Unlocking the Potential of Surplus Zinc Bromide Across Diverse Industries

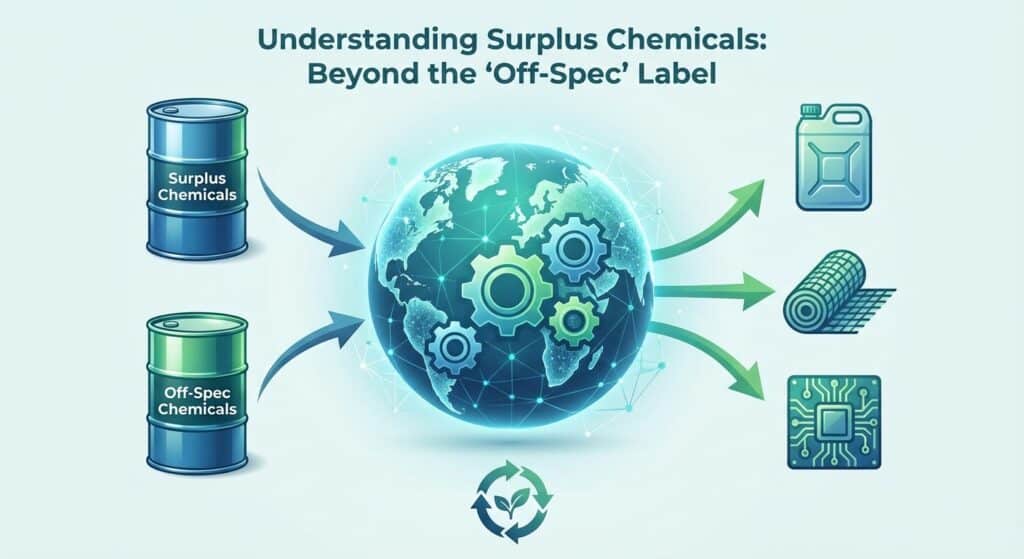

Zinc Bromide, an inorganic specialty chemical, plays a vital role in various high-impact industries including oil and gas, battery technology, metal treatment, catalyst applications, and other industrial chemical sectors. Known for its unique properties such as high density, solubility in water, and ability to conduct electricity when molten or in solution, Zinc Bromide often appears as surplus inventory in manufacturing and processing facilities. In many cases, producers find themselves with excess volumes that, if not managed effectively, can lead to storage challenges and costly disposal. Recognizing its intrinsic value is key to converting surplus into opportunity.

Maximize Value from Surplus Zinc Bromide in Oil & Gas, Battery Tech, and Industrial Chemicals

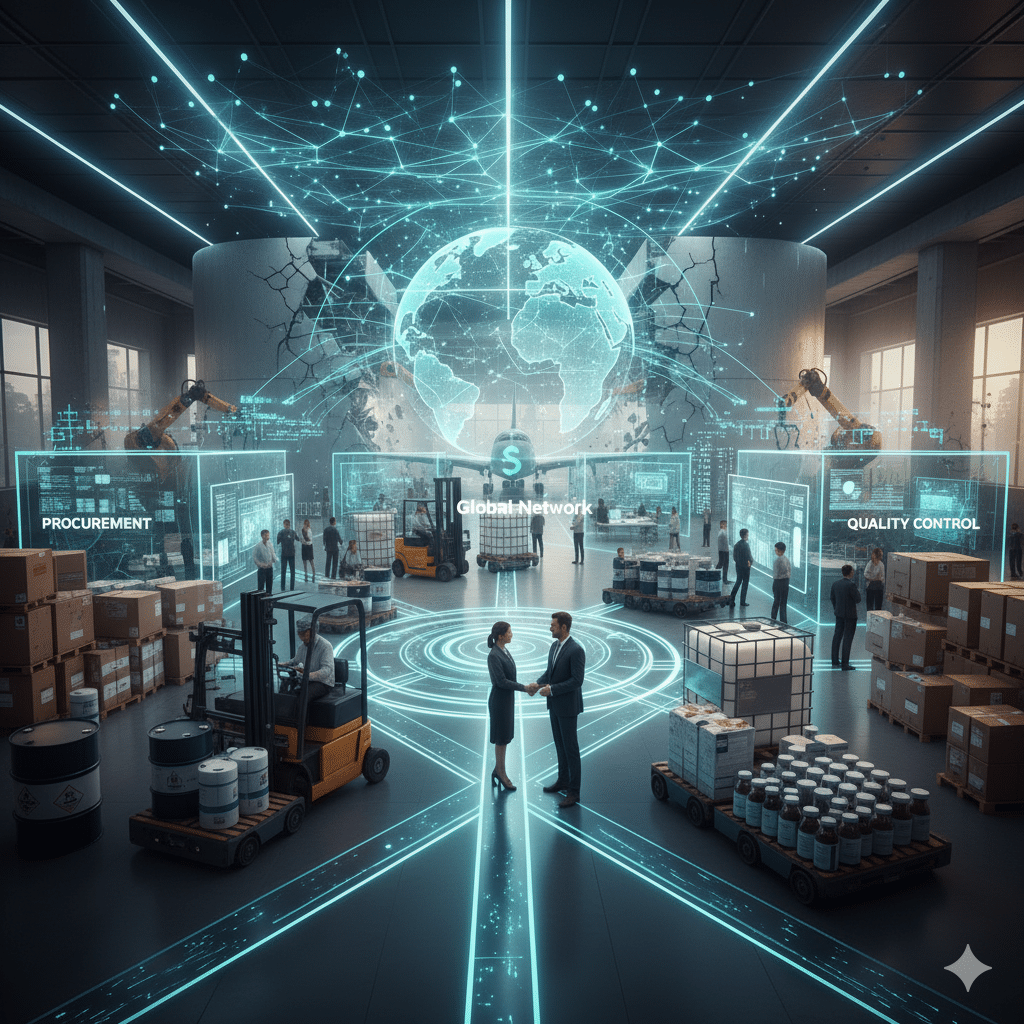

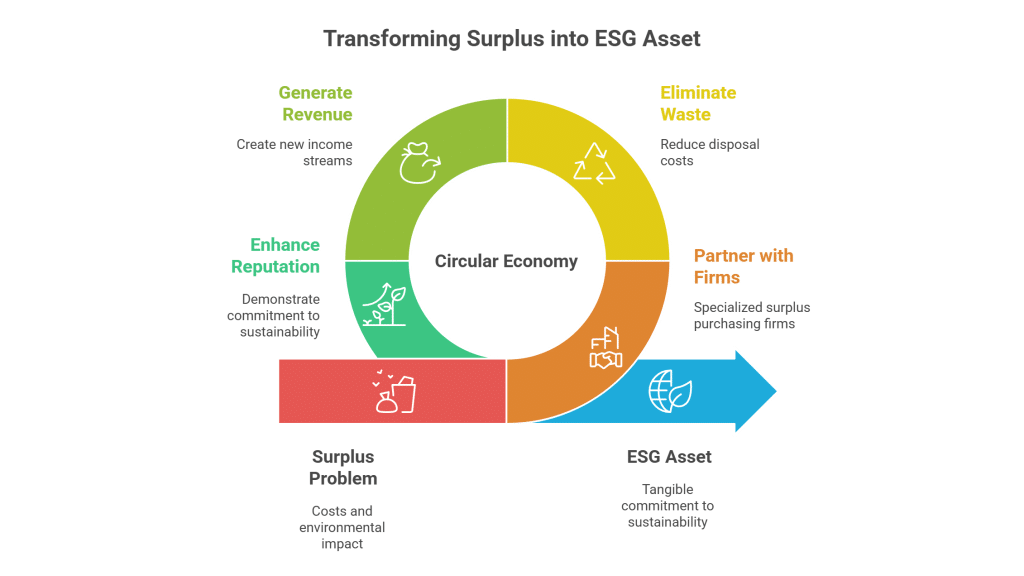

The marketplace for surplus chemicals offers a win-win situation for both sellers and buyers. For companies holding excess Zinc Bromide, selling surplus inventory not only recovers costs but also liberates valuable storage space and reduces expensive disposal fees as well as regulatory risks. Meanwhile, buyers benefit from cost savings, assured supply, and improved sustainability credentials. By diverting chemicals from the waste stream and repurposing them for further industrial applications, businesses can contribute positively to environmental stewardship while boosting their bottom line. This dynamic trading platform facilitates a seamless transition from overstock challenges to profitable resource recovery.

Zinc Bromide Market Insight: Q2 2025 Analysis

Market Outlook: Stable Growth Amid Energy Transition

The global zinc bromide market continues to demonstrate resilience in Q2 2025, with prices stabilizing at $4,200-4,350 per metric ton after the supply chain disruptions that affected Q1 distributions across Asia. This price stability comes as welcome news to traders who weathered volatility throughout late 2024.

Key market drivers include the sustained demand from the oil and gas sector in the Gulf of Mexico and Middle East regions, where completion fluid requirements remain strong despite the ongoing energy transition. However, the most significant growth vector continues to be the rapidly expanding energy storage market.

Battery Sector Driving New Demand

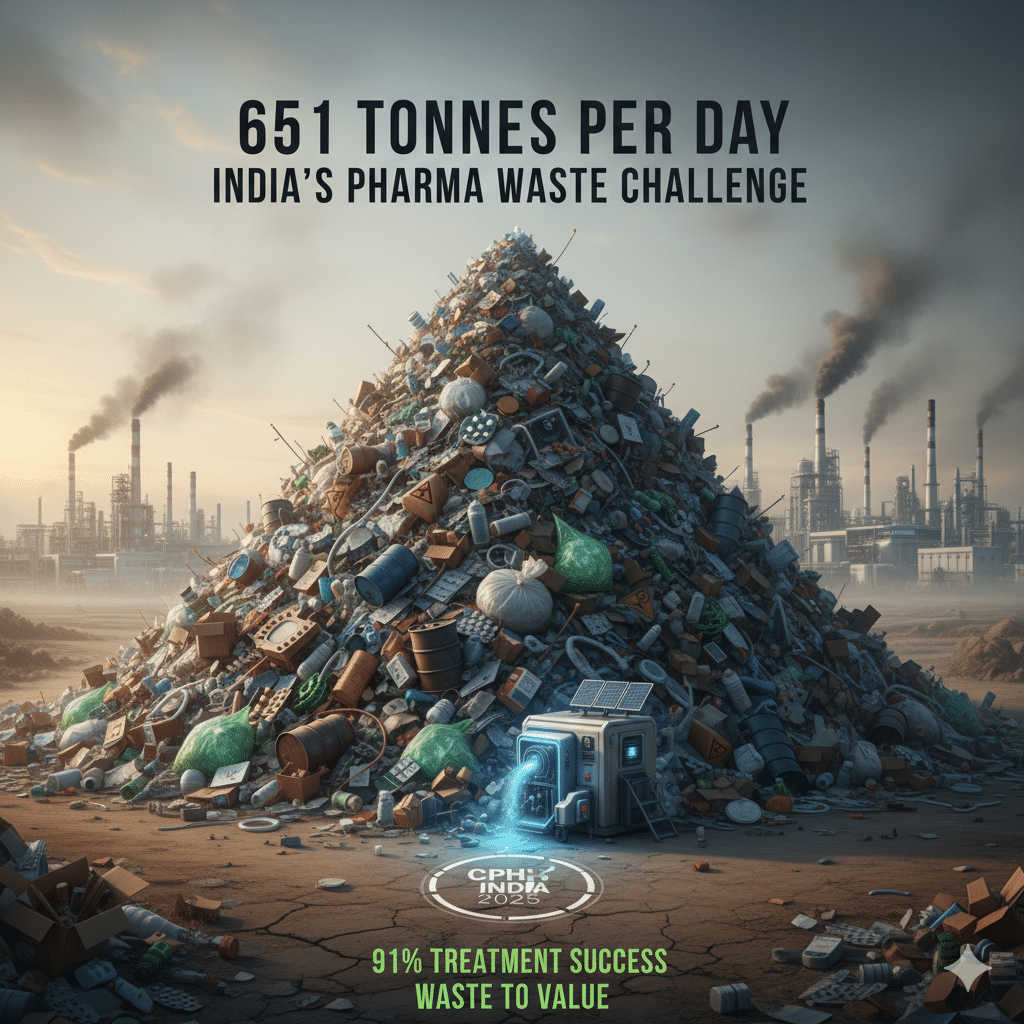

Zinc bromine flow batteries are emerging as a formidable competitor in the grid-scale energy storage landscape. Unlike lithium-ion technologies, these systems offer longer duration storage capabilities (8-10 hours) with minimal degradation over thousands of cycles. Recent deployments in Australia and California have demonstrated commercial viability at scale, triggering increased procurement activity.

TechStorage’s recent 50MW/400MWh installation in South Australia has become a benchmark case study, utilizing approximately 750 metric tons of high-purity zinc bromide. This single project represented nearly 3% of global annual zinc bromide production, signaling the potential impact of the energy storage sector on chemical availability.

Supply Chain Intelligence

North American producers are operating at 87% capacity, while Asian manufacturing has increased output by 12% year-over-year. The Salar de Atacama region in Chile has emerged as a growing source of bromine precursors, potentially diversifying the supply chain beyond traditional producers in the Dead Sea region and China.

Transportation costs have decreased 8% since January, with bulk chemical shipping rates from Asia to North America showing particular improvement. This presents a strategic opportunity for traders looking to replenish inventories before the anticipated demand surge in Q3.

Regulatory Spotlight

The updated UN Globally Harmonized System of Classification and Labelling of Chemicals (GHS) implementation timeline has been accelerated in key markets. Traders should note that all zinc bromide shipments after July 1st must comply with the new labeling requirements and safety data sheet formats. Non-compliance carries significant penalties in EU and North American markets.

Environmental regulations concerning discharge monitoring have tightened in the Gulf region, with particular attention to bromide levels in wastewater. This may impact handling procedures for oil and gas applications.

Technical Corner: Purity Considerations

Recent testing has revealed significant performance variations in zinc bromine flow batteries based on chemical purity. Batteries utilizing 98.5%+ purity zinc bromide showed 7% greater efficiency than those using standard 97% industrial grades. This quality differential is creating a two-tier market, with battery-grade material commanding a 12-15% premium.

Key contaminants affecting battery performance include:

- Iron (Fe): Max acceptable 0.001%

- Chlorides: Max acceptable 0.05%

- Heavy metals: Max acceptable 0.0005%

Understanding these specifications is becoming essential for traders serving the energy storage sector.

For more market intelligence and trading opportunities, contact our specialty chemical trading desk >> Contact us

Zinc Bromide in Oil & Gas, Battery Technology, Metal Treatment and Industrial Chemicals

Buyers in these sectors gain access to high-quality Zinc Bromide at competitive prices, resulting in cost reductions on chemical procurement. Additionally, purchasing surplus inventory helps secure reliable supplies in a volatile market, aligning with sustainability goals by repurposing materials that might otherwise be disposed of.

Sellers benefit by transforming excess, potentially obsolete inventory into immediate revenue. Offloading surplus Zinc Bromide reduces storage burdens and disposal costs while simultaneously enhancing sustainability metrics. This process allows manufacturers and distributors to focus resources on current production demands without the lingering expense of surplus management.

Table of Contents

From Excess to Excellence: A Successful Zinc Bromide Surplus Trade

A leading chemical manufacturer specializing in industrial chemicals found themselves with an excess stock of Zinc Bromide due to reduced seasonal demand. Instead of facing the high costs of storage and disposing of the material in compliance with stringent environmental regulations, they opted to trade their surplus. This strategic move not only recovered significant costs but also provided a reliable supply to a growing battery technology firm. The firm was able to incorporate the high-quality chemical into its zinc-bromine flow batteries, significantly reducing production costs and enhancing performance metrics. This trade exemplifies how proactive surplus management can benefit multiple stakeholders, optimizing resource utilization and promoting sustainable industrial practices across diverse sectors including oil and gas, battery technology, metal treatment, and broader industrial applications.