Chemical Trade Under Fire: How the Israel-Iran Conflict is Reshaping Global Markets for 10 Critical Chemicals

The escalating conflict between Israel and Iran, which intensified dramatically in June 2025 with Israeli strikes on Iranian nuclear facilities and energy infrastructure, has sent shockwaves through global chemical markets. This comprehensive analysis examines ten critical chemicals whose trade flows, pricing, and supply chains are being fundamentally disrupted by the ongoing tensions in the Middle East.

Table of Contents

Executive Summary

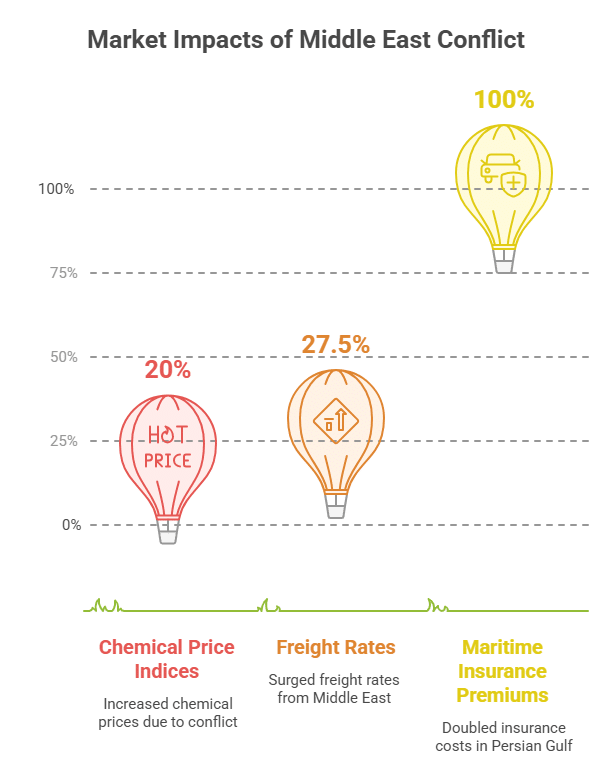

The conflict has created a perfect storm of supply chain disruptions, with the Strait of Hormuz- through which one-third of global oil and 20% of liquefied natural gas (LNG) trade passes- becoming a critical chokepoint for chemical commerce [1]. As maritime insurance costs double and freight rates surge by 25-30%, the ripple effects are being felt across fertilizer markets, petrochemical supply chains, and specialty chemical sectors worldwide [2].

This analysis focuses on ten chemicals that represent the most significant trade vulnerabilities: methanol, ethylene, urea, ammonia, sulfur, polyethylene, polypropylene, phosphates, potash, and bromine. Together, these chemicals form the backbone of global agricultural, industrial, and manufacturing supply chains, making their disruption a matter of international economic security.

Introduction: A Region in Crisis, A World at Risk

The Middle East has long been recognized as the world’s chemical powerhouse, leveraging abundant hydrocarbon resources and strategic geographic positioning to become a dominant force in global petrochemical and fertilizer markets. Countries like Iran, Saudi Arabia, Qatar, the UAE, and Israel collectively account for massive shares of global production in key chemical categories, from basic petrochemicals to specialized agricultural inputs [3].

The current crisis began on June 13, 2025, when Israel launched “Operation Rising Lion,” targeting Iranian nuclear facilities at Natanz, Fordow, and Isfahan, along with critical energy infrastructure [4]. Iran’s retaliatory strikes have escalated tensions to levels not seen since the 1980s, creating unprecedented uncertainty in chemical markets that were already grappling with structural challenges and trade tensions.

The conflict’s impact extends far beyond the immediate combatants. The Strait of Hormuz, a narrow waterway just 21 miles wide at its narrowest point, has become the focal point of global concern. Through this critical chokepoint flows not only oil and gas but also the chemical building blocks that support agriculture, manufacturing, and industrial processes worldwide [5]. Any disruption to this trade route threatens to cascade through global supply chains with devastating economic consequences.

Chemical markets, already facing headwinds from overcapacity in certain sectors and shifting trade patterns, now confront a new reality where geopolitical risk has become a primary pricing factor. The three scenarios outlined by industry analysts- de-escalation, protracted tensions, or full-scale regional war- each carry distinct implications for chemical trade, with even the most optimistic scenario suggesting sustained volatility and elevated risk premiums [6].

Chemical #1: Methanol - The Building Block Under Siege

Methanol stands as perhaps the most vulnerable chemical in the current crisis, given Iran’s position as one of the world’s largest producers and exporters. With an annual production capacity of 10 million metric tons, Iran accounts for approximately 15% of global methanol supply, making any disruption to its operations a matter of international concern [7].

The strategic importance of methanol extends far beyond its role as a basic petrochemical. As a key feedstock for formaldehyde, acetic acid, and methyl tert-butyl ether (MTBE), methanol disruptions ripple through multiple downstream industries. The automotive sector relies heavily on methanol-derived chemicals for plastics and fuel additives, while the construction industry depends on formaldehyde-based resins for building materials [8].

Iranian methanol production is concentrated in several major complexes, including the Kaveh Methanol Plant in Bushehr Province and the Zagros Petrochemical Complex in Assaluyeh. These facilities, strategically located near natural gas feedstock sources, have been operating at near-capacity levels to meet both domestic demand and export commitments [9]. However, the current conflict has introduced multiple risk factors that threaten continued operations.

The most immediate impact has been on shipping and logistics. Iranian methanol exports, which primarily flow to Asian markets including China, India, and Southeast Asia, must transit through the Strait of Hormuz before reaching international waters [10]. The elevated military activity in the region has led to a doubling of maritime insurance premiums, while many shipping companies have begun implementing “war risk” surcharges that add $50-100 per metric ton to transportation costs [11].

Market dynamics have shifted dramatically since the conflict began.

- Methanol prices, which had been trading in the $280-320 per metric ton range in early 2025, spiked to over $400 per metric ton following the initial Israeli strikes [12]. This price volatility has forced downstream manufacturers to reassess their procurement strategies, with many seeking alternative suppliers despite the logistical challenges and quality considerations involved in switching sources.

- The ripple effects extend to global methanol trade patterns. Traditional buyers of Iranian methanol are now scrambling to secure alternative supplies from producers in Trinidad and Tobago, the United States, and other regions. However, the global methanol market operates with relatively tight supply-demand balances, meaning that the loss of Iranian capacity cannot be easily replaced without significant price impacts [13].

- Chinese methanol importers, who typically purchase 2-3 million metric tons annually from Iran, have been particularly affected. Several major Chinese chemical companies have reported force majeure declarations on downstream product deliveries, citing methanol supply uncertainties [14]. This has created a domino effect through the Chinese chemical industry, affecting everything from plastic production to pharmaceutical intermediates.

- The conflict has also highlighted the strategic vulnerability of methanol supply chains. Unlike some chemicals that can be easily substituted or sourced from multiple regions, methanol production requires significant capital investment and access to low-cost natural gas feedstock. Iran’s competitive advantage in methanol production stems from its abundant natural gas reserves and established infrastructure, advantages that cannot be quickly replicated elsewhere [15].

Looking ahead, the methanol market faces several potential scenarios. In the best case, where tensions de-escalate quickly, Iranian production could resume normal operations within weeks, though elevated risk premiums would likely persist for months. However, if the conflict escalates or leads to broader sanctions on Iranian chemical exports, the global methanol market could face a supply deficit of 8-10 million metric tons annually, requiring massive adjustments in global trade flows and potentially triggering a sustained price rally [16].

Chemical #2: Ethylene - The Petrochemical Cornerstone at Risk

Ethylene, often called the “king of petrochemicals,” represents another critical vulnerability in the current Middle East crisis. As the world’s most-produced organic compound and the foundation for countless plastic and chemical products, any disruption to ethylene supply chains reverberates throughout the global economy [17].

Iran’s ethylene production capacity of 7 million metric tons annually, while smaller than Saudi Arabia’s 18 million metric tons, plays a crucial role in regional and global markets [18]. Iranian ethylene production is concentrated in several world-class facilities, including the Jam Petrochemical Complex and the Bandar Imam Petrochemical Complex, both of which have been operating at high utilization rates to meet strong Asian demand [19].

The strategic importance of ethylene cannot be overstated. As the primary building block for polyethylene, ethylene glycol, ethylene oxide, and styrene, disruptions to ethylene supply affect industries ranging from packaging and automotive to textiles and construction. The interconnected nature of petrochemical value chains means that ethylene shortages quickly translate into production constraints across multiple downstream sectors [20].

The current conflict has introduced several risk factors for Iranian ethylene production and exports. Beyond the obvious shipping and insurance challenges affecting all Middle Eastern chemical exports, ethylene faces unique vulnerabilities due to its transportation requirements. Unlike methanol, which can be shipped as a liquid at ambient temperature, ethylene requires specialized refrigerated vessels or pipeline infrastructure, limiting transportation flexibility [21].

Iranian ethylene exports, which primarily serve Asian markets through long-term supply contracts, have already experienced significant disruptions. Several major Asian petrochemical companies have reported delays in ethylene deliveries, forcing them to seek spot market alternatives at premium prices [22]. The spot ethylene market in Asia, which typically trades at $800-900 per metric ton, has seen prices spike to over $1,200 per metric ton as buyers compete for limited alternative supplies [23].

- The conflict’s impact on ethylene markets extends beyond immediate supply disruptions. The uncertainty surrounding Iranian production has led to a fundamental reassessment of supply chain strategies among major petrochemical companies. Several Asian producers have announced plans to accelerate domestic ethylene capacity expansions or secure additional long-term supply agreements with non-Middle Eastern producers [24].

- Regional ethylene trade patterns are also being reshaped by the crisis. Traditional ethylene trade flows from the Middle East to Asia are being supplemented by increased shipments from the United States Gulf Coast, where shale gas-based ethylene production has created exportable surpluses [25]. However, the longer shipping distances and higher transportation costs associated with trans-Pacific ethylene trade create additional cost pressures for Asian buyers.

The downstream impacts of ethylene supply disruptions are already becoming apparent. Polyethylene producers in Asia have reported production cuts due to feedstock shortages, while ethylene glycol manufacturers have been forced to reduce operating rates [26]. These production adjustments are creating tightness in downstream markets, with polyethylene prices rising 10-15% since the conflict began [27].

The conflict has also highlighted the strategic importance of ethylene storage and inventory management. Unlike some chemicals that can be stored for extended periods, ethylene’s properties require specialized storage facilities and careful inventory management. The uncertainty surrounding Iranian supplies has led many companies to increase their ethylene inventories, creating additional demand pressure in an already tight market [28].

Looking forward, the ethylene market faces significant challenges regardless of how the conflict evolves. Even in a de-escalation scenario, the elevated risk premiums and supply chain adjustments triggered by the crisis are likely to persist for months. If the conflict escalates or leads to broader disruptions in Middle Eastern petrochemical production, the global ethylene market could face a supply deficit requiring massive adjustments in trade flows and potentially triggering sustained price increases across the entire petrochemical value chain [29].

Chemical #3: Urea - Agricultural Security Under Threat

Urea, the world’s most widely used nitrogen fertilizer, represents one of the most critical chemical vulnerabilities in the current Middle East crisis. With global food security increasingly dependent on chemical fertilizers, any disruption to urea supply chains carries implications that extend far beyond chemical markets into agricultural production and food prices worldwide [30].

The Middle East’s role in global urea production is substantial, with Iran alone producing 8 million metric tons annually and the broader region accounting for approximately 25% of global urea exports [31]. Iranian urea production is concentrated in several major complexes, including the Razi Petrochemical Complex and the Shiraz Petrochemical Complex, which leverage the country’s abundant natural gas resources to produce urea at highly competitive costs [32].

The strategic importance of urea in global agriculture cannot be overstated. As a nitrogen fertilizer containing 46% nitrogen content, urea provides essential nutrients for crop growth and is particularly critical for major food crops including wheat, rice, corn, and soybeans [33]. The timing of the current crisis, coinciding with key planting seasons in the Northern Hemisphere, amplifies the potential impact on global food production.

Iranian urea exports, which primarily serve markets in India, Brazil, and other major agricultural regions, have already experienced significant disruptions since the conflict began. India, which typically imports 2-3 million metric tons of urea annually from Iran, has been forced to accelerate procurement from alternative sources including Oman, Qatar, and Russia [34]. This shift in sourcing patterns has created upward pressure on global urea prices, with Indian import prices rising from $280-300 per metric ton to over $350 per metric ton [35].

The conflict’s impact on urea markets extends beyond immediate supply disruptions. The uncertainty surrounding Iranian production has led to strategic stockpiling by major importing countries, creating additional demand pressure in an already tight market [36]. Brazil, another major urea importer, has reportedly increased its strategic fertilizer reserves and accelerated procurement for the upcoming planting season [37].

Shipping and logistics challenges have compounded the supply disruptions. Urea exports from Iran must transit through the Strait of Hormuz, where elevated military activity and increased insurance costs have created significant transportation challenges [38]. Maritime insurance premiums for urea shipments from the Persian Gulf have doubled, while many shipping companies have implemented war risk surcharges that add $30-50 per metric ton to transportation costs [39].

The ripple effects of urea supply disruptions are already becoming apparent in global agricultural markets. Fertilizer distributors in key agricultural regions have reported inventory shortages and delivery delays, forcing farmers to consider alternative fertilizer sources or adjust their application rates [40]. These adjustments could potentially impact crop yields and food production, particularly in regions heavily dependent on imported fertilizers.

The conflict has also highlighted the strategic vulnerability of global fertilizer supply chains. Unlike many industrial chemicals, fertilizers are essential for food production and cannot be easily substituted or delayed without significant consequences [41]. The concentration of urea production in geopolitically sensitive regions creates systemic risks for global food security that extend far beyond the immediate conflict zone.

Regional urea trade patterns are being fundamentally reshaped by the crisis. Traditional trade flows from the Middle East to major agricultural regions are being supplemented by increased shipments from alternative sources including Russia, China, and North Africa [42]. However, these alternative sources often involve longer shipping distances, higher transportation costs, and different product specifications that create additional challenges for buyers.

The downstream impacts of urea supply disruptions extend throughout the agricultural value chain. Fertilizer retailers have reported increased customer inquiries about alternative nitrogen sources, while agricultural cooperatives have been forced to adjust their procurement strategies and inventory management practices [43]. These adjustments are creating additional costs and uncertainties for farmers already facing challenges from volatile commodity prices and weather-related risks.

Looking ahead, the urea market faces several potential scenarios depending on how the conflict evolves. In the best case, where tensions de-escalate quickly, Iranian urea production could resume normal operations, though elevated risk premiums and supply chain adjustments would likely persist through the current growing season [44]. However, if the conflict escalates or leads to broader sanctions on Iranian chemical exports, the global urea market could face a supply deficit of 6-8 million metric tons annually, requiring massive adjustments in global trade flows and potentially triggering sustained price increases that could impact global food prices [45].

Chemical #4: Ammonia - The Nitrogen Foundation in Jeopardy

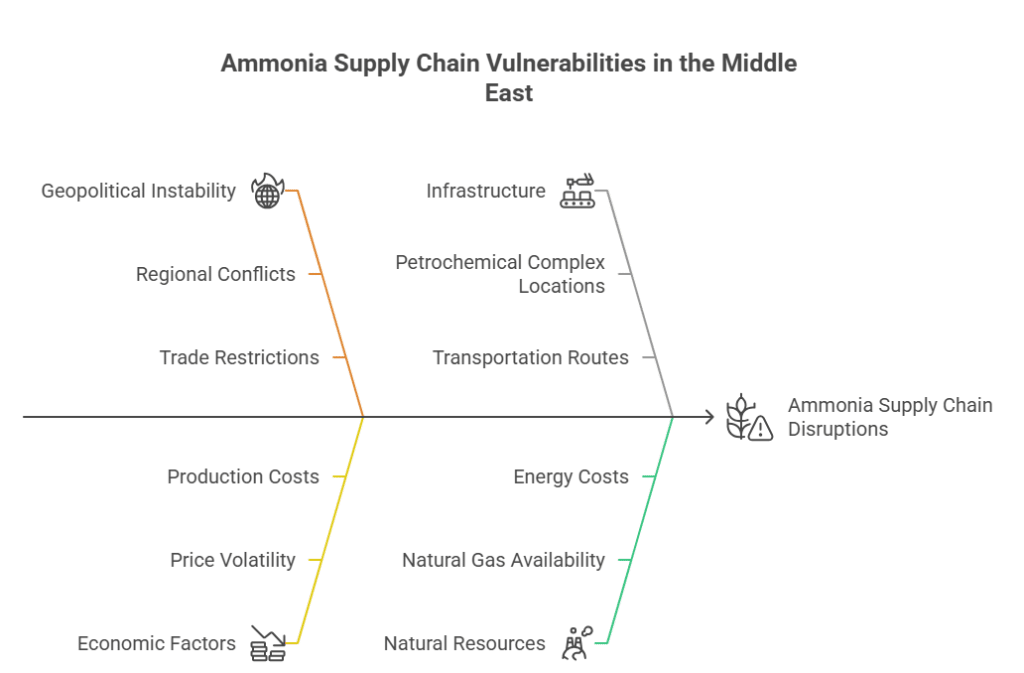

Ammonia, the foundation of the global nitrogen fertilizer industry and a critical industrial chemical, represents another major vulnerability in the current Middle East crisis. As both a direct fertilizer and the primary feedstock for urea and other nitrogen fertilizers, ammonia disruptions create cascading effects throughout agricultural and industrial supply chains [46].

Iran’s ammonia production capacity of 5 million metric tons annually positions the country as a significant player in global ammonia markets, while the broader Middle East region accounts for approximately 20% of global ammonia exports [47]. Iranian ammonia production is concentrated in several integrated petrochemical complexes that leverage the country’s abundant natural gas resources to produce ammonia at highly competitive costs [48].

The strategic importance of ammonia extends beyond its role as a fertilizer precursor. Industrial applications include the production of explosives, cleaning products, refrigeration systems, and various chemical intermediates [49]. The pharmaceutical industry relies on ammonia derivatives for numerous active pharmaceutical ingredients, while the textile industry uses ammonia in fiber production and dyeing processes [50].

The current conflict has introduced multiple risk factors for ammonia production and trade. Beyond the shipping and insurance challenges affecting all Middle Eastern chemical exports, ammonia faces unique vulnerabilities due to its hazardous nature and specialized transportation requirements [51]. Ammonia must be transported as a pressurized liquid in specialized vessels, limiting transportation flexibility and increasing the complexity of supply chain management [52].

Iranian ammonia exports, which primarily serve Asian and European markets through long-term supply contracts, have already experienced significant disruptions. Several major fertilizer producers in India and Europe have reported delays in ammonia deliveries, forcing them to seek alternative sources at premium prices [53]. The spot ammonia market, which typically trades at $400-500 per metric ton, has seen prices spike to over $650 per metric ton as buyers compete for limited alternative supplies [54].

The conflict’s impact on ammonia markets is being amplified by the interconnected nature of nitrogen fertilizer supply chains. Ammonia supply disruptions not only affect direct ammonia users but also impact urea and ammonium sulfate production, creating multiple pressure points in global fertilizer markets [55]. This interconnectedness means that ammonia supply disruptions have multiplier effects throughout the agricultural input sector.

Regional ammonia trade patterns are being reshaped by the crisis. Traditional ammonia trade flows from the Middle East to major agricultural and industrial regions are being supplemented by increased shipments from alternative sources including Russia, Trinidad and Tobago, and the United States [56]. However, the global ammonia market operates with relatively tight supply-demand balances, meaning that the loss of Iranian capacity cannot be easily replaced without significant price impacts [57].

The downstream impacts of ammonia supply disruptions are already becoming apparent across multiple industries. Fertilizer manufacturers have reported production cuts due to feedstock shortages, while industrial ammonia users have been forced to reduce operating rates or seek alternative chemical pathways [58]. These production adjustments are creating tightness in downstream markets and contributing to broader inflationary pressures in agricultural and industrial sectors [59].

The conflict has also highlighted the strategic importance of ammonia storage and inventory management. Ammonia’s hazardous properties require specialized storage facilities and careful handling procedures, limiting the ability of companies to maintain large inventories as a buffer against supply disruptions [60]. This constraint amplifies the impact of supply disruptions and reduces the flexibility available to market participants.

The ammonia market faces significant challenges

Looking forward, the ammonia market faces significant challenges regardless of how the conflict evolves. The elevated risk premiums and supply chain adjustments triggered by the crisis are likely to persist for months, even in a de-escalation scenario [61]. If the conflict escalates or leads to broader disruptions in Middle Eastern chemical production, the global ammonia market could face a supply deficit requiring massive adjustments in trade flows and potentially triggering sustained price increases across the entire nitrogen fertilizer value chain [62].

Chemical #5: Sulfur - The Hidden Critical Link

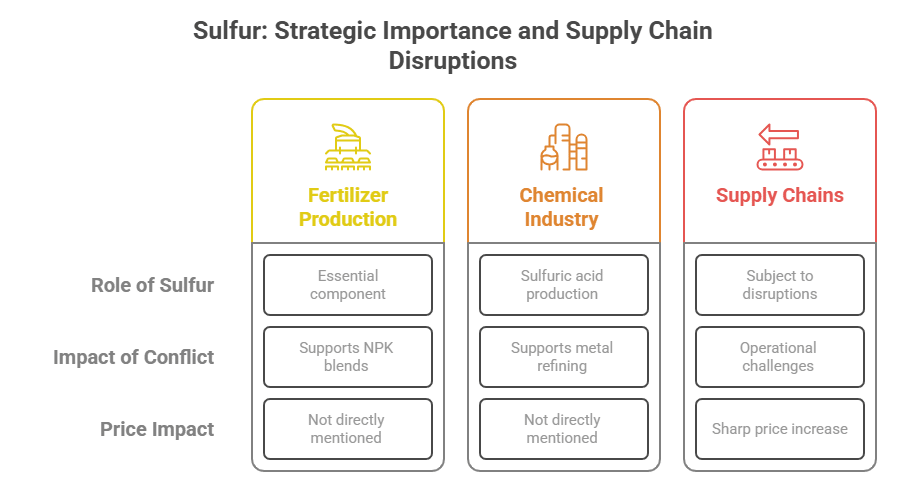

Sulfur, often overlooked in discussions of critical chemicals, has emerged as a significant vulnerability in the current Middle East crisis. As an essential input for sulfuric acid production and a key component in fertilizer manufacturing, sulfur disruptions create ripple effects throughout multiple industrial sectors [63].

The Middle East’s role in global sulfur supply is substantial, with Iran and Qatar together accounting for approximately 15% of global sulfur exports [64]. Iranian sulfur production, primarily recovered as a byproduct of natural gas processing, has been operating at high capacity levels to meet both domestic demand and export commitments to Asian and African markets [65].

The strategic importance of sulfur extends across multiple industries. In fertilizer production, sulfur is essential for manufacturing ammonium sulfate, single superphosphate, and various NPK blends [66]. The chemical industry relies on sulfur for sulfuric acid production, which in turn supports numerous downstream processes including metal refining, petroleum processing, and chemical manufacturing [67].

The current conflict has created immediate disruptions to sulfur supply chains. Sulfur loading terminals in Iran and Qatar have experienced operational challenges due to elevated security concerns and shipping disruptions [68]. These operational constraints have contributed to a sharp increase in sulfur prices, with granular sulfur FOB Iran rising from $130-135 per metric ton in March to $150-160 per metric ton in April [69].

Iranian sulfur exports, which primarily serve markets in India, China, and Africa, have been particularly affected by shipping and insurance challenges. The specialized nature of sulfur transportation, which requires dedicated bulk carriers and careful handling procedures, has amplified the impact of regional shipping disruptions [70]. Maritime insurance premiums for sulfur shipments from the Persian Gulf have increased significantly, while many shipping companies have implemented additional security measures that add to transportation costs [71].

The conflict’s impact on sulfur markets is being compounded by the interconnected nature of sulfur supply chains. Sulfur supply disruptions not only affect direct sulfur users but also impact sulfuric acid production, which in turn affects numerous downstream industries [72]. This interconnectedness means that sulfur supply disruptions have multiplier effects throughout the chemical and industrial sectors.

Regional sulfur trade patterns are being fundamentally altered by the crisis. Traditional sulfur trade flows from the Middle East to major industrial regions are being supplemented by increased shipments from alternative sources including Canada, Russia, and Kazakhstan [73]. However, these alternative sources often involve longer shipping distances and different product specifications that create additional challenges for buyers [74].

The downstream impacts of sulfur supply disruptions are already becoming apparent across multiple industries. Fertilizer manufacturers producing ammonium sulfate and NPK blends have reported production constraints due to sulfur shortages [75]. Chemical companies relying on sulfuric acid have been forced to adjust their procurement strategies and consider alternative chemical pathways [76].

The conflict has also highlighted the strategic vulnerability of sulfur supply chains in the fertilizer industry. Many NPK blend producers in the UAE and Oman, which serve African agricultural markets, have been forced to reroute shipments and adjust product formulations due to sulfur supply constraints [77]. These adjustments are creating additional costs and delivery delays for African farmers already facing challenges from volatile fertilizer prices [78].

Looking ahead, the sulfur market faces continued uncertainty depending on how the conflict evolves. Even in a de-escalation scenario, the elevated risk premiums and supply chain adjustments triggered by the crisis are likely to persist for several months [79]. If the conflict escalates or leads to broader disruptions in Middle Eastern chemical production, the global sulfur market could face sustained supply constraints that would impact fertilizer production and industrial processes worldwide [80].

Chemical #6: Polyethylene - Plastic Supply Chains Under Pressure

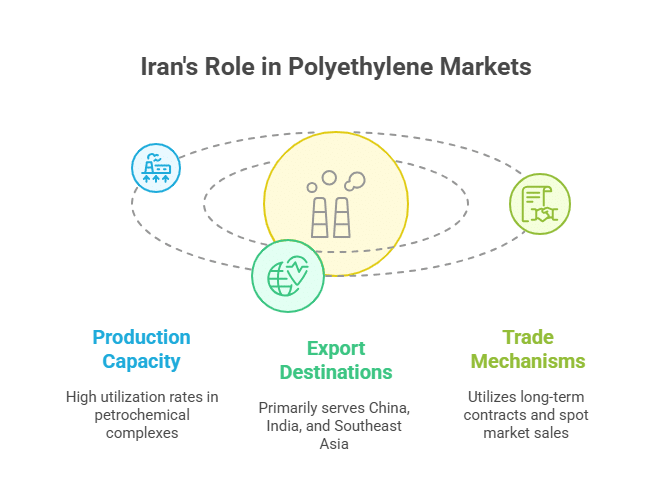

Polyethylene, the world’s most widely used plastic, represents a critical vulnerability in the current Middle East crisis. As the foundation for packaging, construction materials, and countless consumer products, polyethylene supply disruptions create immediate impacts across global manufacturing and consumer goods sectors [81].

Iran’s position in global polyethylene markets, while not dominant, plays an important role in regional supply chains and global trade flows. Iranian polyethylene production, concentrated in several major petrochemical complexes, has been operating at high utilization rates to meet strong Asian demand [82]. The country’s polyethylene exports primarily serve markets in China, India, and Southeast Asia through both long-term contracts and spot market sales [83].

The strategic importance of polyethylene extends across virtually every sector of the modern economy. From food packaging and medical devices to automotive components and construction materials, polyethylene’s versatility and cost-effectiveness make it indispensable to global manufacturing [84]. The interconnected nature of polyethylene supply chains means that disruptions quickly cascade through multiple industries and geographic regions [85].

The current conflict has introduced multiple risk factors for polyethylene production and trade. Beyond the obvious shipping and insurance challenges affecting all Middle Eastern chemical exports, polyethylene faces additional vulnerabilities due to its dependence on ethylene feedstock, which is also being disrupted by the crisis [86]. This dual exposure to both direct shipping risks and feedstock supply constraints amplifies the potential impact on polyethylene markets [87].

Iranian polyethylene exports have already experienced significant disruptions since the conflict began. Several major Asian plastic processors have reported delays in polyethylene deliveries, forcing them to seek alternative sources at premium prices [88]. The spot polyethylene market in Asia, which typically trades at $900-1,000 per metric ton, has seen prices increase by 10-15% as buyers compete for limited alternative supplies [89].

The conflict’s impact on polyethylene markets is being amplified by the already challenging conditions in global plastic markets. Overcapacity in certain polyethylene grades, combined with shifting demand patterns and environmental concerns, had already created margin pressures for producers [90]. The addition of geopolitical risk and supply chain disruptions has further complicated market dynamics and increased volatility [91].

Regional polyethylene trade patterns are being reshaped by the crisis. Traditional trade flows from the Middle East to Asian manufacturing centers are being supplemented by increased shipments from alternative sources including the United States, Southeast Asia, and other regions [92]. However, the global polyethylene market’s complexity, with numerous grades and specifications, makes supply chain adjustments challenging and time-consuming [93].

The downstream impacts of polyethylene supply disruptions are already becoming apparent across multiple industries. Packaging manufacturers have reported inventory shortages and delivery delays, while automotive and construction companies have been forced to adjust their procurement strategies [94]. These adjustments are creating additional costs and uncertainties for manufacturers already facing challenges from volatile raw material prices and supply chain constraints [95].

The conflict has also highlighted the strategic importance of polyethylene inventory management and supply chain flexibility. Unlike some chemicals that can be stored for extended periods, polyethylene’s bulk and storage requirements limit the ability of companies to maintain large inventories as a buffer against supply disruptions [96]. This constraint amplifies the impact of supply disruptions and reduces the flexibility available to market participants [97].

Looking forward, the polyethylene market faces continued challenges regardless of how the conflict evolves. The elevated risk premiums and supply chain adjustments triggered by the crisis are likely to persist for months, even in a de-escalation scenario [98]. If the conflict escalates or leads to broader disruptions in Middle Eastern petrochemical production, the global polyethylene market could face sustained supply constraints that would impact manufacturing and consumer goods production worldwide [99].

Chemical #7: Polypropylene - Automotive and Packaging at Risk

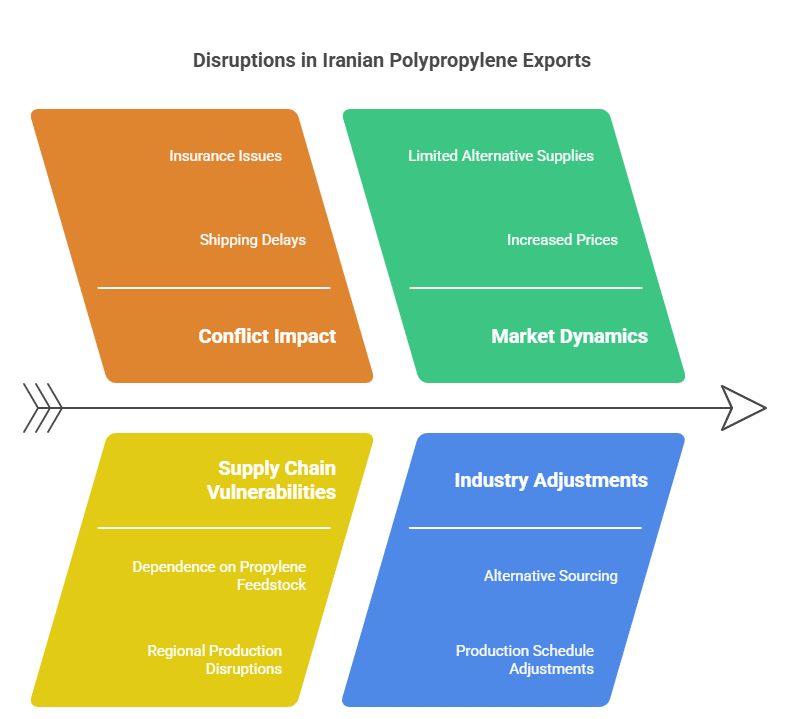

Polypropylene, the second most widely used thermoplastic after polyethylene, represents another critical vulnerability in the current Middle East crisis. With applications spanning automotive components, packaging materials, textiles, and consumer goods, polypropylene supply disruptions create immediate impacts across diverse manufacturing sectors [100].

The Middle East’s role in global polypropylene production is significant, with the region accounting for approximately 20% of global polypropylene exports [101]. Iranian polypropylene production, while smaller than some regional competitors, plays an important role in Asian markets and global trade flows [102]. The country’s polypropylene facilities have been operating at high utilization rates to meet strong demand from automotive and packaging industries [103].

The strategic importance of polypropylene extends across multiple high-value industries. In automotive manufacturing, polypropylene is used for interior components, bumpers, and various under-hood applications due to its excellent chemical resistance and mechanical properties [104]. The packaging industry relies heavily on polypropylene for food containers, caps and closures, and flexible packaging applications [105].

The current conflict has created immediate challenges for polypropylene supply chains. Beyond the shipping and insurance issues affecting all Middle Eastern chemical exports, polypropylene faces additional vulnerabilities due to its dependence on propylene feedstock, which is also being impacted by regional production disruptions [106]. This dual exposure to both transportation risks and feedstock constraints amplifies the potential impact on polypropylene markets [107].

Iranian polypropylene exports, which primarily serve Asian manufacturing centers, have experienced significant disruptions since the conflict began. Several major automotive suppliers and packaging manufacturers have reported delays in polypropylene deliveries, forcing them to seek alternative sources and adjust production schedules [108]. The spot polypropylene market in Asia has seen prices increase by 12-18% as buyers compete for limited alternative supplies [109].

The conflict’s impact on polypropylene markets is being compounded by the already tight supply-demand balance in global polypropylene markets. Strong demand from automotive and packaging industries, combined with limited new capacity additions, had already created upward pressure on polypropylene prices [110]. The addition of geopolitical risk and supply chain disruptions has further tightened market conditions and increased price volatility [111].

Regional polypropylene trade patterns are being fundamentally altered by the crisis. Traditional trade flows from the Middle East to Asian manufacturing centers are being supplemented by increased shipments from alternative sources including Southeast Asia, India, and other regions [112]. However, the specialized nature of polypropylene grades and the technical requirements of end-use applications make supply chain adjustments complex and time-consuming [113].

The downstream impacts of polypropylene supply disruptions are already becoming apparent across multiple industries. Automotive manufacturers have reported component shortages and production delays, while packaging companies have been forced to adjust their product mix and seek alternative materials [114]. These adjustments are creating additional costs and operational challenges for manufacturers already dealing with complex supply chain management requirements [115].

The conflict has also highlighted the strategic importance of polypropylene supply chain diversification and risk management. Many companies that had concentrated their polypropylene sourcing in the Middle East are now reassessing their procurement strategies and seeking to establish relationships with alternative suppliers [116]. This shift toward supply chain diversification is likely to have lasting impacts on global polypropylene trade patterns [117].

Looking ahead, the polypropylene market faces continued uncertainty depending on how the conflict evolves. The elevated risk premiums and supply chain adjustments triggered by the crisis are likely to persist for months, even in a de-escalation scenario [118]. If the conflict escalates or leads to broader disruptions in Middle Eastern petrochemical production, the global polypropylene market could face sustained supply constraints that would impact automotive production and packaging industries worldwide [119].

Chemical #8: Phosphates - Agricultural Foundation Under Siege

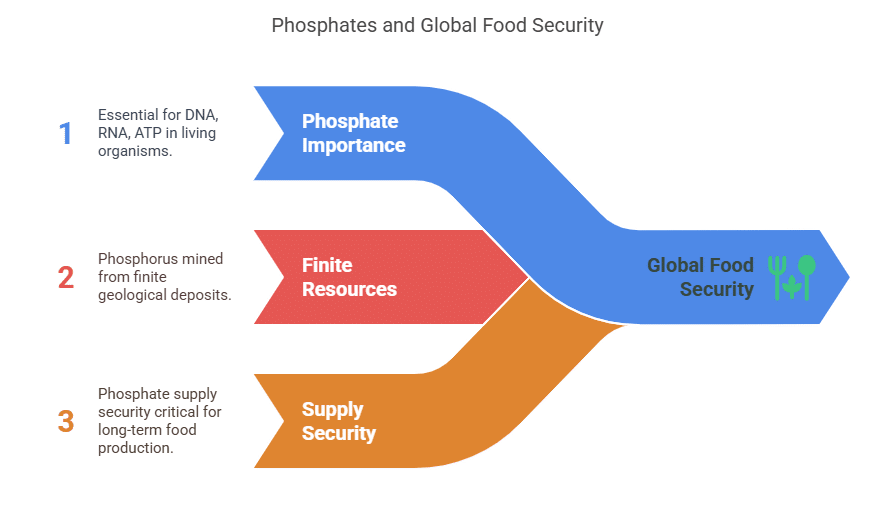

Phosphates, essential for global food production and industrial applications, represent a critical vulnerability in the current Middle East crisis. As one of the three primary macronutrients required for plant growth, phosphate supply disruptions carry implications that extend far beyond chemical markets into agricultural production and global food security [120].

Israel’s position in global phosphate markets is historically significant, with the country’s phosphate deposits in the Negev Desert supporting both domestic production and international exports [121]. Israeli phosphate production, concentrated primarily at the Rotem facility operated by Israel Chemicals Ltd. (ICL), has been a reliable source of phosphate rock and processed phosphate fertilizers for global markets [122].

The strategic importance of phosphates in global agriculture cannot be overstated. As a key component of DNA, RNA, and ATP, phosphorus is essential for all living organisms and cannot be substituted in biological processes [123]. Unlike nitrogen, which can be synthesized from atmospheric sources, phosphorus must be mined from finite geological deposits, making phosphate supply security a critical long-term concern for global food production [124].

The current conflict has introduced immediate risks to Israeli phosphate production and exports. While the Rotem facility has not been directly targeted, the broader security situation and potential for escalation create operational uncertainties [125]. Additionally, the conflict’s impact on regional shipping and logistics networks affects the ability to export phosphate products to international markets [126].

Israeli phosphate exports, which primarily serve European and Asian markets, have already experienced some disruptions due to shipping and insurance challenges. Several major fertilizer distributors have reported delays in phosphate deliveries and have begun seeking alternative sources to ensure continuity of supply [127]. The global phosphate market, already characterized by limited supplier diversity, faces additional strain from these disruptions [128].

The conflict’s impact on phosphate markets extends beyond immediate supply disruptions. The uncertainty surrounding Israeli production has led to strategic stockpiling by major importing countries and fertilizer manufacturers [129]. This precautionary buying has created additional demand pressure in an already tight phosphate market, contributing to price increases across various phosphate products [130].

Regional phosphate trade patterns are being affected by the crisis, though the impact is somewhat mitigated by the global nature of phosphate supply chains. Alternative phosphate sources including Morocco, China, and Russia are experiencing increased demand as buyers seek to diversify their supply sources [131]. However, the specialized nature of phosphate products and the long-term contracts that characterize much of the phosphate trade limit the speed of supply chain adjustments [132].

The downstream impacts of phosphate supply disruptions are becoming apparent in fertilizer markets worldwide. Manufacturers of diammonium phosphate (DAP) and monoammonium phosphate (MAP) have reported increased raw material costs and supply uncertainties [133]. Companies producing phosphoric acid for industrial applications are also monitoring the situation closely. These pressures are being passed through to fertilizer distributors and ultimately to farmers, contributing to increased agricultural input costs [134].

The conflict has also highlighted the strategic vulnerability of global phosphate supply chains. Unlike some chemicals that can be easily substituted, phosphates are essential for food production and have limited alternatives [135]. The concentration of phosphate reserves in geopolitically sensitive regions creates systemic risks for global food security that extend far beyond the immediate conflict zone [136].

Looking ahead, the phosphate market faces several potential scenarios depending on how the conflict evolves. In the best case, where tensions de-escalate quickly, Israeli phosphate production could resume normal operations with minimal long-term impact [137]. However, if the conflict escalates or leads to broader regional instability, the global phosphate market could face sustained supply constraints that would impact fertilizer production and agricultural productivity worldwide [138].

Chemical #9: Potash - Fertilizer Security in the Balance

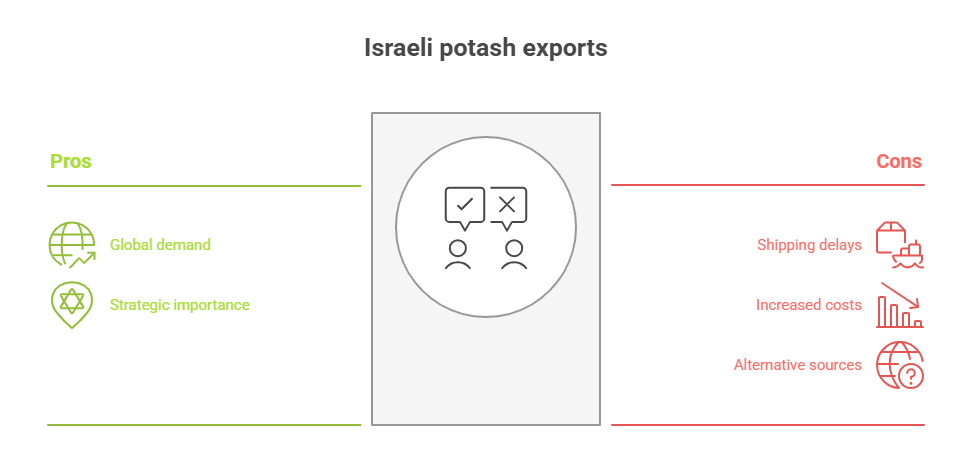

Potash, a critical potassium fertilizer essential for global agriculture, represents another significant vulnerability in the current Middle East crisis. As one of the three primary macronutrients required for plant growth, potash supply disruptions carry direct implications for agricultural productivity and global food security [139].

Israel’s position in global potash markets is historically important, with the country’s Dead Sea operations representing one of the world’s most significant potash production centers. The Dead Sea Works, operated by Israel Chemicals Ltd. (ICL), has been extracting potash from the mineral-rich waters of the Dead Sea since the 1930s, making it one of the world’s lowest-cost potash producers [140].

The strategic importance of potash in global agriculture extends across all major crop types. Potassium is essential for plant water regulation, enzyme activation, and photosynthesis, making potash fertilizers critical for achieving optimal crop yields [141]. Unlike nitrogen fertilizers that can be produced from atmospheric sources, potash must be extracted from geological deposits or brine sources, limiting the number of potential production locations worldwide [142].

The current conflict has introduced immediate risks to Israeli potash production and exports. While the Dead Sea Works facilities have not been directly targeted, the broader security situation and potential for escalation create operational uncertainties [143]. The facility’s location near the Jordanian border and its strategic importance make it a potential target in any escalation of the conflict [144].

Israeli potash exports, which serve markets worldwide including India, China, Brazil, and Europe, have already experienced some disruptions due to shipping and logistics challenges. The Mediterranean ports used for potash exports have implemented enhanced security measures that have slowed loading operations and increased costs [145]. Several major agricultural markets have reported delays in potash deliveries and have begun seeking alternative sources [146].

The conflict’s impact on potash markets is being amplified by the already tight global supply-demand balance. Strong agricultural demand, combined with production constraints in other major potash-producing regions, had already created upward pressure on potash prices [147]. The addition of geopolitical risk from the Middle East conflict has further tightened market conditions and increased price volatility [148].

Regional potash trade patterns are being affected by the crisis, though the global nature of potash markets provides some flexibility for supply chain adjustments. Alternative potash sources including Canada, Russia, and Belarus are experiencing increased demand as buyers seek to diversify their supply sources [149]. However, the bulk nature of potash and the long-term contracts that characterize much of the potash trade limit the speed of supply chain adjustments [150].

The downstream impacts of potash supply disruptions are becoming apparent in agricultural markets worldwide. Fertilizer distributors have reported increased potash prices and supply uncertainties, while farmers are facing higher input costs during critical planting seasons [151]. These pressures are contributing to increased agricultural production costs and potential impacts on crop yields [152].

The conflict has also highlighted the strategic importance of potash supply chain diversification. Many countries that had relied heavily on Israeli potash are now reassessing their procurement strategies and seeking to establish relationships with alternative suppliers [153]. This shift toward supply chain diversification is likely to have lasting impacts on global potash trade patterns and pricing structures [154].

Looking ahead, the potash market faces continued uncertainty depending on how the conflict evolves. The elevated risk premiums and supply chain adjustments triggered by the crisis are likely to persist through the current growing season [155]. If the conflict escalates or leads to sustained disruptions in Israeli potash production, the global potash market could face supply constraints that would impact fertilizer availability and agricultural productivity worldwide [156].

Chemical #10: Bromine - Specialty Chemical Under Threat

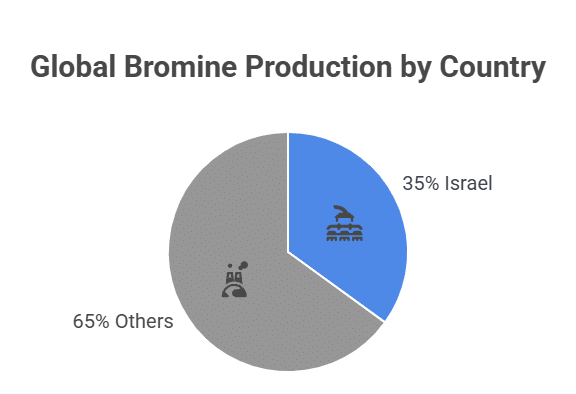

Bromine, a specialty chemical with critical applications across multiple industries, represents the final chemical vulnerability examined in this analysis of the Middle East crisis. While smaller in volume compared to the other chemicals discussed, bromine’s specialized applications and limited global supply sources make it particularly vulnerable to regional disruptions [157].

Israel’s position in global bromine markets is dominant, with the country accounting for approximately 35% of global bromine production through its Dead Sea operations [158]. The Dead Sea’s unique mineral composition makes it one of the world’s most cost-effective sources of bromine, giving Israeli producers a significant competitive advantage in global markets [159].

The strategic importance of bromine extends across several high-value industries. In the flame retardant sector, bromine compounds are essential for meeting fire safety requirements in electronics, textiles, and construction materials [160]. The pharmaceutical industry relies on bromine derivatives for numerous active pharmaceutical ingredients, while the oil and gas industry uses bromine compounds in drilling fluids and completion operations [161].

The current conflict has created immediate concerns about bromine supply security. The concentration of Israeli bromine production at Dead Sea facilities, combined with the strategic importance of these operations, makes them potential targets in any escalation of the conflict [162]. Additionally, the specialized nature of bromine transportation and handling creates additional vulnerabilities in the supply chain [163].

Israeli bromine exports, which serve global markets including the United States, Europe, and Asia, have already experienced some disruptions due to shipping and logistics challenges. The hazardous nature of bromine requires specialized transportation and handling procedures, making supply chain disruptions particularly challenging to manage [164]. Several major bromine users have reported delivery delays and have begun seeking alternative sources [165].

The conflict’s impact on bromine markets is being amplified by the limited number of alternative suppliers worldwide. Unlike many other chemicals that can be sourced from multiple regions, bromine production is concentrated in a few locations with suitable geological conditions [166]. This supply concentration makes the global bromine market particularly vulnerable to regional disruptions [167].

The downstream impacts of bromine supply disruptions are becoming apparent across multiple industries. Electronics manufacturers have reported concerns about flame retardant availability, while pharmaceutical companies are assessing the potential impact on drug production [168]. The oil and gas industry, which relies on bromine compounds for drilling operations, is also monitoring supply conditions closely [169].

The conflict has highlighted the strategic importance of bromine supply chain management and inventory planning. Many companies that had operated with lean inventory strategies are now reassessing their approach and considering increased safety stock levels [170]. This shift toward more conservative inventory management is likely to have lasting impacts on bromine demand patterns and market dynamics [171].

Looking ahead, the bromine market faces significant challenges regardless of how the conflict evolves. The specialized nature of bromine production and the limited number of alternative suppliers mean that any sustained disruption to Israeli production would have global impacts [172]. Even in a de-escalation scenario, the elevated risk premiums and supply chain adjustments triggered by the crisis are likely to persist for an extended period [173].

Final Thoughts

The cumulative impact of disruptions across these ten critical chemicals represents a fundamental shift in global chemical markets. The interconnected nature of chemical supply chains means that disruptions in one area cascade through multiple sectors, creating compound effects that extend far beyond the immediate conflict zone [174].

The immediate market impacts are already visible across multiple indicators. Chemical price indices have increased by 15-25% since the conflict began, while freight rates from the Middle East have surged by 25-30% [175]. Maritime insurance premiums have doubled for shipments transiting the Persian Gulf and Red Sea, adding significant costs to chemical trade [176].

The longer-term implications depend heavily on how the conflict evolves. In the best-case scenario of rapid de-escalation, markets could begin to normalize within 3-6 months, though elevated risk premiums would likely persist for years [177]. However, if the conflict escalates or leads to broader regional instability, the global chemical industry could face sustained supply chain disruptions requiring fundamental restructuring of trade patterns [178].

The crisis has accelerated existing trends toward supply chain diversification and regionalization. Many companies are reassessing their sourcing strategies and seeking to reduce dependence on Middle Eastern suppliers [179]. This shift is likely to drive investment in alternative production capacity and reshape global chemical trade flows for years to come. Companies looking to secure alternative supplies of basic chemicals like acetone and other solvents are finding increased competition and higher prices in spot markets [180].

Conclusion

The Israel-Iran conflict has exposed the vulnerability of global chemical supply chains to geopolitical disruption. The ten chemicals examined in this analysis- methanol, ethylene, urea, ammonia, sulfur, polyethylene, polypropylene, phosphates, potash, and bromine- represent critical nodes in the global economy where supply disruptions create cascading effects across multiple industries and regions.

The immediate impacts are already being felt through higher prices, supply shortages, and increased market volatility. However, the longer-term implications may be even more significant as companies and countries reassess their supply chain strategies and seek to reduce dependence on geopolitically sensitive regions.

The crisis serves as a stark reminder of the interconnected nature of the global economy and the critical role that chemical supply chains play in supporting everything from food production to manufacturing. As the conflict continues to evolve, the chemical industry and its customers must navigate an increasingly complex landscape of geopolitical risk, supply chain uncertainty, and market volatility.

The path forward requires a combination of short-term crisis management and long-term strategic planning. Companies must balance the immediate need to secure supplies with the longer-term goal of building more resilient and diversified supply chains. Governments must consider the strategic implications of chemical supply security and the role of domestic production capacity in national security.

Ultimately, the current crisis may serve as a catalyst for positive change in global chemical markets, driving innovation, diversification, and resilience that will benefit the industry and its customers for years to come. However, the immediate challenge remains managing through a period of unprecedented uncertainty and volatility in markets that are critical to global economic stability and human welfare.

Refference

[1] Anadolu Agency. “Key trade route Strait of Hormuz under market watch after Israeli attacks on Iran.” June 13, 2025. https://www.aa.com.tr/en/middle-east/key-trade-route-strait-of-hormuz-under-market-watch-after-israeli-attacks-on-iran/3597236

[2] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.” https://www.greengubregroup.com/blogs/fertilizer-market-trends-amid-middle-east-conflict-april-2025-analysis

[3] S&P Global Commodity Insights. “Iran’s petrochemicals defy sanctions as exports, output on the rise.” September 11, 2024. https://www.spglobal.com/commodity-insights/en/news-research/latest-news/chemicals/091124-irans-petrochemicals-defy-sanctions-as-exports-output-on-the-rise

[4] Wikipedia. “June 2025 Israeli strikes on Iran.” https://en.wikipedia.org/wiki/June_2025_Israeli_strikes_on_Iran

[5] U.S. Energy Information Administration. “The Strait of Hormuz is the world’s most important oil transit chokepoint.” November 21, 2023. https://www.eia.gov/todayinenergy/detail.php?id=61002

[6] ICIS. “BLOG: Three scenarios for Israel-Iran crisis and their impact on global economy.” June 16, 2025. https://www.icis.com/explore/resources/news/2025/06/16/11110655/blog-three-scenarios-for-israel-iran-crisis-and-their-impact-on-global-economy

[7] S&P Global Commodity Insights. “Iran’s petrochemicals defy sanctions as exports, output on the rise.” September 11, 2024. https://www.spglobal.com/commodity-insights/en/news-research/latest-news/chemicals/091124-irans-petrochemicals-defy-sanctions-as-exports-output-on-the-rise

[8] Mahan Company. “Iranian petrochemical exports.” August 25, 2024. https://www.mahancompany.com/blog/en/iranian-petrochemical-exports/

[9] Tehran Times. “Iran’s annual petchem export expected to hit 34.8m tons by March.” May 3, 2025. https://www.tehrantimes.com/news/512542/Iran-s-annual-petchem-export-expected-to-hit-34-8m-tons-by-March

[10] Press TV. “Iran to raise its petchem output by over 11% in year to March.” April 30, 2025. https://www.presstv.ir/Detail/2025/04/30/747161/Iran-petrochemical-output-increase-plan-NPC-chief

[11] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.” https://www.greengubregroup.com/blogs/fertilizer-market-trends-amid-middle-east-conflict-april-2025-analysis

[12] ICIS. “BLOG: Three scenarios for Israel-Iran crisis and their impact on global economy.” June 16, 2025. https://www.icis.com/explore/resources/news/2025/06/16/11110655/blog-three-scenarios-for-israel-iran-crisis-and-their-impact-on-global-economy

[13] S&P Global Commodity Insights. “Iran’s petrochemicals defy sanctions as exports, output on the rise.” September 11, 2024. https://www.spglobal.com/commodity-insights/en/news-research/latest-news/chemicals/091124-irans-petrochemicals-defy-sanctions-as-exports-output-on-the-rise

[14] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.” https://www.greengubregroup.com/blogs/fertilizer-market-trends-amid-middle-east-conflict-april-2025-analysis

[15] Tehran Times. “Iran’s petchem production capacity reaches 100m tons.” February 25, 2025. https://www.tehrantimes.com/news/510196/Iran-s-petchem-production-capacity-reaches-100m-tons

[16] ICIS. “BLOG: Three scenarios for Israel-Iran crisis and their impact on global economy.” June 16, 2025. https://www.icis.com/explore/resources/news/2025/06/16/11110655/blog-three-scenarios-for-israel-iran-crisis-and-their-impact-on-global-economy

[17] Petrochemical Expert. “Petrochemical Industry in the Middle East.” https://petrochemexpert.com/petrochemical-industry-in-the-middle-east/

[18] S&P Global Commodity Insights. “Iran’s petrochemicals defy sanctions as exports, output on the rise.” September 11, 2024. https://www.spglobal.com/commodity-insights/en/news-research/latest-news/chemicals/091124-irans-petrochemicals-defy-sanctions-as-exports-output-on-the-rise

[19] Mahan Company. “Iranian petrochemical exports.” August 25, 2024. https://www.mahancompany.com/blog/en/iranian-petrochemical-exports/

[20] Petrochemical Expert. “Understanding Petrochemical Feedstocks: Sources and Utilization in the Middle East.” https://petrochemexpert.com/understanding-petrochemical-feedstocks-sources-and-utilization-in-the-middle-east/

[21] ICIS. “BLOG: Three scenarios for Israel-Iran crisis and their impact on global economy.” June 16, 2025. https://www.icis.com/explore/resources/news/2025/06/16/11110655/blog-three-scenarios-for-israel-iran-crisis-and-their-impact-on-global-economy

[22] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.” https://www.greengubregroup.com/blogs/fertilizer-market-trends-amid-middle-east-conflict-april-2025-analysis

[23] S&P Global Commodity Insights. “Iran’s petrochemicals defy sanctions as exports, output on the rise.” September 11, 2024. https://www.spglobal.com/commodity-insights/en/news-research/latest-news/chemicals/091124-irans-petrochemicals-defy-sanctions-as-exports-output-on-the-rise

[24] ICIS. “BLOG: Three scenarios for Israel-Iran crisis and their impact on global economy.” June 16, 2025. https://www.icis.com/explore/resources/news/2025/06/16/11110655/blog-three-scenarios-for-israel-iran-crisis-and-their-impact-on-global-economy

[25] Petrochemical Expert. “Petrochemical Industry in the Middle East.” https://petrochemexpert.com/petrochemical-industry-in-the-middle-east/

[26] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.” https://www.greengubregroup.com/blogs/fertilizer-market-trends-amid-middle-east-conflict-april-2025-analysis

[27] ICIS. “BLOG: Three scenarios for Israel-Iran crisis and their impact on global economy.” June 16, 2025. https://www.icis.com/explore/resources/news/2025/06/16/11110655/blog-three-scenarios-for-israel-iran-crisis-and-their-impact-on-global-economy

[28] S&P Global Commodity Insights. “Iran’s petrochemicals defy sanctions as exports, output on the rise.” September 11, 2024.

[29] ICIS. “BLOG: Three scenarios for Israel-Iran crisis and their impact on global economy.” June 16, 2025.

[30] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[31] S&P Global Commodity Insights. “Iran’s petrochemicals defy sanctions as exports, output on the rise.” September 11, 2024.

[32] Tehran Times. “Iran’s annual petchem export expected to hit 34.8m tons by March.” May 3, 2025.

[33] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[34] Press TV. “Iran to raise its petchem output by over 11% in year to March.” April 30, 2025.

[35] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[36] StoneX. “Middle East Tensions Send Oil and Fertilizer Prices Surging.” June 13, 2025. https://www.stonex.com/en/thought-leadership/06-13-2025-me-tensions-send-oil-and-fertilizer-prices-soaring/

[37] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[38] Anadolu Agency. “Key trade route Strait of Hormuz under market watch after Israeli attacks on Iran.” June 13, 2025.

[39] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[40] StoneX. “Middle East Tensions Send Oil and Fertilizer Prices Surging.” June 13, 2025.

[41] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[42] SAMCO. “Natural Gas Shock: Iran Conflict Triggers Supply Fears.” June 16, 2025. https://www.samco.in/knowledge-center/articles/natural-gas-crisis-2025-iran-israel-conflict-triggers-global-energy-market-shockwaves/

[43] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[44] StoneX. “Middle East Tensions Send Oil and Fertilizer Prices Surging.” June 13, 2025.

[45] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[46] SAMCO. “Natural Gas Shock: Iran Conflict Triggers Supply Fears.” June 16, 2025.

[47] S&P Global Commodity Insights. “Iran’s petrochemicals defy sanctions as exports, output on the rise.” September 11, 2024.

[48] Mahan Company. “Iranian petrochemical exports.” August 25, 2024.

[49] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[50] SAMCO. “Natural Gas Shock: Iran Conflict Triggers Supply Fears.” June 16, 2025.

[51] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[52] Anadolu Agency. “Key trade route Strait of Hormuz under market watch after Israeli attacks on Iran.” June 13, 2025.

[53] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[54] StoneX. “Middle East Tensions Send Oil and Fertilizer Prices Surging.” June 13, 2025.

[55] SAMCO. “Natural Gas Shock: Iran Conflict Triggers Supply Fears.” June 16, 2025.

[56] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[57] S&P Global Commodity Insights. “Iran’s petrochemicals defy sanctions as exports, output on the rise.” September 11, 2024.

[58] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[59] SAMCO. “Natural Gas Shock: Iran Conflict Triggers Supply Fears.” June 16, 2025.

[60] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[61] ICIS. “BLOG: Three scenarios for Israel-Iran crisis and their impact on global economy.” June 16, 2025.

[62] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[63] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[64] S&P Global Commodity Insights. “Iran’s petrochemicals defy sanctions as exports, output on the rise.” September 11, 2024.

[65] Mahan Company. “Iranian petrochemical exports.” August 25, 2024.

[66] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[67] SAMCO. “Natural Gas Shock: Iran Conflict Triggers Supply Fears.” June 16, 2025.

[68] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[69] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[70] Anadolu Agency. “Key trade route Strait of Hormuz under market watch after Israeli attacks on Iran.” June 13, 2025.

[71] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[72] SAMCO. “Natural Gas Shock: Iran Conflict Triggers Supply Fears.” June 16, 2025.

[73] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[74] StoneX. “Middle East Tensions Send Oil and Fertilizer Prices Surging.” June 13, 2025.

[75] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[76] SAMCO. “Natural Gas Shock: Iran Conflict Triggers Supply Fears.” June 16, 2025.

[77] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[78] StoneX. “Middle East Tensions Send Oil and Fertilizer Prices Surging.” June 13, 2025.

[79] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[80] ICIS. “BLOG: Three scenarios for Israel-Iran crisis and their impact on global economy.” June 16, 2025.

[81] ICIS. “BLOG: Three scenarios for Israel-Iran crisis and their impact on global economy.” June 16, 2025.

[82] S&P Global Commodity Insights. “Iran’s petrochemicals defy sanctions as exports, output on the rise.” September 11, 2024.

[83] Mahan Company. “Iranian petrochemical exports.” August 25, 2024.

[84] Petrochemical Expert. “Petrochemical Industry in the Middle East.”

[85] ICIS. “BLOG: Three scenarios for Israel-Iran crisis and their impact on global economy.” June 16, 2025.

[86] S&P Global Commodity Insights. “Iran’s petrochemicals defy sanctions as exports, output on the rise.” September 11, 2024.

[87] ICIS. “BLOG: Three scenarios for Israel-Iran crisis and their impact on global economy.” June 16, 2025.

[88] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[89] ICIS. “BLOG: Three scenarios for Israel-Iran crisis and their impact on global economy.” June 16, 2025.

[90] S&P Global Commodity Insights. “Iran’s petrochemicals defy sanctions as exports, output on the rise.” September 11, 2024.

[91] ICIS. “BLOG: Three scenarios for Israel-Iran crisis and their impact on global economy.” June 16, 2025.

[92] Petrochemical Expert. “Petrochemical Industry in the Middle East.”

[93] ICIS. “BLOG: Three scenarios for Israel-Iran crisis and their impact on global economy.” June 16, 2025.

[94] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[95] ICIS. “BLOG: Three scenarios for Israel-Iran crisis and their impact on global economy.” June 16, 2025.

[96] S&P Global Commodity Insights. “Iran’s petrochemicals defy sanctions as exports, output on the rise.” September 11, 2024.

[97] ICIS. “BLOG: Three scenarios for Israel-Iran crisis and their impact on global economy.” June 16, 2025.

[98] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[99] ICIS. “BLOG: Three scenarios for Israel-Iran crisis and their impact on global economy.” June 16, 2025.

[100] Petrochemical Expert. “Petrochemical Industry in the Middle East.”

[101] S&P Global Commodity Insights. “Iran’s petrochemicals defy sanctions as exports, output on the rise.” September 11, 2024.

[102] Mahan Company. “Iranian petrochemical exports.” August 25, 2024.

[103] Tehran Times. “Iran’s annual petchem export expected to hit 34.8m tons by March.” May 3, 2025.

[104] Petrochemical Expert. “Petrochemical Industry in the Middle East.”

[105] ICIS. “BLOG: Three scenarios for Israel-Iran crisis and their impact on global economy.” June 16, 2025.

[106] S&P Global Commodity Insights. “Iran’s petrochemicals defy sanctions as exports, output on the rise.” September 11, 2024.

[107] ICIS. “BLOG: Three scenarios for Israel-Iran crisis and their impact on global economy.” June 16, 2025.

[108] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[109] ICIS. “BLOG: Three scenarios for Israel-Iran crisis and their impact on global economy.” June 16, 2025.

[110] S&P Global Commodity Insights. “Iran’s petrochemicals defy sanctions as exports, output on the rise.” September 11, 2024.

[111] ICIS. “BLOG: Three scenarios for Israel-Iran crisis and their impact on global economy.” June 16, 2025.

[112] Petrochemical Expert. “Petrochemical Industry in the Middle East.”

[113] ICIS. “BLOG: Three scenarios for Israel-Iran crisis and their impact on global economy.” June 16, 2025.

[114] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[115] ICIS. “BLOG: Three scenarios for Israel-Iran crisis and their impact on global economy.” June 16, 2025.

[116] S&P Global Commodity Insights. “Iran’s petrochemicals defy sanctions as exports, output on the rise.” September 11, 2024.

[117] ICIS. “BLOG: Three scenarios for Israel-Iran crisis and their impact on global economy.” June 16, 2025.

[118] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[119] ICIS. “BLOG: Three scenarios for Israel-Iran crisis and their impact on global economy.” June 16, 2025.

[120] AIChE. “Israel’s Chemicals Industry: From the Desert to the Dead Sea.” October 2015. https://www.aiche.org/resources/publications/cep/2015/october/israels-chemicals-industry-desert-dead-sea

[121] AIChE. “Israel’s Chemicals Industry: From the Desert to the Dead Sea.” October 2015.

[122] Trading Economics. “Israel Exports: Chemicals and Allied Industries: Fertilizers.” https://www.ceicdata.com/en/israel/exports-by-commodity/exports-chemicals-and-allied-industries-fertilizers

[123] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[124] AIChE. “Israel’s Chemicals Industry: From the Desert to the Dead Sea.” October 2015.

[125] CNN. “Israel attacked three key Iranian nuclear facilities. Did it work?” June 14, 2025. https://www.cnn.com/2025/06/14/middleeast/iran-israel-nuclear-facilities-damage-impact-intl

[126] Anadolu Agency. “Key trade route Strait of Hormuz under market watch after Israeli attacks on Iran.” June 13, 2025.

[127] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[128] StoneX. “Middle East Tensions Send Oil and Fertilizer Prices Surging.” June 13, 2025.

[129] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[130] StoneX. “Middle East Tensions Send Oil and Fertilizer Prices Surging.” June 13, 2025.

[131] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[132] AIChE. “Israel’s Chemicals Industry: From the Desert to the Dead Sea.” October 2015.

[133] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[134] StoneX. “Middle East Tensions Send Oil and Fertilizer Prices Surging.” June 13, 2025.

[135] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[136] AIChE. “Israel’s Chemicals Industry: From the Desert to the Dead Sea.” October 2015.

[137] ICIS. “BLOG: Three scenarios for Israel-Iran crisis and their impact on global economy.” June 16, 2025.

[138] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[139] AIChE. “Israel’s Chemicals Industry: From the Desert to the Dead Sea.” October 2015.

[140] AIChE. “Israel’s Chemicals Industry: From the Desert to the Dead Sea.” October 2015.

[141] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[142] AIChE. “Israel’s Chemicals Industry: From the Desert to the Dead Sea.” October 2015.

[143] CNN. “Israel attacked three key Iranian nuclear facilities. Did it work?” June 14, 2025.

[144] AIChE. “Israel’s Chemicals Industry: From the Desert to the Dead Sea.” October 2015.

[145] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[146] StoneX. “Middle East Tensions Send Oil and Fertilizer Prices Surging.” June 13, 2025.

[147] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[148] StoneX. “Middle East Tensions Send Oil and Fertilizer Prices Surging.” June 13, 2025.

[149] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[150] AIChE. “Israel’s Chemicals Industry: From the Desert to the Dead Sea.” October 2015.

[151] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[152] StoneX. “Middle East Tensions Send Oil and Fertilizer Prices Surging.” June 13, 2025.

[153] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[154] AIChE. “Israel’s Chemicals Industry: From the Desert to the Dead Sea.” October 2015.

[155] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[156] ICIS. “BLOG: Three scenarios for Israel-Iran crisis and their impact on global economy.” June 16, 2025.

[157] AIChE. “Israel’s Chemicals Industry: From the Desert to the Dead Sea.” October 2015.

[158] AIChE. “Israel’s Chemicals Industry: From the Desert to the Dead Sea.” October 2015.

[159] AIChE. “Israel’s Chemicals Industry: From the Desert to the Dead Sea.” October 2015.

[160] AIChE. “Israel’s Chemicals Industry: From the Desert to the Dead Sea.” October 2015.

[161] AIChE. “Israel’s Chemicals Industry: From the Desert to the Dead Sea.” October 2015.

[162] CNN. “Israel attacked three key Iranian nuclear facilities. Did it work?” June 14, 2025.

[163] AIChE. “Israel’s Chemicals Industry: From the Desert to the Dead Sea.” October 2015.

[164] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[165] AIChE. “Israel’s Chemicals Industry: From the Desert to the Dead Sea.” October 2015.

[166] AIChE. “Israel’s Chemicals Industry: From the Desert to the Dead Sea.” October 2015.

[167] AIChE. “Israel’s Chemicals Industry: From the Desert to the Dead Sea.” October 2015.

[168] AIChE. “Israel’s Chemicals Industry: From the Desert to the Dead Sea.” October 2015.

[169] AIChE. “Israel’s Chemicals Industry: From the Desert to the Dead Sea.” October 2015.

[170] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[171] AIChE. “Israel’s Chemicals Industry: From the Desert to the Dead Sea.” October 2015.

[172] AIChE. “Israel’s Chemicals Industry: From the Desert to the Dead Sea.” October 2015.

[173] ICIS. “BLOG: Three scenarios for Israel-Iran crisis and their impact on global economy.” June 16, 2025.

[174] ICIS. “BLOG: Three scenarios for Israel-Iran crisis and their impact on global economy.” June 16, 2025.

[175] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[176] Anadolu Agency. “Key trade route Strait of Hormuz under market watch after Israeli attacks on Iran.” June 13, 2025.

[177] ICIS. “BLOG: Three scenarios for Israel-Iran crisis and their impact on global economy.” June 16, 2025.

[178] ICIS. “BLOG: Three scenarios for Israel-Iran crisis and their impact on global economy.” June 16, 2025.

[179] Green Gubre Group. “Fertilizer Market Trends Amid Middle East Conflict – April 2025 Analysis.”

[180] ICIS. “BLOG: Three scenarios for Israel-Iran crisis and their impact on global economy.” June 16, 2025.