation risks include damage, loss, contamination, and regulatory violations during international shipment. These risks are often higher for off-spec chemicals due to their non-standard nature and potential for mishandling or misclassification.

Environmental liability risks include potential contamination, improper disposal, and regulatory violations that can result in significant cleanup costs and penalties. Professional liability insurance and environmental coverage are essential for managing these risks in off-spec chemical trading.

Political and country risks include changes in trade policies, sanctions, and political instability that can affect international trading operations. These risks require ongoing monitoring and may necessitate alternative trading arrangements or risk mitigation strategies.

Emerging Trade Facilitation Technologies

Digital technologies are increasingly being adopted to facilitate international trade in chemicals, including off-spec materials. These technologies can reduce transaction costs, improve compliance, and enhance transparency throughout the trading process.

Blockchain technology provides opportunities for immutable documentation and traceability throughout the international trading process. This technology can provide enhanced security and transparency for certificates of analysis, regulatory compliance documentation, and chain of custody records.

Electronic data interchange (EDI) systems enable automated exchange of trade documentation between trading partners, customs authorities, and regulatory agencies. These systems can reduce processing times and errors while improving compliance with documentation requirements.

Artificial intelligence and machine learning technologies can assist with customs classification, regulatory compliance assessment, and risk management for off-spec chemical trading. These technologies can process complex regulatory requirements and provide decision support for classification and compliance decisions.

Digital platforms and marketplaces are emerging to facilitate international chemical trading, including off-spec materials. These platforms can provide enhanced market access, price transparency, and transaction efficiency while maintaining appropriate regulatory compliance and quality assurance.

Risk Management and Best Practices

Comprehensive Risk Assessment Framework

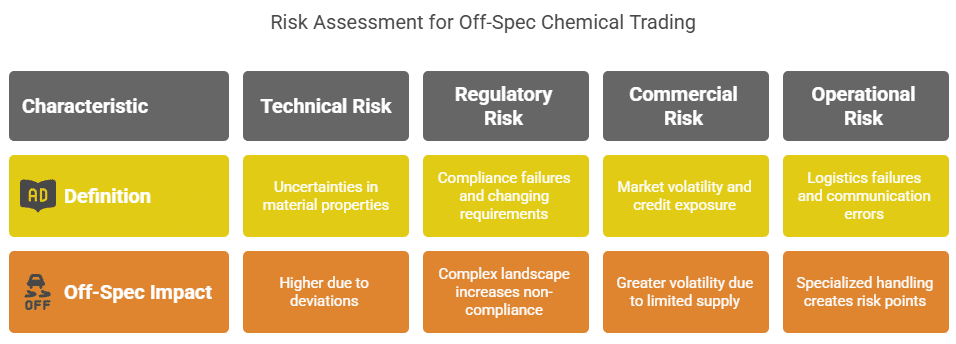

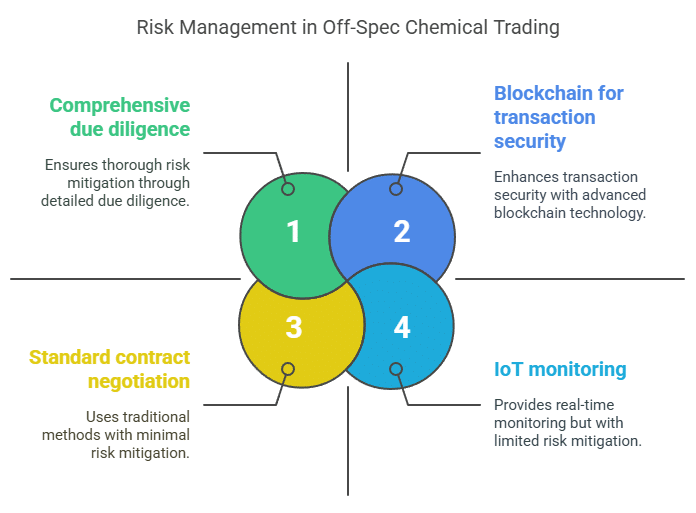

Effective risk management in off-spec chemical trading requires a comprehensive framework that addresses technical, regulatory, commercial, and operational risks throughout the entire transaction lifecycle. This framework must be tailored to the specific characteristics of off-spec materials and the unique challenges they present compared to standard chemical trading.

Technical risks encompass uncertainties related to material properties, performance characteristics, and suitability for intended applications. Off-spec chemicals inherently carry higher technical risks due to their deviation from original specifications, requiring enhanced due diligence and testing protocols. Risk assessment must consider not only the known deviations but also potential unknown variations that may affect performance or safety.

Regulatory risks include compliance failures, classification disputes, and changing regulatory requirements that can impact transaction feasibility and profitability. The complex regulatory landscape governing chemical trading creates multiple points of potential non-compliance, each carrying significant financial and legal consequences. Risk assessment must consider all applicable regulations across all relevant jurisdictions throughout the transaction lifecycle.

Commercial risks encompass market volatility, credit exposure, and competitive pressures that can affect transaction economics and success. Off-spec chemical markets often exhibit greater volatility than prime-grade markets due to limited supply sources and specialized demand patterns. Risk assessment must consider both immediate transaction risks and longer-term market dynamics.

Operational risks include logistics failures, quality control breakdowns, and communication errors that can disrupt transactions and create additional costs or liabilities. The specialized nature of off-spec chemical handling and the involvement of multiple parties in typical transactions create numerous operational risk points that require careful management.

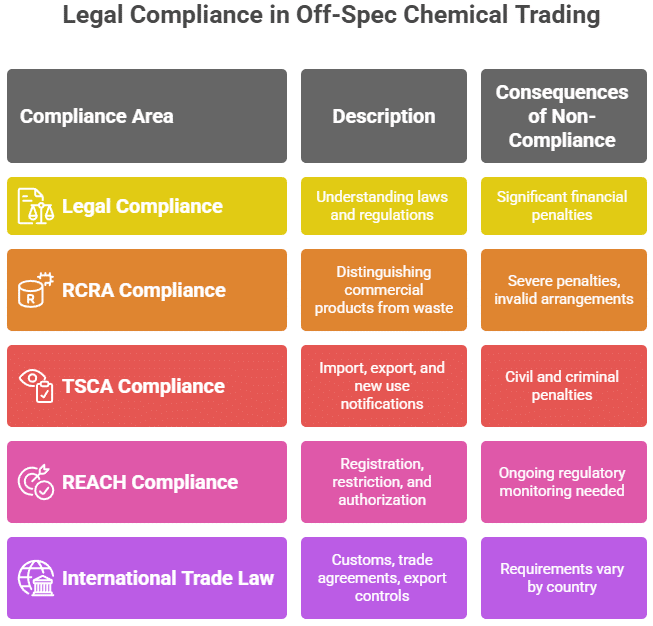

Legal and Regulatory Compliance

Legal compliance in off-spec chemical trading requires comprehensive understanding of applicable laws and regulations across multiple jurisdictions, along with robust systems to ensure ongoing compliance throughout all trading activities. The consequences of non-compliance can include significant financial penalties, criminal liability, and business disruption.

The fundamental legal distinction between commercial chemical products and hazardous waste represents the most critical compliance issue in off-spec chemical trading. The EPA’s guidance under RCRA provides detailed criteria for making this distinction, but application to specific situations often requires expert legal and technical analysis [1]. Misclassification can result in severe penalties and may invalidate entire trading arrangements.

TSCA compliance requires careful attention to import certification, export notification, and new use notification requirements [2]. The complexity of these requirements, particularly for off-spec materials that may have novel applications, necessitates expert regulatory guidance and comprehensive documentation systems. Violations can result in significant civil and criminal penalties.

REACH compliance in the European Union requires understanding of registration, restriction, and authorization requirements that may apply to off-spec chemicals [3]. The evolving nature of REACH implementation and the complexity of its requirements make ongoing regulatory monitoring and expert consultation essential for compliance.

International trade law compliance encompasses customs regulations, trade agreement provisions, and export control requirements that may apply to off-spec chemical trading. These requirements vary significantly by country and can change rapidly in response to political and economic developments.

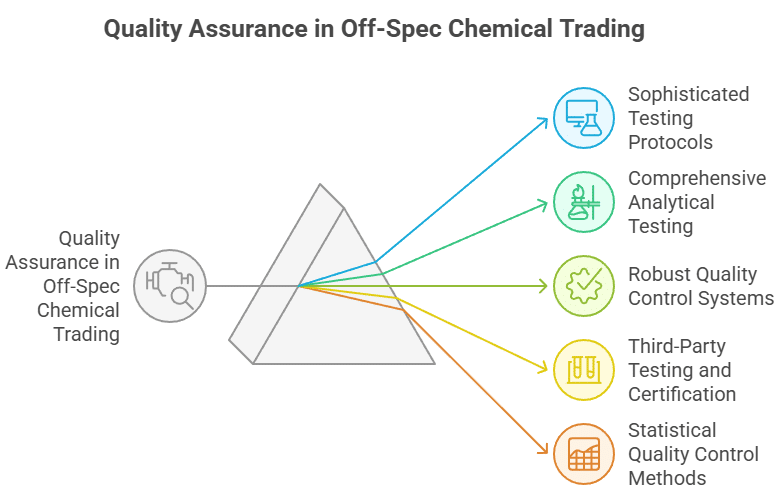

Quality Assurance and Testing Protocols

Quality assurance in off-spec chemical trading must address the inherent uncertainties associated with materials that deviate from original specifications while providing confidence in material characterization and suitability for intended applications. This requires sophisticated testing protocols and quality systems that exceed those typically used for prime-grade materials.

Analytical testing protocols must be comprehensive and appropriate for the specific off-spec materials involved. Standard testing methods may not be suitable for materials with unusual compositions or properties, requiring development of specialized testing approaches. Testing must address not only composition and purity but also stability, compatibility, and performance characteristics relevant to intended applications.

Quality control systems must include multiple verification points throughout the trading process to ensure that materials maintain their characterized properties and remain suitable for intended applications. This includes incoming material verification, storage and handling monitoring, and pre-shipment confirmation testing.

Third-party testing and certification can provide additional confidence and credibility for off-spec chemical characterization. Independent laboratories with appropriate accreditations and expertise can provide unbiased assessment of material properties and suitability for specific applications.

Statistical quality control methods can help identify trends and variations in off-spec material properties that may affect trading decisions. Control charts, trend analysis, and statistical process control techniques can provide early warning of quality issues and support continuous improvement efforts.

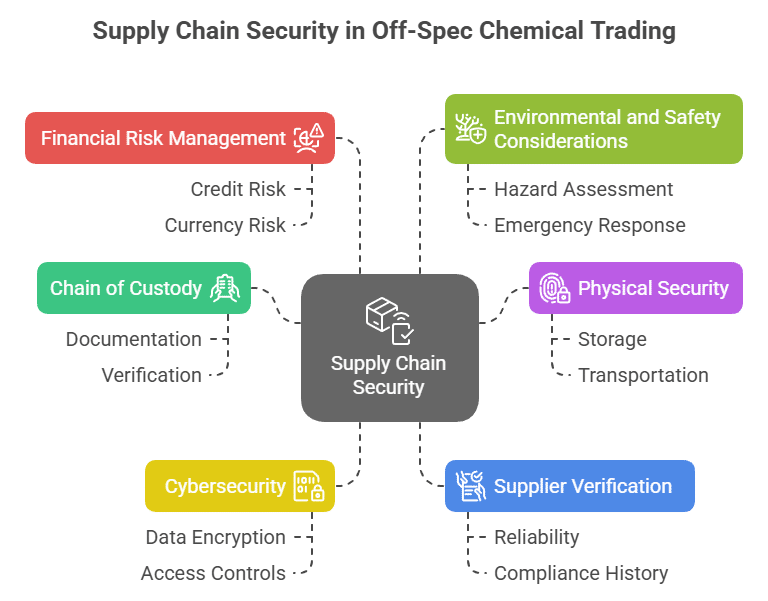

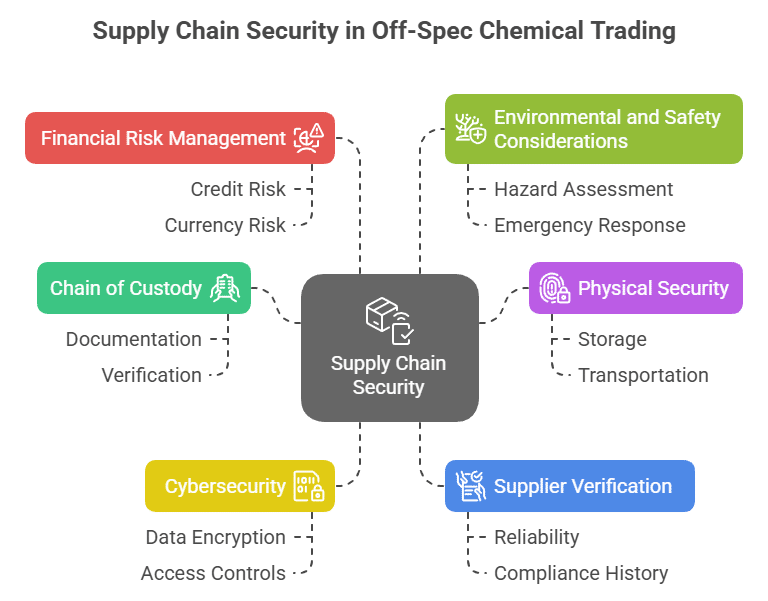

Supply Chain Security

Supply chain security in off-spec chemical trading requires comprehensive measures to ensure the integrity, authenticity, and traceability of materials throughout the entire supply chain. The complex nature of off-spec chemical supply chains, often involving multiple intermediaries and cross-border transactions, creates numerous security vulnerabilities that must be addressed.

Chain of custody procedures must provide complete documentation of all parties involved in handling off-spec chemicals from original manufacture through final delivery. This documentation must include verification of each party’s qualifications, certifications, and compliance history to ensure supply chain integrity.

Physical security measures must address the storage, handling, and transportation of off-spec chemicals to prevent theft, contamination, or unauthorized access. These measures must be appropriate for the specific hazard characteristics of the materials involved and must comply with applicable security regulations.

Cybersecurity considerations are increasingly important as digital systems become more prevalent in chemical trading. Protection of sensitive commercial and technical information requires robust cybersecurity measures including data encryption, access controls, and incident response procedures.

Supplier verification and qualification procedures must evaluate the reliability, competence, and compliance history of all supply chain participants. This includes original manufacturers, intermediaries, testing laboratories, logistics providers, and end users. Ongoing monitoring and periodic re-qualification ensure continued supply chain integrity.

Financial Risk Management

Financial risk management in off-spec chemical trading must address the unique financial exposures associated with these specialized transactions while providing appropriate protection for all parties involved. The non-standard nature of off-spec materials and their markets creates financial risks that may not be present in conventional chemical trading.

Credit risk assessment must consider the financial stability and creditworthiness of all transaction participants, including manufacturers, intermediaries, and end users. Off-spec chemical transactions may involve parties with limited credit history or specialized business models that require enhanced due diligence.

Currency risk management is essential for international off-spec chemical trading, where transactions may involve multiple currencies and extended settlement periods. Hedging strategies and currency risk allocation must be appropriate for the specific transaction characteristics and risk tolerance of the parties involved.

Price risk management must address the volatility inherent in off-spec chemical markets, where limited supply sources and specialized demand can create significant price fluctuations. Risk management strategies may include price hedging, volume commitments, and alternative sourcing arrangements.

Insurance coverage must be comprehensive and appropriate for the specific risks associated with off-spec chemical trading. This includes general liability, product liability, environmental liability, and professional liability coverage. Specialized chemical trading insurance may be required to address unique exposures.

Environmental and Safety Considerations

Environmental and safety management in off-spec chemical trading requires comprehensive programs that address the unique hazards and exposures associated with materials that deviate from original specifications. These programs must ensure protection of human health and the environment while enabling legitimate commercial activities.

Hazard assessment must be based on the actual properties of off-spec materials rather than original specifications. This assessment must consider any changes in composition, concentration, or physical properties that may affect hazard characteristics. Professional toxicological and environmental assessment may be required for materials with significant deviations.

Exposure assessment must evaluate potential human and environmental exposures throughout the entire lifecycle of off-spec chemical use. This includes occupational exposures during handling and processing, consumer exposures if applicable, and environmental releases during use and disposal.

Risk characterization combines hazard and exposure assessments to determine overall risk levels and identify appropriate risk management measures. This characterization must consider uncertainties associated with off-spec materials and may require conservative assumptions to ensure adequate protection.

Emergency response planning must address the specific hazards and response requirements for off-spec chemicals. Standard emergency response procedures may not be appropriate for materials with unusual properties or compositions. Coordination with local emergency responders and regulatory authorities may be required.

Best Practices for Transaction Management

Transaction management best practices in off-spec chemical trading encompass comprehensive procedures and systems that ensure successful completion of transactions while minimizing risks and maximizing value for all parties involved. These practices must address the unique challenges and requirements of off-spec chemical trading.

Due diligence procedures must be comprehensive and appropriate for the specific risks associated with off-spec chemical trading. This includes technical due diligence on material properties and applications, regulatory due diligence on compliance requirements, and commercial due diligence on market conditions and transaction economics.

Contract negotiation and documentation must address the unique aspects of off-spec chemical transactions including specification deviations, quality assurance requirements, regulatory compliance obligations, and risk allocation. Standard chemical trading contracts may not be appropriate for off-spec materials.

Project management systems must coordinate the multiple activities and parties involved in off-spec chemical transactions. This includes technical evaluation, regulatory compliance, logistics coordination, and commercial negotiation. Clear communication and coordination protocols are essential for transaction success.

Performance monitoring and continuous improvement systems must track transaction outcomes and identify opportunities for improvement in processes, procedures, and risk management. Regular review and updating of best practices ensures continued effectiveness and adaptation to changing market and regulatory conditions.

Technology and Innovation in Risk Management

Technology and innovation are increasingly important tools for risk management in off-spec chemical trading, providing enhanced capabilities for risk identification, assessment, and mitigation. These technologies can improve efficiency, accuracy, and effectiveness of risk management programs while reducing costs and improving outcomes.

Data analytics and artificial intelligence can process large amounts of information to identify patterns, trends, and risks that may not be apparent through traditional analysis methods. These technologies can support risk assessment, market analysis, and decision-making processes in off-spec chemical trading.

Sensor technologies and Internet of Things (IoT) devices can provide real-time monitoring of storage conditions, transportation parameters, and handling activities. This monitoring can provide early warning of potential problems and support proactive risk management.

Blockchain technology can provide enhanced security, transparency, and traceability for transaction documentation and supply chain management. This technology can reduce fraud risks and improve confidence in transaction integrity.

Digital platforms and marketplaces can provide enhanced market access, price transparency, and transaction efficiency while maintaining appropriate risk management and compliance controls. These platforms can reduce transaction costs and improve market liquidity for off-spec chemicals.

Future Outlook and Trends

Market Evolution and Growth Projections

The off-spec chemical trading market is positioned for continued growth and evolution driven by multiple converging trends including sustainability imperatives, technological advancement, and regulatory modernization. Industry analysts project sustained growth rates of 5-8% annually over the next decade, with the global market potentially reaching $15-20 billion by 2035.

Sustainability pressures from stakeholders, regulators, and customers are fundamentally reshaping how companies view off-spec materials. The transition from a linear “take-make-dispose” model to circular economy principles positions off-spec chemical trading as an essential component of sustainable chemical industry operations. Companies are increasingly incorporating off-spec material utilization into their environmental, social, and governance (ESG) strategies and sustainability reporting.